In this article we will discuss about the debit and credit items listed in a contract account.

Debit Items of Contract Account:

1. Materials:

Materials include:

(a) Materials specifically purchased for the contract,

ADVERTISEMENTS:

(b) Materials issued from stores against material requisition note, and

(c) Materials transferred from other contracts. The cost of these types of materials is debited to the Contract Account.

When material is returned to the store after the completion of contract, it is credited to the related Contract Account. But, sometimes the value of materials consumed is given, in that case it is shown in the debit side of Contract Account then materials returned to store and material in hand on site are not taken into consideration or they are not taken into consideration in Contract Account.

Alternatively, value of material returned to store and material in hand on site are added back to material consumed and the amount thus obtained is shown in the debit side of Contract Account and the value of material returned to store and materials in hand on site are shown in the credit side of Contract Account. For example – material consumed is Rs. 4,000, materials returned to store Rs. 400, material in hand on site Rs. 600.

ADVERTISEMENTS:

On the basis of above method these will be treated in Contract Account as under:

2. Direct Wages:

All wages of workers engaged on a particular contract are charged direct to the Contract Account. When several contracts are running at different locations, pay-roll is normally sectionalised so as to have separate pay-roll for each contract. Difficulties in costing may be encountered when some workers may have to move from one site to another when a number of small contracts are undertaken.

ADVERTISEMENTS:

In such situations it becomes necessary to provide time sheets from which allocation can be made. In order to control labour utilisation and prevent fraud in the payment of wages, surprise visits by head office personnel will be necessary. If there is any outstanding wages, it is also charged to Contract Account and in Balance Sheet as a liability, if it is required.

3. Direct Expenses:

In addition to materials and labour there are some other direct expenses which are charged to Contract Account. They are – Architects’ and consultant fee, the hire of plant from outside firms, electricity charges, insurance, telephone, postage and other general expenses. Outstanding expenses in this respect are also debited to Contract Account.

4. Indirect Expenses:

ADVERTISEMENTS:

When a contractor undertakes more than one contract simultaneously, he will set up a common office and engage common supervisory staff. The administration expenses incurred and supervisor’s salary etc. are the example of indirect expenses. These expenses are apportioned among the contracts on some suitable basis.

5. Plant and Machinery and Depreciation there on:

Some of the assets that are to be depreciated while on use on a contract are:

Bulldozers, mobile crane, cement mixer, tiles polishing machines, tractor and Lorries. There are two ways of dealing with the plant and machineries used on a contract –

ADVERTISEMENTS:

a. 1st Method:

Under this method, Contract Account is debited with the cost of the plant installed. When the contract is completed or the plant is no longer required, the plant is revalued and Contract Account is credited with the depreciated value of the plant. In case plant is sold on the completion of the contract, the Contract Account is credited with its sale proceeds. If plant is sold at a profit then the amount of profit will be shown in the debit side of Contract Account.

The net effect of the above debit and credit will be that the Contract Account will stand debited with the amount of depreciation which is the difference between the value of plant debited and the value of plant credited. This method is generally used on long contracts which extend over more than one year because depreciated value of the plant is credited to the Contract Account and brought down as an opening balance in the next period.

b. 2nd Method:

ADVERTISEMENTS:

Alternatively, Contract Account is simply debited with the amount of depreciation. This method is used when plant is sent to contract only for a short period or plant is used in different contracts. For example – mobile crane or bulldozer used in a contract may be charged on this basis.

However, when a plant is hired for a contract, a charge for the hire of the plant is debited to the Contract Account as a direct expense.

Computation of Depreciation on Plant:

i. 1st Method:

ADVERTISEMENTS:

If the rate percentage of depreciation per annum is given, then depreciation will be charged only for the period machine used. For example – if machine has been used for six months, then depreciation will be charged only for six months not for one year.

ii. 2nd Method:

If a fixed percentage of depreciation (i.e. the term per annum is not mentioned) is given, then depreciation will be charged for one year. In this case length of period for the use of machine is not taken into consideration. For example – if machine has been used for six months, even then depreciation will be charged for one year.

The above things can be made more clear by taking an example as under:

6. Profit on Sale of Plant:

ADVERTISEMENTS:

If there is profit on sale of any part of plant then sale proceeds of the plant will be shown in the credit side of Contract Account and profit on plant sold in the debit side of Contract Account.

7. Sub-Contract Cost:

Work of specialised character, for which facilities are not internally available, is offered to a sub-contractor. For example – steel work, glass work, painting, etc. is usually carried out by the sub-contractors who are accountable to the main contractor. The cost of such work is charged to the Contract Account.

8. Expenses of Extra Work:

Sometimes the contractor is required to do some extra work like additions or alterations in the work originally done as per agreement. The contractor will charge extra money for such extra work. The cost of such extra work is debited to the Contract Account and extra price realised is credited to the Contract Account.

9. Profit on Sale of Materials:

If there is profit on sale of material then sale proceed of material is shown in the credit side of Contract Account and profit there on in the debit side of contract account.

10. Provision for Contingencies:

Sometimes, the fully or partly payment of contract price is made after examining the work done for some period. After making provision for contingencies for such period rest amount is transferred to Profit and Loss Account. This provision for contingencies is posted to debit side of Contract account.

11. Opening Value of Work-in-Progress:

Work-in-progress standing in the books of a contractor at the beginning of any financial year should be taken into account in preparing the Contract Account for the current financial year. It should be entered on the debit side of the Contract Account is “To Work in Progress A/c b/d”.

Of course, in case the work-in-progress account also is prepared, then, the opening work-in-progress should appear also in the Work-in-progress Account. In the Work-in-progress Account, it should be entered on the debit side as “To Balance b/d.”

Items of Credit Side of Contract Account:

The items of credit side of Contract Account depend upon two things:

I. When contract is completed and

II. When contract is incomplete.

I. When Contract is Completed:

1. Contract Price:

The contract price is the total price payable by the contractee to the contractor for the construction work. The contract price should be brought into the Contract Account only when the contract is completed.

As such, the contract price should be recorded in the Contract Account only in the year in which the contract is completed and not in the year or years in which it remains incomplete. In the year in which the contract is completed, the contract price is brought into the account by debiting the Contractee’s Account and crediting the Contract Account.

2. Balance of Materials:

If there is any balance of material after the completion of contract, it will be shown in the credit side of Contract Account. For this balance of Material Account will be debited and Contract Account will be credited.

3. Return of Materials:

Those materials which are returned from the contract to the store or seller are also shown in the credit side of Contract Account as materials returned to store or materials returned to the supplier.

4. Materials Transferred:

Those materials which are transferred to other contracts are also shown in the credit side of Contract Account.

5. Sale of Materials:

If Materials are sold on profit, the total sale proceed is shown in the credit side of Contract Account and profit thereon on the debit side of Contract Account. But, if material has been sold at a loss then sale proceed as well as the amount of loss both will be shown in the credit side of Contract Account.

6. Return of Plant and Machinery:

If plant and machinery is returned either on the completion of the contract or in the middle term, then after charging depreciation the written down value of the plant is credited to the Contract Account.

7. Loss on Damage of Materials and Plant, etc.:

If materials at site or plant at site are lost either due to fire or theft they are not taken as expense for the contract because they have already been debited to Contract Account while sending them to site. Therefore, now they will credited to Contract Account for which Profit and Loss Account will be debited (loss on plant by theft or fire, etc.) and Contract Account will be credited.

II. When Contract is Incomplete:

1. Work-in-Progress:

Work-in-progress refers to the work in the process of completion. It consist of work certified and work uncertified. The value of work-in-progress at the end of financial year should be entered on the credit side of Contract Account so as to ascertain the actual amount of profit.

2. Value of Work Certified:

When a contractor undertakes a big contract requiring two or more years for its completion, naturally, he may not like to wait till the completion of the contract for receiving the contract price. He may like to receive the contract price from the contractee in instalments. So he may enter into an agreement with the contractor for the payment of the contract price in instalments.

Whenever there is an agreement between the contractee and the contractor providing for the payment of the contract price in instalment, before making the payment of any instalment, the contractee would like to make sure that the part of the contract for which the payment is made has been done by the contractor according to the specifications contained in the agreement.

In order to sure of this, he would appoint an architect or a surveyor to verify the work and certify the value of the work completed by the contractor. The architect or the surveyor verifies the work and issues a certificate stating the value of the work completed according to the specifications. The value of the work certified by the architect is called ‘Work Certified’.

The value of the work certified can be dealt within the Contract Account in any of the following two ways:

i. First Method:

Under this method, first, when the work is certified by the architect or the engineer, the value of the work certified is debited to Contractee’s Account and credited to Contract Account. Then, when cash is received from the contractee, the amount received is debited to Cash or Bank Account and is credited to Contractee’s Account. But, this method is not very popular.

ii. Second Method:

Under this method, first, when the work is certified, the value of the work certified is debited to Work- in-progress Account and is credited to Contract Account. Then, when the amount is received from the contractee, it is debited to Cash or Bank Account and is credited to Contractee’s Account.

In short, the value of work certified is entered on the credit side of the Contract Account as “Work-in-progress Account – Value of Work Certified.” This method is very popular and is recommended by almost all the authors.

Computation of the Value of Work Certified:

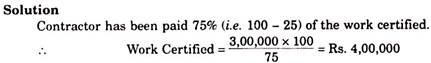

Sometimes the value of work certified is not given but relevant information is given in such a case the value of work certified will be calculated as follows –

Example:

Cash received by the contractor Rs. 2,40,000 which is 80% of the work certified. Find out the value of work certified.

Example:

Contractor is paid Rs. 3,00,000 by the contractee after deducting 25% as retention money. Find out the amount of work certified.

3. Work Uncertified:

If at the end of the financial year, certain work has not reached the stipulated stage, then, the architect may not value and certify that portion of the work. That part of the work which is actually done by the contractor, but has not reached the stipulated stage, and so, is not certified by the architect is called “Work Uncertified or Work done, but not Certified.”

The work uncertified is valued at cost and is brought into the Contract Account by debiting the Work-in-progress Account and crediting the Contract Account. Example – the financial year of a contractor comes to an end on 30th June and the architect of the contractee certifies the work on 15th June after verifying it.

After 15th June expenditure incurred by the contractor on the contract as follows:

Materials Rs. 10,000, Labour Rs. 5,000 and Other Expenses Rs. 2,500. Thus, the cost of work uncertified will be Rs. 17,500 (i.e. 10,000 + 5,000 + 2,500). This amount of work uncertified will be included in Work-in-progress Account.

Sometimes, the architect (engineer) of the contractee does not certify the part of the work, which is done in such case the cost of work uncertified will be calculated as under:

Example:

4/5 work of the contract has been completed by the contractor.

Cost of the 4/5 work is Rs. 1,50,000,

Work certified is 1/2 of the work,

Cost of work uncertified =?

4. Plant at Site:

The amount that should be taken into account, while recording the plants, tools or equipments on site at the end of the financial year, will be the value of the plants, tools or equipments at the end of the financial year (i.e. the cost of the plants, tools or equipments on site minus the depreciation on the plants, tools or equipments on site from the beginning of the financial year to the end of the financial year.

While calculating the value of the plant at site, the value of plant returned to stores and plant lost either due to plant lost by theft or destroyed by fire should be deducted from the value of plant then applicable depreciation should be charged to find out the closing balance of plant (plant at site).

Plant, tools or equipments in hand or on site at the end of the financial year should be recorded on the credit side of the Contract Account.

The above things can be explained with the help of following example:

1. Materials returned to stores,

2. Materials returned to the suppliers,

3. Sale of materials (Total sale proceed whether at profit or at loss),

4. Materials transferred to other contracts,

5. Materials lost in accident or theft away (P/L A/c),

6. Loss on sale of materials,

7. Plant and machinery returned after depreciation,

8. Plant transferred to other contracts after depreciation,

9. Sale of plant and machinery (total sale proceed),

10. Plant lost in accident,

11. Loss on sale of plant and machinery.

Description of Some Other Important Items:

1. Retention Money and Cash Ratio:

It is usual practice not to pay the full amount of work certified. The contractee may pay a fixed percentage, say 80% or 90% of the work certified, depending upon the terms of the contract. This is known as ‘Cash Ratio’. The balance amount not paid is known as ‘Retention Money’. For example – if cash ratio is 75% the retention money will be 25% (i.e. 100 – 75).

This retention money is a type of security for any defective work which may be found in the contract later on. This also works as a deterrent for the contractor to leave the contract incomplete, if he finds the contract unprofitable. The retention money may also be adjusted against penalties that become due if the contract is not completed within the stipulated time as per the terms of the agreement.

2. Notional Profit and Estimated Profit:

(a) Notional Profit:

Notional profit is the difference between the value of work-in-progress certified plus the cost of work not yet certified and cost of work to date. It is computed as follows (figures are assumed):

(b) Estimated Profit:

Estimated profit represents the excess of the contract price over the estimated total cost of the contract. It is computed as follows (figure are assumed) –

3. Escalation Clause and De-Escalation Clause:

(a) Escalation Clause:

Escalation clause is a clause in the agreement between the contractor and the contractee which provides for an upward revision of the contract price; in the event of the cost of the contract going beyond a certain level on account of rise in the prices of material and labour, or on account of change in the utilisation of material and labour.

The object of escalation clause is to cover up any likely increase in the cost of contract beyond a certain level on account of rise in the price of material and labour or change in the utilisation of material and labour.

This clause is, generally, included in long period contracts. The escalation clause is of particular importance to the contractor. It safeguards the contractor against unfavourable changes i.e. rise in the prices of material and labour; by providing for upward revision of the contract price.

(b) De-Escalation Clause:

In the context of the study of escalation clause, it is also necessary to have some idea about de-escalation clause. Just as if there is escalation clause, there can also be a de-escalation clause in the agreement between the contractor and the contractee.

The de-escalation clause provides for downward revision of the contract price in the event of the cost of the contract going below a certain level on account of fall in prices of materials and labours. The de-escalation clause safeguards the interests of the contractee by providing a downward revision of the contract price.

4. Cost-Plus Contract:

Cost -plus contract is a contract in which the contract price is ascertained by adding a specified amount of percentage of profit to the costs allowed in the contract. This type of contract terms are agreed upon in those cases where it is not possible to compute the cost in advance with a reasonable degree of accuracy due to unstable conditions of market prices, labour rates, etc.

The contractee undertakes to reimburse the actual cost of contract plus a stipulated profit. The profit to be added to cost may be either fixed amount or a specified percentage of cost. The times of cost to be included for the purpose of determining contract price are broadly agreed upon in advance. The accounts of the contractor are usually subject to audit by the contractee.

Cost-plus contracts are usually entered into for executing special type of work like construction of dam, power house, newly designed ship, etc., where cost estimation is difficult. Government often prefers to give contracts on ‘cost-plus’ terms.

Suitability of Cost-Plus Contract:

Cost-plus contracts are, usually, adopted in the following cases:

(1) In cases where the cost of a contract cannot be estimated in advance with a reasonable degree of accuracy owing to the unsteady prices of materials, labour and other expenses.

(2) In cases where a contract takes a number of years for its completion, and the prices of materials, labour and other items are quite unsteady.

(3) In cases of construction works during war time where the prices of materials, labour and other expenses are unsteady.

(4) In cases where the work to be done is not definitely fixed at the time of entering into the contract.

(5) In cases where the quality of the work is of utmost importance.

Usually, cost -plus contracts are entered into for executing special type of work such as the construction of a dam, a power house, newly designed aircraft, a newly designed ship, etc., where estimates of cost in advance is difficult. In this connection, it may be noted that, usually, Government contracts are on cost-plus terms.

Advantages of Cost-Plus Contract:

A cost-plus contract has certain advantages. They are:

To the Contractor:

(1) There is no risk of loss on such contract.

(2) It protects the contractor from the risk of fluctuations in market prices of material, labour etc.

(3) It simplifies the work of preparing tenders and quotations.

(4) Earliest completion of the work.

(5) Procurement of the services of the experts.

To the Contractee:

(6) By giving to the contractee the right to inspect the accounting records of the contractor, a cost-plus contract ensures a fair price to the contractee.

(7) In the case of cost-plus contracts, generally, the quality of the work does not suffer. In other words, it assures quality work to the contractee.

(8) Under this method, the contractor can know in advance the profit that can expect to work on the contract on its completion.

Disadvantages of Cost-Plus Contract:

Following are the main disadvantages of cost-plus contract:

To the Contractor:

(1) The contractor is deprived of the advantages which would have accrued due to favourable market prices.

(2) The contractor has to suffer for his own efficiency. This is because profit is usually based as a percentage of cost and efficient working resulting lower cost also leads to lower profits.

To the Contractee:

(3) The contractee has to pay more for the efficiency of the contractor as a contractor has no incentive to reduce cost.

(4) The price a contractee has to pay is unknown until after the completion of work.

(5) Misuse of materials and labour by the contractor.

(6) Generally the contract price is widely increased, etc.