Here is a compilation of top eight problems on break-even analysis with their relevant solutions.

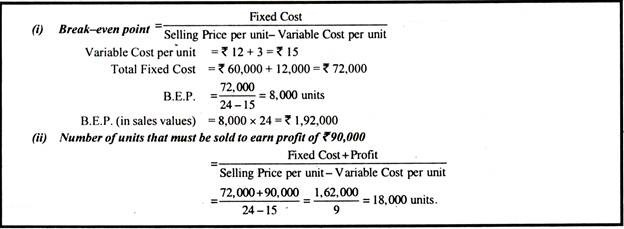

Break-Even Analysis: Problem with Solution # 1.

From the following particulars, calculate:

(i) Break-even point in terms of sales value and in units.

(ii) Number of units that must be sold to earn a profit of Rs. 90,000.

Solution:

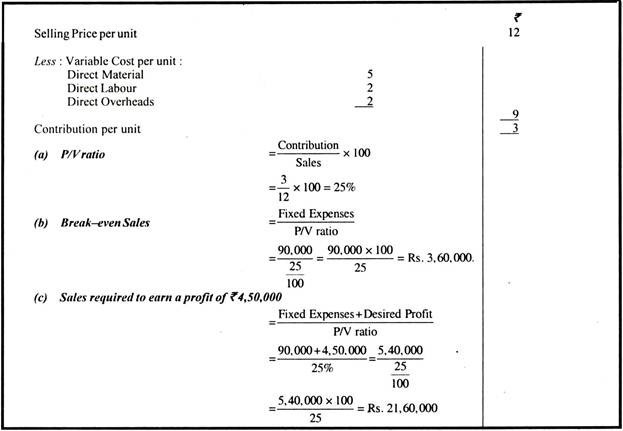

Break-Even Analysis: Problem with Solution # 2.

From the following data, you are required to calculate:

ADVERTISEMENTS:

(a) P/V ratio

(b) Break-even sales with the help of P/V ratio.

(c) Sales required to earn a profit of Rs. 4,50,000

Fixed Expenses = Rs. 90,000

ADVERTISEMENTS:

Variable Cost per unit:

Direct Material = Rs. 5

Direct Labour = Rs. 2

Direct Overheads = 100% of Direct Labour

ADVERTISEMENTS:

Selling Price per unit = Rs. 12.

Solution:

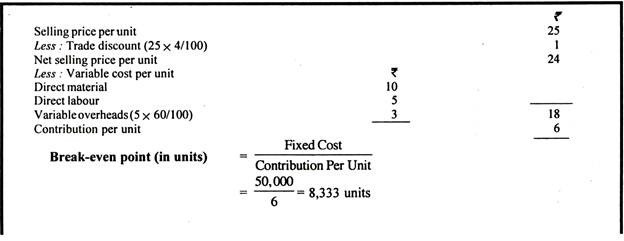

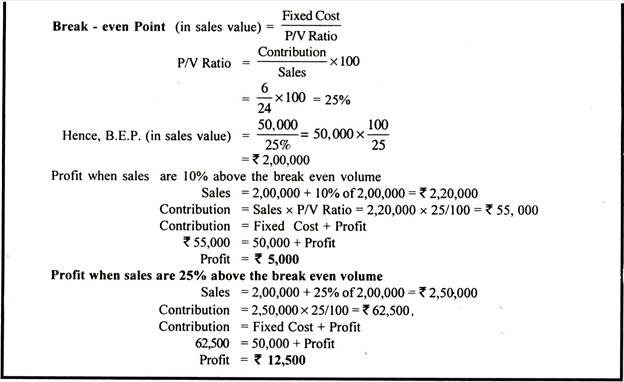

Break-Even Analysis: Problem with Solution # 3.

ADVERTISEMENTS:

From the following data, you are required to calculate break-even point and net sales value at this point:

If sales are 10% and 25% above the break even volume, determine the net profits.

Solution:

Break-Even Analysis: Problem with Solution # 4.

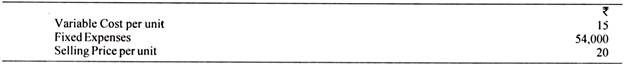

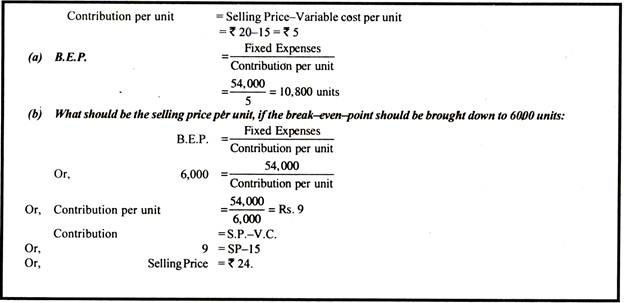

From the following particulars, find out the break-even-point:

What should be the selling price per unit, if the break-even point should be brought down to 6,000 units?

ADVERTISEMENTS:

Solution:

Break-Even Analysis: Problem with Solution # 5.

The fixed costs amount to Rs. 50,000 and the percentage of variable costs to sales is given to be 66 ⅔%.

If 100% capacity sales are Rs. 3,00,000, find out the break-even point and the percentage sales when it occurred. Determine profit at 80% capacity:

ADVERTISEMENTS:

Solution:

Break-Even Analysis: Problem with Solution # 6.

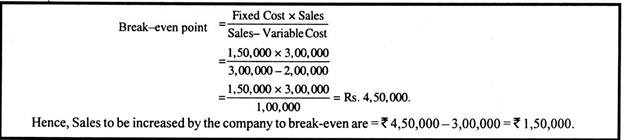

From the following information, ascertain by how much the value of sales must be increased by the company to break-even:

Solution:

Break-Even Analysis: Problem with Solution # 7.

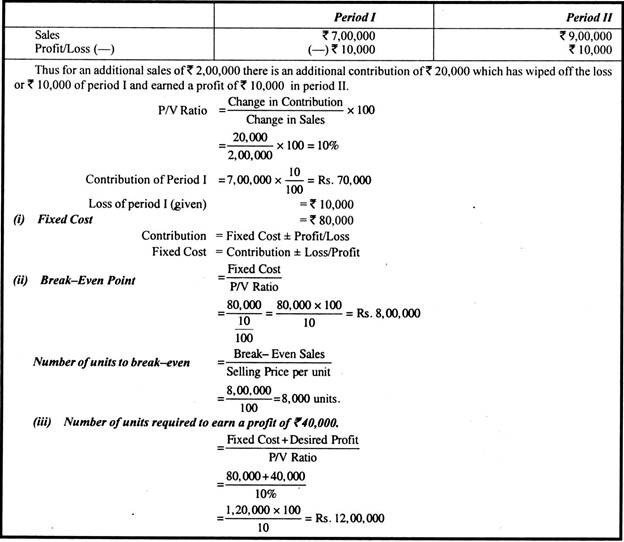

Calculate:

(i) The amount of fixed expenses.

(ii) The number of units to break-even.

(iii) The number of units to earn a profit of Rs. 40,000.

The selling price per unit can be assumed at Rs. 100.

The company sold in two successive periods 7,000 units and 9,000 units and has incurred a loss of Rs. 10,000 and earned Rs. 10,000 as profit respectively.

Solution:

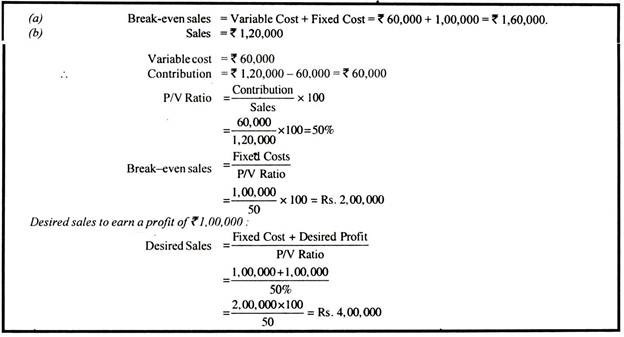

Break-Even Analysis: Problem with Solution # 8.

A company is making a loss of Rs. 40,000 and relevant information is as follows:

Sales Rs. 1,20,000; Variable Costs Rs. 60,000; Fixed costs Rs. 1,00,000.

Loss can be made good either by increasing the sales price or by increasing sales volume. What are Break even sales if

(a) Present sales level is maintained and the selling price is increased.

(b) If present selling price is maintained and the sales volume is increased. What would be sales if a profit of Rs. 1,00,000 is required ?

Solution: