Here is a compilation of top four accounting problems on double account system with its relevant solutions.

ADVERTISEMENTS:

Problem 1:

The following balances are extracted from the books of M/s. Flashlight Electric Company Ltd:

(i) Fixed assets:

Expenditure up to 1.1.2006:

ADVERTISEMENTS:

(a) Land and Buildings Rs 10,00,000 ;

(b) Machinery Rs 15, 00,000.

(ii) Additions during the year – Machinery Rs 3, 50,000

(iii) Depreciation Fund:

ADVERTISEMENTS:

(a) Machinery Rs 3, 00,000;

(b) Buildings Rs 1, 00,000.

(iv) Authorised Capital Rs 50, 00,000 divided into equity shares of Rs 100 each.

(v) Issued and fully paid-up 20,000 equity shares of Rs 100 each (including 2,500 equity shares issued during the year).

ADVERTISEMENTS:

(vi) 7.5% Debentures Rs. 10, 00,000 secured by a charge on Fixed Assets.

(vii) Sundry Creditors Rs. 2,50,000; Reserve Fund Rs. 5,00,000; Reserve Fund Investments at cost Rs. 5,00,000; (Market value Rs. 5,25,000).

(viii) Stock Rs. 3, 02,500; Sundry Debtors Rs. 4, 50,000; Cash at Bank Rs. 2, 00,000; Cash in hand Rs. 50,000.

(ix) Profit and Loss Account (Cr.) Rs 2, 02,500.

ADVERTISEMENTS:

Your are instructed to prepare:

(i) The Balance Sheet as on December 31, 2006, according to Schedule VI to the Companies Act, 1956, under the Single Account System (previous year’s figures not required).

(ii) (a) Capital Account

(b) General Balance Sheet as on the same date under the Double Account System.

Problem 2:

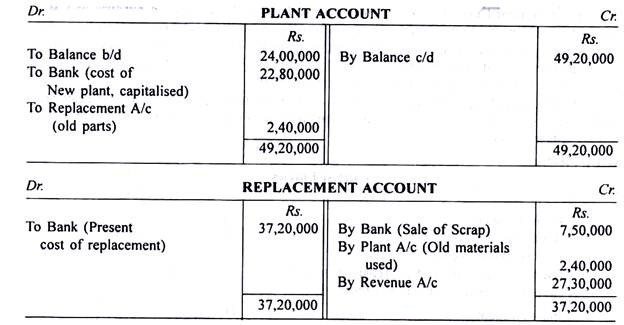

The Chennai Electricity Company decides to replace one of its old plants with a modern one with a larger capacity. The plant when installed ten years back cost the company Rs. 24,00,000, the components of materials, labour and overheads being in the ratio of 5:3:2.

It is ascertained that the costs of materials and labour have gone up by 40% and 80% respectively. The proportion of overheads to total costs is expected to remain the same as before. The cost of the new plant as per improved design is Rs. 60 lakhs and in addition, materials recovered from the old plant of a value of Rs. 2, 40,000 has been used in the construction of the new plant. Old plant was scrapped and sold for Rs. 7, 50,000.

ADVERTISEMENTS:

The accounts of the company are maintained under the double account system. Indicate how much would be capitalized and the amount to be charged to revenue. Show journal entries and prepare ledger accounts.

Problem 3:

In the year 1984 railway lines were laid between Agra and Delhi at a cost of Rs 1, 50, 00,000. This expenditure was distributed over overheads, wages and material in the ratio of 2: 4: 9. The lines were replaced in the year 2004 at a cost of Rs 3, 80, 00,000. It was estimated that the price of overheads, wages and material had gone up during this period of 20 years as follows: overheads 25%; wages 20% and materials 45%.

Ascertain the amount to be capitalized in respect of the railway lines for the purpose of preparing the final accounts for the year 2004.

Problem 4:

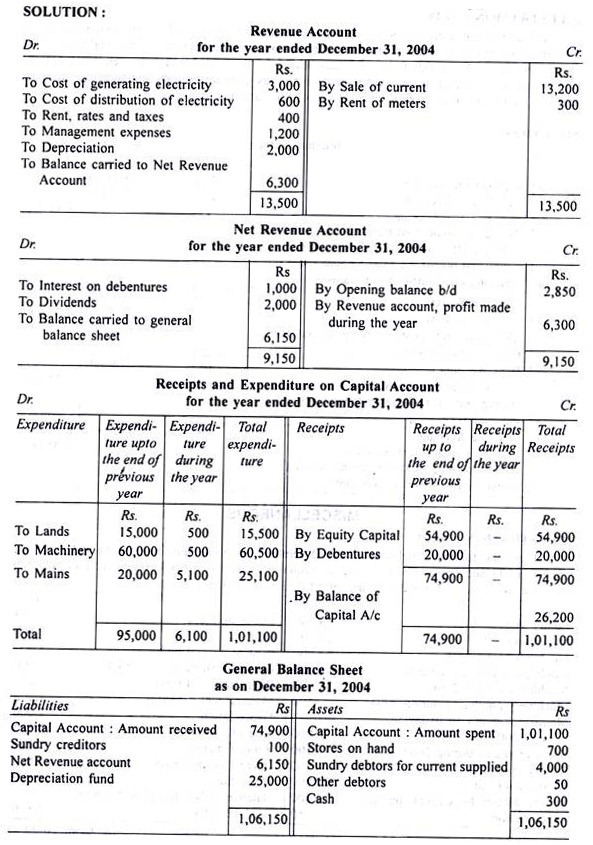

From the following balances as on December 31, 2004, appearing in the ledger of the Electric Light and Power Co. Ltd. you are required to prepare:

(a) Revenue Account,

(b) Net Revenue Account,

(c) Capital Account, and

(d) General Balance Sheet.