In this article we will discuss about Marginal Costing:- 1. Meaning of Marginal Costing 2. Need for Marginal Costing 3. Ascertainment of Profit 4. Features 5. Advantages 6. Limitations.

Contents:

- Meaning of Marginal Costing

- Need for Marginal Costing

- Ascertainment of Profit under Marginal Costing

- Features of Marginal Costing

- Advantages of Marginal Costing

- Limitations of Marginal Costing

1. Meaning of Marginal Costing:

According to CIMA Terminology Marginal Costing is the ascertainment of marginal cost and of the effect on profit of changes in volume or type of output by differentiating between fixed costs and variable costs. In this technique of costing only variable costs are charged to operations, processes or products, leaving all indirect costs to be written off against profits in the period in which they arise.

ADVERTISEMENTS:

It is clear from the above that only variable costs form part of product cost in the technique of marginal costing because only variable costs are changed if output is increased or decreased and fixed costs remain the same.

Marginal costing is different from direct costing. Direct costing is the practice of charging all direct costs to operations, processes or products, leaving all indirect costs to be written off against profit in the period in which they arise. Thus, in direct costing some fixed costs could be considered to be direct costs in appropriate circumstances but fixed cost is never taken in marginal cost.

The Chartered Institute of Management Accountants, London, defines the term “marginal cost” as follows:

Marginal Cost is the amount at any given volume of output by which aggregate costs are changed if the volume of output is increased or decreased by one unit. In this context a unit may be a single article, a batch of articles, an order, a stage of production capacity or a department.

ADVERTISEMENTS:

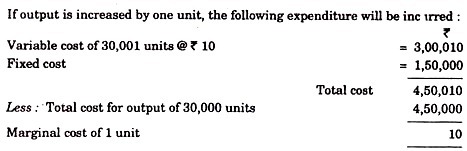

It relates to the change in output in the particular circumstances under consideration. For example, if variable costs per unit are Rs.10 and fixed expenses are Rs.1, 50,000 per annum, an output of 30,000 units per annum results in the following expenditure:

2. Need for Marginal Costing:

ADVERTISEMENTS:

Fixed expenses remain constant in aggregate amount and do not vary with the increase or decrease in production up-to a particular level of output. Just contrary to this variable expenses increase or decrease in proportion to increase or decrease in output and remain constant per unit of output.

Fixed expenses per unit continue to vary with the increase or decrease in production because these expenses remain constant up-to a certain level of production. Thus, fixed overheads lead to different costs per unit at different levels of production.

On account of this, a special technique known as marginal costing has been developed which excludes fixed overheads entirely from the cost of production and gives us the same cost per unit up-to a particular level of output. Thus, under this technique fixed expenses are not allocated to cost units but are charged against “fund” which arises out of excess of selling price over total variable costs.

3. Ascertainment of Profit under Marginal Costing:

ADVERTISEMENTS:

Ascertainment of marginal cost is different from absorption cost. In marginal cost it is assumed that the difference between the aggregate sales value and the aggregate marginal cost of the output sold is contribution and provides a fund to meet the fixed cost and profit of the firm.

In respect of each product, the difference between its sales value and the marginal cost is known as “contribution” made by the product to this fund. This contribution is also the aggregate of fixed expenses and profit (or minus loss).

If more than one product are produced, contribution of all products are merged into the fund out of which fixed expenses are deducted to get the figure of the profit. Following diagram represents a firm manufacturing three products and shows how individual product contributions are merged into the fund, the total amount of which should be sufficient to meet the fixed expenses and provide the desired profit.

4. Features of Marginal Costing:

Following are the main features of Marginal Costing:

a. It is a technique of costing which is used to ascertain the marginal cost and to know the impact of variable cost on the volume of output.

b. All costs are classified into fixed and variable cost on the basis of variability. Even semi fixed cost is segregated into fixed and variable cost.

ADVERTISEMENTS:

c. Variable costs alone are charged to production. Fixed costs are recovered from contribution.

d. Valuation of stock of work in progress and finished goods is done on the basis of marginal cost.

e. Selling price is based on marginal cost plus contribution.

f. Profit is calculated by deducting marginal cost and fixed cost from sales.

ADVERTISEMENTS:

g. Cost Volume Profit (or Break Even) Analysis is one of the integral parts of marginal costing.

h. The profitability of a product/department is based on contribution made available by each product/department.

5. Advantages of Marginal Costing:

Following are the main advantages of marginal costing:

a. It is simple to understand and easy to operate.

b. The valuation of closing stock under marginal costing is done at marginal cost and thus prevents the illogical carry forward of fixed costs of one period to the next period as part of value of closing stock.

ADVERTISEMENTS:

c. There is no problem of computing fixed overhead recovery rates and their under or over recovery as fixed overheads are charged against the contribution.

d. In marginal costing, it is established that profit is a function of sale and not of production as profit depends on sales volume and not on production volume. This can be verified by preparing a profit statement under marginal costing.

e. It facilitates control over variable costs by avoiding arbitrary apportionment or allocation of fixed costs.

f. It is a very useful tool of profit planning. It guides the management about the profitability at various levels of production and sales.

g. It is very valuable technique in decision-making. It provides information to the management in making decisions like make or buy, selling price fixation, export decision etc.

h. It provides the management with useful techniques like break even analysis, P/V ratio etc.

i. It helps in cost control by concentrating on variable cost as the fixed cost is non-controllable in the short period.

j. It helps in evaluation of performance of different departments, divisions, products, salesmen etc.

k. It is a valuable adjunct to standard costing and budgetary costing.

6. Limitations of Marginal Costing:

Marginal costing technique has certain limitations which must be kept in mind while making use of this technique:

a. The separation of expenses into fixed and variable presents certain technical difficulties whereas marginal costing technique assumes that all expenses can be divided into fixed and variable. In fact, no variable cost is completely variable and no fixed cost is completely fixed. Actually, most of the expenses are semi-variable and it is difficult to segregate them into fixed and variable.

b. Time taken for the completion of jobs is not given due attention because marginal cost excludes fixed expenses which are connected with time. Fixed expenses should be considered if the suitable comparison of two jobs is to be made.

c. With the development of technology, fixed expenses have increased and their impact on production is much more than that of variable expenses. Therefore, a system of costing which ignores fixed expenses is less effective because a significant portion of the cost representing fixed expenses is not taken care of.

d. It is possible that a concern using marginal costing technique may value work-in-progress and finished stocks at marginal cost.

The arguments against valuing these items at marginal costs are as follows:

(i) Balance Sheet will not exhibit a true and fair view because work-in-progress and finished stock will be shown at marginal costs which do not include fixed expenses. Thus, finished stocks and work-in-progress will be understated in the Balance Sheet.

(ii) In case of loss by fire, full loss on account of stock destroyed by fire cannot be recovered from the insurance company because marginal costing technique of valuation of stock will not take fixed expenses into consideration.

e. Marginal costing technique does away with the difficulties involved in the apportionment of overheads because fixed expenses are deducted from total contribution. But the problem of apportionment of variable costs still arises.

f. Marginal costing technique is difficult to apply in contract or shipbuilding industry where the value of work-in-progress is high in relation to turnover. If fixed expenses are not included in the valuation of work-in-progress, losses may occur every year till the contract is completed, while on the completion of the contract there may be huge profits.

g. Cost control can be better achieved with the help of other techniques such as budgetary control and standard costing as marginal costing technique does not provide any standard for the evaluation of performance which is provided by standard costing and budgetary control.

h. Marginal costing technique cannot be successfully applied in cost plus contracts unless a high percentage over the marginal cost is charged from the contractee to cover the fixed costs and profits.

i. Sometimes, an order from a new customer is accepted at a very low price on the argument that if marginal cost is little less than the price of the order, it will give some contribution. This may sometimes lead to a general reduction in selling price and thus to losses.