In this article we will discuss about the accounting treatments for payment of purchase price in relation to acquisition of business, explained with the help of suitable illustrations.

ADVERTISEMENTS:

ADVERTISEMENTS:

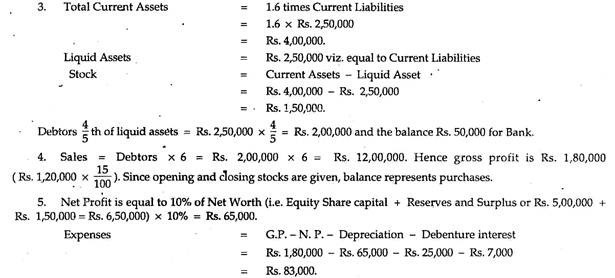

(A) New Set of Books are Opened:

The following are the entries recorded by the purchasing company:

First Method:

Note:

ADVERTISEMENTS:

(a) If the purchase price exceeds the net assets, the excess amount is debited to Goodwill Account; and if the net assets exceeds the purchase price, the excess amount is credited to Capital Reserve Account.

(b) Only one figure will appear, i.e. either Goodwill A/C or Capital Reserve A/C

(c) When the shares or debentures are issued at premium or discount, then the respective account may be credited or debited, as the case may be.

ADVERTISEMENTS:

ADVERTISEMENTS:

Second Method:

* Only one figure will appear. That is, any difference between the totals of debit and credit is debited to Goodwill Account or credited to Capital Reserve Account.

Illustration 1:

ADVERTISEMENTS:

A company was formed with an authorised capital of Rs. 5,00,000 divided into 25,000 Equity shares of Rs. 10 each and 2,500 10% Preference shares of Rs. 100 each to purchase the going concern of Ram whose Balance Sheet Stood as follows:

The purchase price was agreed at Rs. 1, 75,000 payable as to Rs. 50,000 in fully paid Equity shares, Rs. 50,000 in fully paid Preference shares, Rs. 30,000 debentures and the balance in cash.

The remaining shares were issued to and paid for by the public with the exception of Rs. 3 per share on 600 Equity shares, which were subsequently forfeited and re-issued at a discount of 20%.

ADVERTISEMENTS:

Give journal entries to record these transactions in the books of the company and prepare its initial Balance Sheet.

Solution:

Note:

ADVERTISEMENTS:

Balance of the Shares Forfeited Account can be used in writing off the Goodwill.

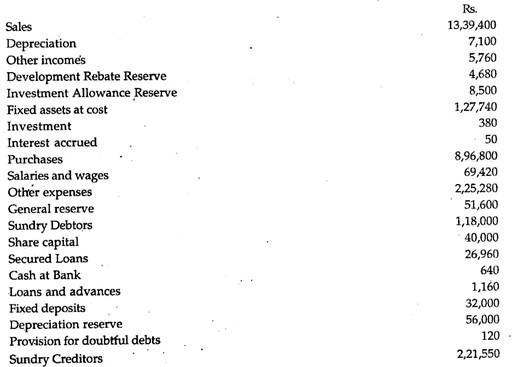

Illustration 2:

B.K. Limited registered with a capital of Rs. 10,00,000 in Equity shares of Rs. 10 each, acquired the business of Prem Brothers.

The Balance Sheet of the firm at the date of acquisition was as under:

The assets and liabilities were subject to the following revaluation:

(a) Machinery and Furniture to be depreciated at 10% and 15% respectively.

(b) Premises should be appreciated by 20%.

(c) Make provision for bad debts on debtors at 2.5%.

(d) Goodwill of the firm valued at Rs. 24,000

(e) The purchase consideration was to be discharged as follows:

(i) Allotment of 10,000 Equity shares of Rs. 10 each at Rs. 12 each.

(ii) Allotment of 500 10% Debentures of Rs. 100 each at a discount of Rs. 10 each.

(iii) Balance in cash.

You are required to show journal entries in the books of the Company and prepare the Balance Sheet.

Solution:

Vendor’s Debtors and Creditors:

Sometimes, the book debts and trade liabilities belonging to the vendor are not taken over by the purchasing company. This is because, complete recovery of the amount against book debts may not be possible and trade liabilities may he more than the estimated figure. Thus there arises a risk in taking over the vendor’s debtors and creditors.

In certain case, the purchasing company takes over the book debts on a guarantee given by the vendor for their realisation. An agreed amount is retained against the Vendor Guarantee Account. The amount is adjusted against the purchase price. That is, purchase price is paid after deducting the guarantee amount.

If full amount is realised, the guarantee amount is returned; if not, the Guarantee Account is debited to the extent of loss and the balance is paid. The purchasing company may charge a nominal commission for the job done on behalf of the vendor.

Alternative to the above, the purchasing company takes the responsibility of collection of debtors and paying off the creditors, as an agent for the vendor. For this service, the company charges a commission at an agreed rate.

The entries to be passed by the purchasing company in such a case are as follows:

Alternatively, when no record is maintained in the books of purchasing company, only the receipts and payments on behalf of the vendor are recorded in vendor’s Current Account.

The entries are:

Illustration 3:

On 1st January Koniamman Ltd. acquired the business of Mariamman taking over all the assets with the exception of book debts which it undertook to collect on behalf of Mariamman, and out of the proceeds pay the liabilities owing at the date of the transfer. At that date, the book debts amounted to Rs. 54,000 and the creditors Rs. 37,000. The company agreed to do the job for vendors on 3 per cent commission on amounts collected and 1 per cent on amounts paid.

The company could not collect Rs. 2,800 from the existing debtors and allowed Rs. 300 as cash discount to the remaining debtors. The company could collect the time-barred debt (which was written-off as bad by the vendors) of Rs. 2,000. The company paid Rs. 35,000 to creditors satisfaction of total amount due. However, the company was forced to meet a contingent liability on bills discounted by the vendors of Rs. 3,000.

Give journal entries (including that of cash) in the books of Koniamman Ltd.

Illustration 4:

A Company was incorporated for taking over the business of Mr Engineer on and from 1st January 2004.

The following is the Balance Sheet of Mr Engineer as on 31st December 2003:

The Company takes over the business with the fixed assets and loan creditors on the following terms:

1. The fixed assets should be depreciated at 10%.

2. The value of goodwill is estimated at Rs. 20, 000.

The Company, as an agent of the vendor, realised Rs. 20,000 from the sundry debtors in full settlement and discharged all the trade creditors by paying Rs. 17,000.

The loan creditors accepted 10% Preference shares of Rs. 100 each in discharge of the loans. After realisation of the debts and discharge of the liabilities, the total amount due to the vendor was settled by issue of fully paid Equity shares of Rs. 10 each.

Pass journal entries for the above in the books of the Company.

Solution:

(B) Conversion by Continuing the Same Set of Books:

Sometimes on conversion of a business into a Company, no new set of book is opened but the purchasing company decides to continue with the same set of books. In such a case, the books of the old business are converted into the books of the Company by passing certain adjustments and transfer entries. There will be no closing entries in the books of the old firm nor opening entries in the books of the company. However, the following points may be kept in mind.

1. When it is agreed to revalue the assets and liabilities for the purpose of conversion, Revaluation Account may be opened to incorporate the changes in the values of assets and liabilities. The Revaluation Account, as in “Admission of a Partner” is closed by transferring to Capital Accounts.

2. The assets and liabilities, which are not taken over by the company are transferred to Capital Accounts.

3. Close the undistributed profits to Capital Accounts in profits sharing ratio.

4. Close the adjusted Capital Accounts by debiting and Share Capital is credited.

Illustration 5:

A and B carrying on business in partnership, sharing profits and losses in the ratio of 3: 2, wish to dissolve the firm and sell the business to a limited company on 31st December when the firm’s Balance Sheet as under:

A limited company with an authorised capital of Rs. 3, 00,000 in Equity shares of Rs. 10 each, is registered to purchase the above business on the following terms:

1. Goodwill is valued at Rs. 30,000.

2. Furniture and stock are revalued at Rs. 6,000 and Rs. 85,000 respectively.

3. Debtors are subject to 5% provision.

The auto is not required by the company and A takes over it at an agreed valuation of Rs. 8,000.

Purchase consideration is satisfied by the issue of Equity shares of Rs. 10 each at par.

Show the journal entries and Balance Sheet of the company assuming that the same set of books is continued.

Solution:

Illustration 6:

Following is the Balance Sheet of X and Y. They share profits and losses equally.

On the basis of above Balance Sheet, P. Ltd. purchased the business of X and Y. Purchase price is Rs. 1, 70,000. Purchase price is paid by 5,000 shares of Rs. 10 each (market price Rs. 11 per share) and the balance is paid in cash. It was decided that X and Y should get equal shares out of purchase price in P Ltd. Pass necessary journal entries in the books of the firm X & Y and P

Ltd. and prepare necessary accounts in the books of Vendor.

Solution: