The below mentioned article provides a brief note on contributories, explained with the help of suitable illustrations.

Meaning of Contributories:

According to Section 428 of the Companies Act, 1956, a contributory is “every person liable to contribute to the assets of a company in the event of its being wound up, and includes a holder of fully paid-up shares, and also any person alleged to be contributory.” A fully paid shareholder will not however, be placed on the list of contributories, as he is not liable to make any contribution to the assets except in cases where surplus assets are likely to be available for distribution.

The liability of a contributory extends only to the amount, if any, remaining unpaid on the shares help by him. In the case of a contributory who holds fully paid shares, there is no liability. There is liability only in the case of partly paid shares, to the extent of share amount remaining unpaid.

Contributories mean all those persons who are responsible to make payment to the company at the time of its winding up. Unless the court dispenses with the settlement of a list of contributories, the liquidator prepares the list of contributories. If the name of a shareholder falls in the list of contributories, he becomes liable to pay only such amount which has so far not been called and paid by him on the shares held by him. He can save himself from paying this amount only when he proves that his name has been wrongly included in the list of contributories.

List of Contributories:

ADVERTISEMENTS:

The following two lists of contributories are prepared at the time of dissolution of a company:

(1) Contributories (List A):

Those shareholders who are members of the company at the time of its winding-up are included in list ‘A’. They are primarily liable for making payment to the company at the time of its winding-up up to the extent of the amount which remains unpaid on their shares up to that time. They are also called existing contributories.

(2) Contributories (List B):

ADVERTISEMENTS:

Those persons who cease to be the members of the company within one year before the date of winding-up of a company are included in the List B. If the company is not in a position to pay its creditors, and the amount of deficiency is not recovered from contributories of List A, Liquidator makes a call on the contributories of List B. They are liable to contribute only towards those debts of the company which were in existence at the time when they ceased to the member of the company.

They are never liable for those debts of the company which were incurred by the company after they ceased to be the members of the company. All the contributories of this list shall share the liability of the company proportionately. These contributories are never liable to pay more than the amount which remains unpaid on their shares.

In the case of company limited by guarantee no contribution shall be required from any past or present member exceeding the amount undertaken to be contributed by him to the assets of the company in the event of its being wound up.

Points to be noted:

ADVERTISEMENTS:

(1) The shareholders who ceased to be the members of the company for 12 months before the winding up of the company are never liable as contributories.

(2) If the liability of a shareholder is limited by share, he cannot be asked to pay more than the unpaid amount on his shares.

(3) A member of a company, whose liability is limited by guarantee, is not liable to pay more than the amount of guarantee.

Illustration 1:

ADVERTISEMENTS:

A Limited company went into liquidation having the following liabilities:

(a) Secured creditors Rs 20,000 (securities realised Rs 25,000)

(b) Preferential creditors Rs 600

(c) Unsecured creditors Rs 30,500

ADVERTISEMENTS:

Liquidator’s expenses amount to Rs 252. The Liquidator is entitled to a remuneration of 3% on the amount realised and I’A % on the amounts distributed to unsecured creditors. The various assets (excluding securities) realised Rs 26,000.

Prepare Liquidator’s Final Statement of Account.

ADVERTISEMENTS:

Illustration 2:

ADVERTISEMENTS:

A company passes a resolution for voluntary winding-up on March 31, when its Balance:

Dividend on Preference Shares remains unpaid for full one year.

Interest (payable annually on December 31) on Debentures has been paid up to December 31 1st.

Unsecured Creditors include Rs 2,000 as Preferential Creditors.

Plant and Machinery realise Rs 2,80,000; Furniture and Fittings Rs 400; Sundry Debtors Rs. 1, 50,000. Stock realises nothing.

ADVERTISEMENTS:

The winding up is completed on June 30, when the debentures are repaid.

The expenses of winding up amount to Rs 3,006.

The liquidator’s remuneration consists of 4 per cent, on realisation of Assets excluding cash in hand, and 2 per cent, on distribution amongst unsecured creditors only.

Draw up liquidator’s Statement of Account as at the end of the winding up.

Note:

Funds are insufficient for any payment to shareholders. Commission calculated only on the amount of Rs 2, 98,900.

Illustration 3:

The Ultra Optimist Limited went into voluntary liquidation on 31st March 2004 and the following Balance Sheet was prepared:

The Liquidator realised the assets as follows:

(a) Freehold property Rs 35,000

(b) Plant Rs 51,000

(c) Stock in trade Rs 39,000

(d) Sundry Debtors Rs 58,500

(e) Bills Receivable Rs 2,500

The expenses of liquidation amount to Rs 1,000 and the liquidator’s remuneration was agreed at 2’/4% on the amount realised and 2% on the amount paid to the unsecured creditors and preferential creditors.

You are required to prepare:

(i) Liquidator’s Final Statement of Account

(ii) The working of Liquidator’s Remuneration.

Illustration 4:

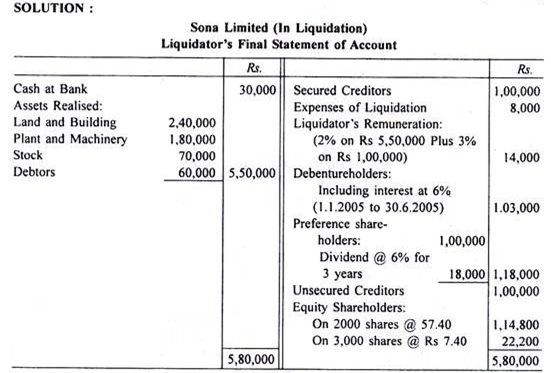

Balance Sheet of Sona Limited as on 31st December, 2004.

The company went into liquidation on 1st January, 2005.

The preference dividends were in arrears for the three years. The arrears are payable on liquidation.

Illustration 5:

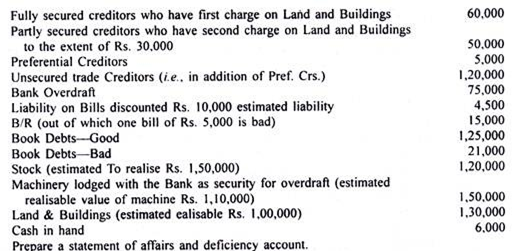

X Co. went into compulsory liquidation of 31st March, 2004.

Following informations were received on this date from the books of the company: