In this article we will discuss about Budget:- 1. Definition of Budget 2. Purposes of a Budget 3. Elements 4. Steps.

Definition of Budget:

A Budget is a plan expressed in quantitative usually monetary terms, covering a specified period of time, usually one year. Many companies refer to their annual budget as a profit plan since it shows the planned activities that the company expects to undertake in its responsibility centers in order to obtain its profit goals.

In the words of Charles T. Horngren, “A budget is a formal quantitative expression of management plans”. The Chartered Institute of Management Accountant of London (CIMA) defines a Budget in the following words.

“A Budget is a plan quantified in monetary terms, prepared and approved prior to a defined period of time, usually showing planned income to be generated and/or expenditure to be incurred during that period and the capital to be employed to attain a given objective.”

ADVERTISEMENTS:

“A budget is a pre-determined statement of management policy during a given period which provides a standard for comparison with the result actually achieved.” —J.R. Brown and L.R. Howard. Therefore, preplanning is a cardinal feature of budgetary control.

Purposes of a Budget:

The budget of an enterprise serves the following purposes:

(i) Budget is an aid in making and coordinating short-range plans.

(ii) It is a device for communicating these plans to the responsibility center managers.

ADVERTISEMENTS:

(iii) Budget is a way of motivating managers to achieve their responsibility centers goals.

(iv) It is a bench mark for controlling on-going activities.

(v) Budget is a basis for evaluating the performance of responsibility centres and their managers.

(vi) It is a means of educating the managers in an organisation.

ADVERTISEMENTS:

(vii) Under suitable condition, standard costing and budgetary control may go hand in hand and can harmonies and make the planning and control more effective.

Elements of a Budget:

A budget is defined as a “comprehensive and coordinated plan, expressed in financial terms, for the operations and resources, of an enterprise for some specified period in the future”. —J.M. Fremgen.

According to the above definition, the essential elements of a budget that average are:

(i) Plan;

ADVERTISEMENTS:

(ii) Operations and resources;

(iii) Financial terms;

(iv) Specified future period;

(v) Comprehensiveness;

ADVERTISEMENTS:

(vi) Coordination.

Plan:

The term ‘plan’ with reference to budgeting has a specific connotation. Budgetary plan includes two aspects which have a bearing on the operations of an enterprise. One set of factors that determine a firm’s future operations are wholly external and beyond firm’s control like general business conditions, government policy and size and composition of population.

The second set of factors that affect future activities are within the firm’s control and discretion, i.e., they are internal like promotional programmes, manufacturing processes etc. Thus, budgeting not only suggests what will happen but should also make things happen. A budget is an expression partly of what the management expects to happen and partly of what the management intends to happen.

ADVERTISEMENTS:

Operations and Resources:

A budget is a mechanism to plan for the firm’s operations and resources. A budget should qualify the revenues to be realised from products/services and the expenses to be incurred on goods or services used in generating revenues. It also covers the resources of the firm. The budget makes plan for various assets to be used in its operations and the sources of funds to finance the assets both fixed and current assets.

Financial Terms:

Budgets are always prepared in financial terms i.e., in terms of monetary value such as rupee, dollar, sterling etc.

ADVERTISEMENTS:

Specified Future Period:

Budget is prepared for a specified period of time, usually for a year. Sales budget, production budget, cash budget are all prepared for a financial period of one year.

Comprehensiveness:

A budget is comprehensive i.e., all the activities and operations of an organisation are included in the budget. Budgets are prepared for each segment, facet, activity, division’ of an organisation. These activities, segments are integrated into an overall budget for the entire organisation. This overall budget is known as master budget.

Coordination:

The budget coordinates the various operational activities of an enterprise so as to take care of the situations and problems of each component. The budgets for each of the components are prepared in harmony with each other to make budgets more effective and meaningful.

Steps in Budgeting:

ADVERTISEMENTS:

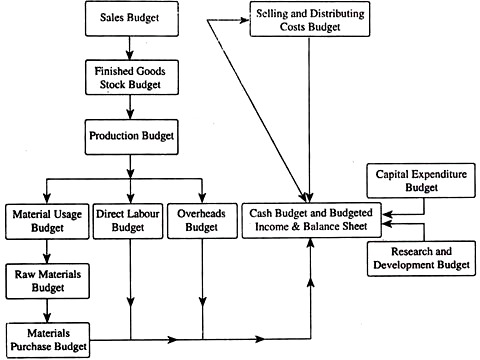

The following exhibit illustrates how (he various resources and activities of an enterprise are coordinated through budgetary planning.

The above exhibit indicates that the first stage of budgeting exercise is the determination of the ‘key’ factors or constants which impose overall limits to the budget plan. Among these factors are the productive capacity of the plant, the finance available to the firm, and, of course, the market conditions that impose a total limit on the output the firm is able to sell.

Normally from the management point of view, the critical question is ‘what is the firm able to sell in the budget period?’, and this question summarizes all the limits to the budget plan.

It is for this reason that the sales budget is at once the starting point and the fulcrum of the budgeting process. The arrows in the above exhibit indicate the flow of relevant information. Once the level of sales is established, selling and distribution cost may be ascertained.

The production budget itself is determined by the sales forecast, the desired level stock of finished goods and plant capacity. From the production budget may be estimated the production costs and cost schedules for materials, labour, and overheads.

In addition, the budgeting process for capital expenditure reflects decision taken in developing the long-range plan. The capital expenditure budget is concerned with expenditure during the budget period on the maintenance and improvement of the existing productive capacity. Moreover, Research and Development costs for improving methods of production and product improvement are associated with this budget.

From a financing point of view, the cash surplus or deficit arising out of the overall budget are revealed by the cash budget which incorporates all cash revenues and cash expenditures. This enables the firm to arrange its financial needs accordingly.

Finally, the projected results in terms of the overall net profits, and the changes in the structure of the firm’s assets and liabilities are expressed in the budgeted profit and loss account and the budgeted balance sheet at the end of the budget period.

Budget coordinates the various activities of the firm in a simplified manner. So, budgetary planning is an activity which is of critical importance to the firm, and the problems involved are often complex and difficult ones to resolve. For example, a firm’s sales policy cannot be considered in isolation from its pricing policy and its cost structure.

The firm’s production costs in relation to the required output may be too high to reach the profit target.

The role of the budget committee is, therefore, a very important and crucial one. It has not only to harmonize all the divisional budgets into an overall planning framework, but it has to deal with the numerous adjustments which may have to be made if the overall budget fails to meet some of the firm’s stated objectives.

Hence, the role of the budget committee is not only important in a practical sense, it embraces important and sensitive areas of policy making and management.