The following points highlight the eight important principles of accounting. The principles are: 1. Cost Principle 2. Dual-Aspect Principle 3. Accrual Principle 4. Conservatism Principle 5. Matching Principle 6. Consistency Principle 7. Materiality Principle 8. Full-Disclosure Principle.

Accounting Principle # 1. Cost Principle:

The cost principle requires that assets be recorded at their exchange price, i.e., acquisition cost, or historical cost. Historical cost is recognised as the appropriate valuations basis for recognition of the acquisition of all goods and services, expenses, costs and equities.

In other words, an item is valued at the exchange price at the date of acquisition and shown in the financial statements at that value or an amortized portion of it. For accounting purposes, business transactions are normally measured in terms of the actual prices or costs at the time the transaction occurs.

That is, financial accounting measurements are primarily based on exchange prices at which economic resources and obligations are exchanged. Thus, the amounts at which assets are listed in the accounts of a firm do not indicate what the assets could be sold for.

ADVERTISEMENTS:

However, some accountants argue that accounting would be more useful if estimates of current and future values were substituted for historical costs under certain conditions. The extent to which cost and value should be reflected in the accounts is central to much of the current accounting controversy.

The historical cost concept implies that since the business is not going to sell its assets as such, there is little point in revaluing assets to reflect current values. In addition, for practical reasons, the accountant prefers the reporting of actual costs to market values which are difficult to verify.

By using historical costs, the accountant’s already difficult task is not further complicated by the need to keep additional records of changing market value. Thus, the cost concept provides greater objectivity and greater feasibility to the financial statements.

Accounting Principle # 2. Dual-Aspect Principle:

This principle lies at the heart of the whole accounting process. The Accountant records events affecting the wealth of a particular entity. The question is— which aspect of this wealth are important? Since an accounting entity is an artificial creation, it is essential to know to whom its resources belong or what purpose they serve. It is also important to know what kind of resources it controls, e.g., cash, buildings or land.

ADVERTISEMENTS:

Accounts recording systems have therefore developed so as to show two main things:

(a) The source of wealth and

(b) The form it takes.

Suppose Mr. X decides to establish a business and transfers Rs. 1000 from his private bank account to a separate business account.

ADVERTISEMENTS:

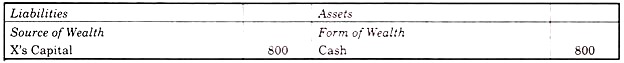

He might record this event as follows:

Clearly the source of wealth must be numerically equal to the form of wealth. Since they, are simply different aspects of the same things, i.e., in the form of an equation: S (sources) must equal F (forms). Moreover, any transaction or event affecting the wealth of entity must have two aspects recorded in order to maintain the equality of both sides of the accounting equation.

If business has acquired an asset, it must have resulted in one of the following:

ADVERTISEMENTS:

(а) Some other asset has been given up.

(b) The obligation to pay for it has arisen.

(c) There has been a profit, leading to an increase in the amount that the business owes to the proprietor or

(d) The proprietor has contributed money for the acquisition of asset.

ADVERTISEMENTS:

This does not mean that a transaction will affect both the source and form of wealth.

There are four categories of events affecting the accounting equation:

(а) Both sources and forms of wealth increase by the same amount.

(b) Both sources and forms of wealth decrease by the same amount.

ADVERTISEMENTS:

(c) Some forms of wealth increase while others decrease without any change in the source of wealth

(d) Some sources of wealth increase while others decrease without any change in the form in which wealth is held.

The example given above illustrates category (a) since the commencing transaction for the entity results in the source of wealth and form of wealth, cash, both increasing from zero to Rs. 1000. By contrast, X might decide to withdraw Rs. 200 cash from the business.

ADVERTISEMENTS:

Then financial positions of business entity would result:

It is essential to appreciate why both sides of the equation decrease. By taking out cash, X automatically reduces his supply of private finance to the business and by the same amount.

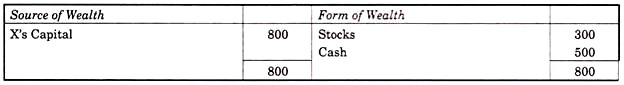

Suppose now that Mr. X buys stocks of goods for Rs. 300 with the available cash. His supply of capital does not change, but the composition of the business assets.

The two aspects of this transaction are not in the same direction but compensatory, an increase in stocks offsetting a decrease in cash.

Similarly sources of wealth also may be affected by a transaction.

ADVERTISEMENTS:

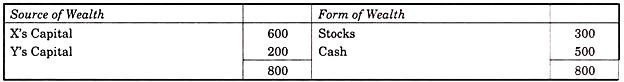

Thus, if X gives his son Y, a Rs. 200 share in the business by transferring part of his own interest, the effect is as follows:

If however, X gives Y Rs. 200 in cash privately and Y then puts it into the business, both sides of equation would be affected, Y’s capital of Rs. 200 being balanced by an extra Rs. 200 in cash, X’s capital remaining at Rs. 800.

Accounting Principle # 3. Accrual Principle:

According to Financial Accounting Standards Board (USA), “accrual accounting attempts to record the financial effects on an enterprise of transactions and other events and circumstances that have cash consequences for the enterprise in the periods in which those transactions, events and circumstances occur rather than only in the periods in which cash is received or paid by the enterprise. Accrual accounting is concerned with the process by which cash expended on resources and activities is returned as more (or perhaps less) cash to the enterprise, not just with the beginning and end of that process. It recognises that the buying, producing, selling and other operations of an enterprise during a period, as well as other events that affect enterprise performance, often do not coincide with the cash receipts and payments of the periods.”

A business enterprises economic activity in a short period seldom follows the simple form of a cycle from money to productive resources to product to money. Instead, continuous production, extensive use of credit and long-lived resources, and over-lapping cycles of activity complicate the evaluation of periodic activities.

As a result, non-cash resources and obligations change in time periods other than those in which money is received or paid. Recording these changes is necessary to determine periodic income and to measure financial position. This is the essence of accrual accounting.

Thus, accrual accounting is based not only on cash transactions but also on credit transactions, barter exchanges, changes in prices, changes in the form of assets or liabilities, and other transactions, events, and circumstances that have cash consequence for an enterprise but involve no concurrent cash movement.

Although it does not ignore cash transactions, accrual accounting is primarily accounting for non-cash assets, liabilities, revenues, expenses, gains and losses.

Accounting Principle # 4. Conservatism Principle:

This principle is often described as “anticipate no profit, and provide for all possible losses.” This characterisation might be viewed as the reactive version of the minimax managerial philosophy, i.e., minimise the chance of maximum losses.

The concept of accounting conservatism suggests that when and where uncertainty and risk exposure so warrant, accounting takes a wary and watchful stance until the appearance of evidence to the contrary.

Accounting conservatism does not mean to intentionally understate income and assets; it applies only to situations in which there are reasonable doubts. For example, inventories are valued at the lower of cost or current replacement value.

In its applications to the income statement, conservatism encourages the recognition of all losses that have occurred or are likely to occur but does not acknowledge gains until actually realised. The procedure of reducing inventory values when market has declined below cost but the failure to countenance “write-ups” under reverse conditions can be attributed to conservatism.

The early amortisation of intangible assets and the restrictions against recording appreciation of assets have also, at least to some extent, been motivated by Conservatism Failure to recognise revenue until a sale has transferred is still another manifestation of conservatism.

Conservatism concept is very vital in the measurement of income and financial position of a business enterprise. The accountant avoids the recognition and measurement of value changes and income until such time as they may be evidenced readily.

This concept may result in stating net income and net assets at amounts lower than would otherwise result from applying the pervasive measurement principles. This concept is extremely difficult to standardize or regulate.

It may vary from entity to entity, depending on the particular attitudes of the different accountants and managers concerned. This concept is defended due to the uncertainty of the future, which in turn raises doubts about the ultimate realisability of unrealized value increments.

It is argued that accountants are practical men who have to deal with practical problems, and so they have a tendency to avoid the somewhat speculative area of accounting for unrealized gains.

They have also inherited role of acting as a curb on the enthusiasm of businessmen who want to report to ownership as successful story as possible. Also, traditional accounting reports are intended primarily for stewardship purposes, a function which incurs no legal obligation to report beyond the facts of realised transaction.

Accounting Principle # 5. Matching Principle:

The matching concept in financial accounting is the process of matching (relating) accomplishments or revenues (as measured by the selling prices of goods and services delivered) with efforts or expenses (as measured by the cost of goods and services used) to a particular period for which the income is being determined.

This concept emphasises which items of cost are expenses in a given accounting period. That is, costs are reported as expenses in the accounting period in which the revenue associated with those costs is reported. For example, when the sales value of some goods is reported as revenue in a year, the cost of that goods would be reported as an expense in the same year.

Matching concept needs to be fulfilled only after realisation (accrual) concept has been completed by the accountant; first revenues are measured in accordance with the realisation concept and then costs are associated with these revenues. Costs are matched with revenues, not the other way around.

The matching process, therefore, requires cost allocation which is significant in historical cost accounting. Past (historical) costs are examined and, despite their historic nature, are subjected to a procedure whereby elements of cost regarded as having expired service potential are allocated or matched against relevant revenues.

The remaining elements of costs which are regarded as continuing to have future service potential are carried forward in the historical balance sheet and are termed as assets. Thus, the balance sheet is nothing more than a report of unallocated past costs waiting expiry of their estimated future service potential before being matched with suitable revenues.

The most important feature of the matching concept is that there should be some positive correlation between respective revenues and costs. There is, however, much difficulty inherent in this exercise because of the subjective-ness of the cost allocation process which results from estimating the existence of unexpired future service potential in the historic costs concerned.

A variety of allocation practices is available, and each one is capable of producing different cost aggregates to match against revenues (the main areas of difficulty affecting inventory valuation and fixed assets depreciation policies).

Matching is, therefore, not as easy or as straight forward as it looks, and consequently much care and expertise is required to give the allocated figures sufficient credibility to satisfy their users.

Accounting Principle # 6. Consistency Principle:

This principle requires that once an organisation has decided on one method, it should use the same method for all subsequent transactions and events of the same nature unless it has sound reason to change methods. If accounting methods are frequently changed, comparison of its financial statements for one period with those of another period would be difficult.

The consistent use of accounting methods and procedures over time will check the distortion of profit and loss account and balance sheet and the possible manipulation of these statements. Consistency is necessary to help external users in comparing financial statements of a given firm over time and in making their decisions.

Accounting Principle # 7. Materiality Principle:

Materiality concept implies that the transactions and events that have material or insignificant effects, should not be recorded and reported in the financial statements. It is argued that the recording of insignificant events cannot be justified in terms of its subsequent poor utility to users.

There is no agreement as to the meaning of materiality and what can be said to be material or immaterial events and transactions. It is for the preparer of accounts to interpret what is and what is not material.

Probably the materiality of an event or transaction can be decided in terms of its impact on the financial position, results of operations, changes in the financial position of an organisation and on evaluations or decisions made by users.

Accounting Principle # 8. Full-Disclosure Principle:

The concept of full disclosure requires that a business enterprise should provide all relevant information to external users for the purpose of sound economic decisions. This concept implies that no information of substance or of interest to the average investors will be omitted or concealed from an entity’s financial statements.