Everything you need to know about material losses in Cost Accounting. Losses of materials may arise during handling, storage or during process of manufacture.

In the process of handling, storage and usage of materials, a part of the materials may be wasted, spoiled or scrapped and thus lost. The problems of wastage, spoilage and scrap are common to all manufacturing organisations.

In every type of manufacturing organization, there is some difference between input and output of production process. If output is less than the input, then it is termed as material losses.

Material losses do occur in every type of manufacturing organization. These losses may be in the form of waste, spoilage or defective work. There is no uniformity in the terminology and accounting treatment of these items.

ADVERTISEMENTS:

Material losses take place in one way or the other in the process of material handling, storage and issue to respective departments or jobs.

Material losses can be classified on the basis of:- 1. Wastage 2. Spoilage 3. Scrap 4. Defectives 5. Obsolete Materials.

Additionally, learn about the accounting treatment and control of each type of material losses.

Material Losses in Cost Accounting – Wastage, Spoilage, Scrap, Defectives and Obsolete Materials

Material Losses in Cost Accounting: Normal and Abnormal Loss: Scrap, Spoilage and Defective Materials

There may be loss of materials during process of manufacturing.

ADVERTISEMENTS:

These losses are classified into the following two categories:

(1) Normal Loss:

It is that loss which cannot be avoided and it has a tendency to occur, such as:

(a) Loss due to evaporation

ADVERTISEMENTS:

(b) Loss due to breaking

(c) Loss in loading and unloading of materials.

(2) Abnormal Loss:

This loss arises on account of inefficiency and mischief etc., such as:

ADVERTISEMENTS:

(i) Improper storage

(ii) Breakage of materials

(iii) Theft and Pilferage

(iv) Use of defective weighing machine

ADVERTISEMENTS:

(v) Fire, accident, flood, earth quacks etc.

(vi) Other unavoidable reasons.

Waste:

That portion of raw materials, which is lost in the process of manufacturing is known as waste. Waste may be visible or invisible. Quantity of production is reduced on account of wastes. If waste is a part of abnormal loss, it is transferred to P/L A/c.

Scrap:

The incidental residue of small quantity and low value is known as scrap. Scrap increases the cost of production and a proper control is to be made on it. Sale of scrap may be treated as other income and can be credited to P/L A/c. The realised value of scrap may be credited to the process account.

Spoilage:

ADVERTISEMENTS:

When materials are damaged, which cannot be brought to normal conditions is known as spoilage. Normal spoilage is a part of total cost, while abnormal spoilage is to be transferred to profit and loss account.

Defectives:

The production which is below the fixed standard and can be rectified by incurring additional expenditure is known as defective item. Proper control should be exercised over the defective goods. The rectification costs should be debited to the concerning jobs. In case of abnormal defective work, the cost may be transferred to costing profit and loss account.

Material Losses in Cost Accounting – With Accounting Treatment and Control

1. Waste:

Waste is the portion of basic raw material lost in processing, having no recoverable value. Waste may occur due to evaporation, breaking the bulk, loading and unloading, leakage, inefficient handling, fire, etc. It may be visible or invisible, for example, gases, dust, and smoke and unsaleable residues. The effect of waste is to increase the unit cost of production, since the total cost is spread over a smaller number of good units.

Accounting Treatment:

ADVERTISEMENTS:

The accounting treatment of waste depends upon whether the waste is normal or abnormal.

For normal waste arising from breakage, evaporation, deterioration, shrinkage in production, the total cost incurred is distributed over the good output. The treatment is based on the principle that normal losses should be borne by good output.

Abnormal wastage of material arising due to abnormal reasons, i.e. theft, fire, careless handling, etc., is not added to the cost of production but is transferred to costing profit and loss account. This is necessary to avoid any fluctuation in cost of production.

Control of Waste:

In order to control waste in manufacturing industries, a waste report is prepared at regular intervals. The actual percentage of waste is compared with the standard percentage and remedial measures are taken to remove any abnormal waste.

2. Scrap:

Scrap is defined as the incidental residue from certain types of manufacture usually of small amount and low value recoverable without further processing. Example of scrap are available in operations like turning, boring, punching, shaving, moulding, etc.

ADVERTISEMENTS:

There are three types of scraps, namely-

(a) Legitimate scrap, i.e. scrap which is predetermined and arises due to the nature of operations like turning, boring, punching, etc.

(b) Administrative scrap, i.e. scrap which arises due to administrative action such as change in the method of production,

(c) Defective scrap, i.e. scrap which arises because of the use of inferior quality of material or bad workmanship or defective machine.

There is difference between waste and scrap. Waste cannot be realised whereas scrap can be realised. Scrap is always visible whereas waste may or may not be visible.

Accounting of Scrap:

The usual methods for accounting of scrap are as follows:

i. The sale value of scrap is credited to profit and loss account as other income. The unit cost of production is, therefore, inclusive of cost of scrap. This method fails to secure effective control over scrap as detailed records are not kept and scraps are not identified to jobs or processes.

ii. From the sale proceeds of scrap selling and distribution costs are deducted and the net value is deducted from material cost or factory overhead. The effect of this method is to reduce material cost or overhead recovery rate. This method fails to secure effective control of scraps arising in processes or jobs. It is suitable in cases where several production orders are taken in hand and it is not possible to segregate the value of scrap for each order.

iii. The value realised from sale of scrap is credited to particular job, process or operation. This method has an advantage of identifying scrap with each operation, process or job.

Control over Scrap:

Control over scrap is possible by:

i. Setting standards for scrap,

ii. Determining the responsibility for scrap,

iii. Keeping up proper records of scrap in the form of scrap reports.

3. Spoilage:

Spoilage consists of goods that do not meet production standards and are either sold for their salvage value or discarded without further processing. Spoilage cost is the difference between costs incurred up to the point of rejection less the disposal or salvage value. When spoiled goods are discovered, they are taken out of production and no further work is performed on them.

Accounting of Spoilage:

i. If spoilage is caused by an order’s exacting specifications, the spoilage cost as reduced by the recovery or sales value of the spoiled units should be charged directly to that order.

ii. If some spoilage is normal in the manufacturing process, the cost of such spoilage will be borne by good units.

iii. In case of abnormal spoilage, cost of spoilage is transferred to costing profit and loss account.

Control of Spoilage:

For effective cost control, normal spoilage rates should be established for each department and for each type or class of material. Weekly or monthly spoilage reports should be reviewed by the inspector. The actual spoilage is compared with the standard or normal spoilage and steps are taken to remove any abnormal spoilage.

4. Defectives:

Goods that do not meet production standards and must be processed further in order to be saleable as good units are known as defectives. Defective work can be corrected to meet specified standards with additional materials, labour and overhead. Defectives may arise due to substandard materials, poor workmanship, bad supervision and careless inspection.

The additional cost of rectifying the defectives is added to the total cost and the quantity of defectives rectified is added to the quantity of good output because defective units rectified can be sold as ‘first’ or ‘seconds’. The main difference between spoilage and defectives is that spoilages are sold without further processing, whereas defectives are rectified by additional expenditure and sold as ‘first’ or ‘seconds’.

Accounting of Defectives:

i. If the defective units are clearly identified with a numbered job order and the defects are peculiar to the job, the cost to complete the defective units can be charged to the job.

ii. If defective units occur irregularly, the cost of rectification is properly charged to factory overhead.

iii. If the defective production is due to abnormal reasons, the rectification cost is transferred to costing profit and loss account.

Control of Defectives:

On the receipt of defective work report, a decision is taken whether to rectify or not to rectify the work. All costs of rectification are collected against the rectification work order. Adequate steps should be taken to see that defective work remains within standard limits.

Material Losses in Cost Accounting – With Its Treatment

In the process of handling, storage and usage of materials, a part of the materials may be wasted, spoiled or scrapped and thus lost. The problems of wastage, spoilage and scrap are common to all manufacturing organisations. There is no uniformity, however, in the accounting treatment of these items.

The most commonly followed practices in respect of these items are given below:

1. Wastage and Its Treatment:

Wastage is that portion of basic raw material, lost in the processing, having no value to be recovered. Wastage is a complete loss. Wastage may occur due to evaporation, breaking the bulk, loading and unloading, leakage, inefficient handling, fire etc. It may be visible or invisible. There can be two types of wastage, namely normal wastage and abnormal wastage.

i. Normal Wastage:

Normal wastage is one which is natural and incidental to production. It is one which can be pre-determined on the basis of past experience. This wastage is unavoidable. The causes which bring about such wastage – are evaporation of oil, paints etc. absorption of moisture in the case of lime etc., natural deterioration (rusting); difficulty of breaking the bulk as in the case of coal etc.

The costing rule is that the loss on account of normal wastage will be borne by the good units. Normal wastage is treated as a part of cost, i.e., the rate per unit is inflated to recover the loss.

ii. Abnormal Wastage:

Loss of materials which is in excess of normal wastage is known as abnormal wastage. Such losses may be caused by any of the following factors – Pilferage, defective storage, careless handling of materials, obsolescence, natural calamities, theft etc.

The value of such type of wastage is not added to the cost of production but is transferred to Costing Profit and Loss Account so that a meaningful comparison of cost of production of different periods could be made. Abnormal wastage needs careful investigation to determine the causes so as to prevent recurrence.

2. Scrap and Its Treatment:

Scrap is the incidental residue from certain types of manufacture, usually of small quantity and low value, recoverable without further processing. Scrap may arise on account of turnings, borings, trimmings etc. from metals on which certain machine operations are carried out.

Examples of scrap are – metal from stamping operation; iron fillings, odd pieces of timber, strips of cloth, chemical residue etc., left after the completion of the manufacturing process. Scrap may occur because of – faulty planning, poor manufacturing methods, employment of low quality materials, defective inspection methods, outdated machines and tools etc.

Types of Scrap:

Scraps are of three types:

i. Legitimate Scrap – This type of scrap is unavoidable and such losses are bound to arise. These losses, in most cases, are pre-determined or anticipated.

ii. Administrative Scrap – This type of scrap arises because of the administrative defects; for example scrap resulting from obsolescence of design, inferior quality of materials, poor workmanship, unsuitable machines etc. Such type of scrap is treated as abnormal because of abnormal reasons.

iii. Defective Scrap – This arises because of inferior quality of or bad workmanship

Treatment:

The usual methods for the treatment of scrap may be listed thus:

(i) When the value of scrap is negligible, the realisable value is credited to the costing profit and loss account as an abnormal gain. This method is simple but it fails to have effective control over scrap because no detailed records are maintained.

(ii) When several production orders are processed simultaneously, the sale value of the scrap may be deducted from the material cost or factory overhead (because it is not possible to segregate the value of scrap from each order separately). This will reduce the material cost or factory overhead. However, this method fails to ensure effective control over scraps arising in processes or jobs.

(iii) The value realised from sale of scrap may be credited to the particular job, process or operation.

Control:

Control of Scrap is made effective through:

i. Setting up standards

ii. Keeping proper records of scraps

iii. Fixing responsibility on individuals.

3. Spoilage and Its Treatment:

Spoilage occurs when goods are so damaged in course of manufacturing process as to become not rectifiable with some additional cost. Material used in spoiled units can be used again as material by the same or another process or product. Spoilage cost is the difference between the cost incurred up to the point of rejection less salvage value or cost of materials used.

Treatment of Cost of Spoilage:

The treatment of cost of spoilage depends upon the nature of spoilage. If the spoilage is normal, the cost is borne by good units of output. In case of abnormal spoilage, cost of spoilage is transferred to Costing Profit and Loss Account. When, however, the normal spoiled units are used again as raw material in the same manufacturing process, no separate treatment becomes necessary.

If they are used for another process, job or order, a proper credit should be given to the process, job or order, giving rise to the spoilage keeping in view the utility value of the spoilage to the process, job or order for which the same is used.

4. Defectives and Accounting Treatment:

Defectives are that part of product which in the process of manufacturing, develop some imperfection and which can be rectified at an extra cost of operation on it. Defective work is to be distinguished from spoiled work.

There is some imperfection which can be brought up to the standard by additional materials or labour in respect of defective. But the spoiled work cannot be reconditioned and the units must be sold as scrap or second or third grade products.

Reasons:

Defectives occur because of the following reasons:

i. Poor quality of raw materials

ii. Poor workmanship

iii. Improper maintenance of machines

iv. Faulty design of products

v. Wrong setting of tools and equipment

vi. Lack of supervision at various levels

vii. Lapse of time (e.g., chemicals)

viii. Unsound working conditions

ix. Poor manufacturing conditions

x. Management failure etc.

Treatment:

The usual methods regarding treatment for defectives are as follows:

(i) If the defective production is identified with a specific job or department, the cost of rectification is charged to that specific job or department.

(ii) If the defective production is not identified with a particular job or department, the cost of rectification is added to general factory overhead.

(iii) If the defective production is due to abnormal reasons, the rectification cost is transferred to Costing Profit and Loss Account.

Material Losses in Cost Accounting – With Control of Material Losses

Losses of materials may arise during handling, storage or during process of manufacture.

Such losses or wastages are classified into two categories:

1. Normal loss, and

2. Abnormal loss.

1. Normal Loss:

This is that loss which has necessarily to be incurred and thus is unavoidable. Examples are –

i. Loss by evaporation in case of liquid materials.

ii. Loss due to breaking the bulk, say, when materials are purchased in large quantity and issued to production in small lots.

iii. Loss due to loading and unloading of materials.

Normal losses of materials cannot be completely eliminated but may be controlled to a limited extent.

2. Abnormal Loss:

This is that loss which arises due to inefficiency in operations, bad luck, mischief, etc. Examples are –

i. Theft or pilferage

ii. Breakage

iii. Fire accident, flood, etc.

iv. Use of inaccurate weighing instruments

v. Improper storage of materials, etc.

Control of Material Losses:

The following steps may be taken to control losses of materials:

1. Proper storage conditions should be provided, particularly in case of perishable materials.

2. The store rooms should be well guarded and protected to avoid the risks of theft, fire, etc.

3. In order to reduce losses due to obsolescence, materials should be issued on first-in-first-out basis.

4. Accuracy of weighing instruments should be periodically checked.

5. A systematic procedure should be developed regarding movement of materials from one place to another and no unauthorised movements of materials should be permitted.

6. Specialised material handling equipment should be employed so as to minimise losses in material handling.

It is a principle of costing that all normal losses which are necessarily to be incurred are treated as a part of the cost and abnormal losses which are really avoidable should not be included in the cost. Therefore, in order to absorb normal material losses in cost, the rates of usable materials in stock are inflated so that such losses are covered. Alternatively, normal material loss is transferred to factory overhead.

Abnormal material losses, such as- due to breakage, theft, fire, Hood, abnormal evaporation, etc., are charged to costing profit and loss account.

Waste and Scrap:

Waste and scrap are forms of material losses.

These two terms are briefly explained below:

Waste:

Waste has been defined as – “that portion of a basic raw material which is lost in processing, having no recovery value.” Thus waste is a material loss arising in production which has little or no value. Waste may be visible or invisible. Visible waste is that which is physically present, e.g., ash, saw dust, etc. An invisible waste, on the other hand, is the disappearance of basic raw material in the form of evaporation, smoke, etc. Waste in certain industries creates problems of disposal. Usually this is disposed of in the easiest and cheapest manner, e.g., liquid wastes may be poured into adjacent rivers.

Scrap:

This is defined as – “the incidental residue from certain types of manufacture usually of small amount and low value, recoverable without further processing”.

Scrap has the following features:

a. Scrap is incidentally produced from the manufacturing process.

b. Scrap is usually of small value.

c. No further processing is required to realise its saleable value.

d. Scrap cannot be used as a material for its original purpose.

e. Unlike waste, scrap is always physically available.

Examples of scrap are trimmings in timber industries; cuttings, pieces, etc., in leather and readymade garments factory, off-cuts of sheet metal, etc.

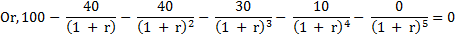

Stock Turnover Ratio (Inventory Turnover Ratio):

This is the ratio of materials consumed during the year to the average stocks of raw materials.

Its formula is as follows:

Stock turnover ratio is an indicator of the rate of consumption i.e., the fast moving and slow moving materials. A high stock turnover ratio indicates fast moving materials and a low ratio indicates slow moving materials. The turnover of different materials may be compared to detect those items which do not move regularly. This will enable the management to avoid keeping capital locked up in undesirable items of materials.

Material Losses in Cost Accounting – 4 Major Forms: Waste, Scrap, Spoilage, Defectives and Its Types

In every type of manufacturing organization, there is some difference between input and output of production process. If output is less than the input, then it is termed as material losses.

Material loss may be in following forms:

Classification # 1. Waste:

Waste is that portion of basic raw material which is lost in production processes and has no recoverable value. Waste may be visible which can be seen e.g., ash, sand, dust, etc., and invisible which is disappearance of a portion of a raw material e.g., shrinkage, evaporation, etc.

i. Normal Waste – It arises because of causes inherent in the production. Normal waste is unavoidable and uncontrollable e.g., evaporation, shrinkage.

Cost of normal waste is treated as cost of production and it is distributed over balance of material. Thus per unit cost would increase.

ii. Abnormal Waste – It arises due to abnormal factors or causes not inherent in the production. These factors are avoidable or controllable e.g., fire, theft, careless in handling, etc.

Cost of abnormal waste is not a part of cost of production, so it is charged to costing profit or loss account.

Classification # 2. Scrap:

Scrap is the incidental residue resulting out of manufacturing process. It has usually small money value. Scrap is always visible e.g., cut ends of metals in engineering industries.

When the value of scrap is negligible, it is sold in scrap and net sales proceeds are credited to costing P/L A/c. But when the value of scrap is important in case:

i. When several production orders are taken, the net sales proceed from sale of scrap is deducted from factory overheads or material cost. Thus the overall cost of material or overheads is reduced.

ii. When scrap is related with a particular job, net sales proceeds from sale of scrap are credited to that particular job only.

Difference between Waste and Scrap:

i. Waste may be visible or invisible but scrap is always visible.

ii. Waste has no recoverable value but scrap has always recoverable value i.e., it can be sold.

Classification # 3. Spoilage:

Meaning- Spoilage is loss of not only material but also labour and overheads which are damaged in manufacturing process. They cannot be further processed and thus are to be disposed off.

Spoilage may be of two types:

i. Normal Spoilage – It is the part of production process as it arises out of causes inherent in the production process. Thus cost of normal spoilage is borne by good production units. Realizable value of spoilage is credited to the account in which cost of spoilage is charged.

ii. Abnormal Spoilage – It arises due to causes which are not inherent in production. So it is controllable though unexpected and it is charged to costing P/L A/C.

(a) Scrap always arises in the process of material and spillage occurs only due to some defects in material or production process.

(b) Scrap means loss of material only but spoilage includes not only loss of material but also of labour and overheads.

(c) Scrap has (always) low value but spoilage value may vary from low to high. Low spoilage (badly spoiled) may be sold like scrap. High spoilage may be sold as seconds.

Classification # 4. Defectives:

Defectives represent that portion of production which can be rectified as a finished product by the help of more material, labour and overhead expenses. Defectives are the products which are not according to the standards but they can rectify as a finished product by incurring rectification (rework) cost.

The additional cost which is incurred to rectify a defective product is known as Rectification cost.

i. Normal defectives arise due to common causes inherent in the production process. If they are identical with a particular job then it is charged to that particular job. When defectives are not identifiable with particular job then it should be charged to production overheads.

ii. Abnormal defectives arises due to the abnormal factors, they are transferred to costing P/L A/C.

The only difference is that spoilage can be rectified but defectives can be rectified by the help of additional material, labour and overheads.

Material Losses in Cost Accounting – With Accounting Treatment and Control

Material losses do occur in every type of manufacturing organisation. These losses may be in the form of waste, spoilage or defective work. There is no uniformity in the terminology and accounting treatment of these items.

The most commonly adopted practice in respect of each of the above items is given below:

1. Waste:

It represents that portion of the basic raw material which has been lost in the manufacturing process and which has no recoverable value, e.g., gases, dust, smoke, unsaleable residue, losses on account of shrinkage or evaporation of materials etc.

Control of Waste:

Standard or norms should be fixed for each type of waste. The actual percentage of waste should be compared with the normal percentage. Waste Reports should be prepared at regular intervals. Particular care has to be taken to check abnormal waste. This can be done by holding regular meetings with the foreman and his staff.

Accounting Treatment:

(a) Normal Waste – Waste within the normal limits should be distributed over good output. Thus, per unit cost would be increased.

(b) Abnormal Waste – Waste beyond the normal limits should be transferred to costing profit and loss account so as to avoid any fluctuations in the cost of production.

2. Scrap:

Scrap is the incidental material residue coming out of certain types of manufacturing processes, usually of small amount and low value, recoverable without further processing. Scrap may arise on account of turnings, borings, trimmings etc. from metals of which machine operations are carried out. By-products of small value which are sold without further processing are also treated as scrap. It should be noted that ‘scrap’ is always physically available while ‘waste’ may or may not be present in the form of a residue. Control over scrap.

Control over scrap is possible by:

(i) Setting standards for scrap;

(ii) Determining the responsibility for scrap;

(iii) Keeping up proper records of scrap in the form of Scrap Reports.

Accounting Treatment:

The usual methods regarding treatment of scarp are as follows:

(i) The sale value of scrap is credited to costing profit and loss account as an abnormal gain. This method is followed in those cases where the scrap is almost negligible. However, the method fails to secure effective control over scrap is almost negligible. However, the method fails to secure effective control over scrap as detailed records are not kept and scraps are not identified to jobs or processes.

(ii) The net sale proceeds (total sale proceeds from sale of scrap—selling and distribution costs) from sale of scrap is deducted from the material cost or factory overhead. Thus, the overall cost of materials or overheads is reduced by this method. The method fails to secure effective control over scraps arising in processes or jobs. The method is suitable in case where several production orders are taken in hand and it is not possible to segregate the value of scrap for each order.

(iii) The value realised from sale of scrap is credited to the particular job, process or operation. The method has an advantage of identifying scarp with each operation, process or job.

3. Spoilage:

Spoilage refers to goods damaged beyond rectification and which are to be sold suitably without further processing.

Spoilage differs from scrap.

The difference is as given below:

(i) Scrap always arises as a result of the processing of materials while spoilage occurs due to some defects in materials or operations which may or may not be inherent in manufacturing process or operation.

(ii) Scrap has always a relatively low but some definite value. But the value of spoilage may vary from naught, if it is waste, to high values if it could be sold as seconds.

(iii) Scrap involves loss of materials only while spoilage involves besides loss of materials loss of labour and manufacturing overheads also.

Control of Spoilage:

The Inspector prepares a Spoilage Report on finding that the work has been spoiled. The actual spoilage is compared with the standard or normal spoilage and remedial measures are taken for preventing any abnormal spoilage.

Accounting Treatment:

(a) Normal spoilage – It is the spoilage which is the inherent result of the process and therefore uncontrollable in the short run. The cost of such spoilage will be borne by good units.

(b) Abnormal spoilage – This spoilage is avoidable and controllable even in the short run. Its cost shall, therefore, be charged to costing profit and loss account.

Salvage:

The material which is retrieved from the spoilage work is known as salvage. This material is usable in production. Its value may be credited to the account to which a charge for spoilage is made.

4. Defectives:

It represents that portion of production which can be rectified and turned into good units by putting in extra material, labour and overheads. The main difference between spoilage and defectives is that spoilages cannot be rectified and sold as “seconds” or “thirds”, (in a majority of cases) while defectives can be rectified by reworking and sold as “firsts” or “seconds”.

Control of Defectives:

When a work on inspection is found to be defective, the inspector makes out a “Defective Work Report”. The cost of rectification is estimated and a decision is taken whether to see that defective work remains within the standard limits.

Accounting Treatment:

(a) Normal defectives – Normal defectives arise on account of inherent nature of the manufacturing process. Cost of rectification of such defectives should be charged to specific jobs or processes if identification is possible, otherwise to the works overheads.

(b) Abnormal defectives – They arise on account of abnormal circumstances and, therefore, should be taken to costing profit and loss account.

Material Losses in Cost Accounting – With Specimens of Reports

Material losses take place in one way or the other in the process of material handling, storage and issue to respective departments or jobs.

The losses are broadly classified into four categories viz.,

1. Wastage,

2. Spoilage,

3. Scrap, and

4. Defectives.

These are discussed as follows:

Classification # 1. Wastage:

Wastage of materials can be either normal or abnormal.

Normal wastage is inevitable which occurs due to some of the following reasons:

(a) Evaporation of oil, chemicals and paints etc.

(b) Leakage of certain liquid materials.

(c) Natural decay or deterioration of materials e.g., rusting etc.

(d) Breakage in case of delicate material items.

Normal wastages are not separately recorded in costing books but are covered by enhancing the production cost by increasing the unit price of materials issued for recovering the total cost out of a quantity which is actually used.

Abnormal wastages occur when normal limits of wastage are crossed. It is transferred to Costing Profit and Loss account so as to avoid fluctuations in production costs.

Following reasons are responsible for such losses, viz.-

(a) Accidents, fire and earth-quake etc.

(b) Defective and careless storage and handling of materials.

(c) Pilferage.

(d) Mischief on account of delibrate destruction and spoilage of materials.

(e) Obsolescence of materials due to improper and irregular issue of materials i.e., issuing fresh supplies earlier than old ones.

With certain care and caution, abnormal wastages can be minimised by controlling certain controllable causes viz., pilferage, defective and careless handling and resorting to proper method of material issues to different jobs or departments etc.

For apprising the authorities with regard to occurrence of wastage and suggesting proper ways and means to control the same, a Waste Report is prepared by the foreman or inspector concerned with the inspection of the job.

A specimen of waste report is given as under:

Classification # 2. Spoilage:

Spoilage refers to the deterioration of goods beyond rectification and are sold out without any further processing. Spoilage is of two types. The first is normal spoilage which occurs due to inherent nature of the manufacturing operations. Such a spoilage is uncontrollable. Like normal wastage it is not recorded in the books of cost accounts but its cost is spread over the remaining units.

The second type is abnormal spoilage which takes place due to certain avoidable causes as explained while discussing abnormal wastage. It is debited to Costing Profit and Loss Account.

A specimen of spoilage report is given below:

Classification # 3. Scrap:

Scrap may be defined as “the incidental residue from certain types of manufacture usually of small amount and low value, recoverable without further processing.” For example, outlined metal from turnings, borings, saw dust, short lengths from wood work operations and iron dust from machines and foundry works etc.

The difference between scrap and waste is that the former is always available after the completion of a particular production operation while the latter may or not be available in the residue form.

For controlling or minimising scrap, proper standards for scrap should be fixed in advance of actual operations and records in the form of Scrap Reports should be prepared and preserved for future references.

A specimen of scrap report is given below:

Scrap can be of three types viz.,

(a) Pre-determined or Anticipated Scrap is fixed in advance at the time of anticipation of costs.

(b) Administrative Scrap occurs due to obsolete design of a product.

(c) Defective Scrap takes place due to basic defects in raw materials, production processes and other discrepancies leading to unsaleable products.

Accounting Treatment of Scrap:

Under the first method, the realisable value of scrap is credited to Costing Profit and Loss Account and termed as abnormal gain. The unit cost of the product includes the value of scrap. This method of recording scrap value is quite simple and can be employed very successfully where the quantum of scrap is negligible. Effective control over scrap lacks under this method as detailed records of scrap values are not prepared and are not identified with different jobs and processes.

Under the second method, the net sale proceeds of scrap (obtained after deducting selling and distribution costs) is deducted from material cost or factory overheads, thereby reducing the overall cost of materials and overheads. This method is most suitable where several production orders are undertaken simultaneously and scrap values are not worked out for each order. Again this method is very suitable in exercising control over scrap arising in different processes and jobs.

Under the third method, which is an improvement over the first two methods, the scrap values realised are credited to each job, process or operation. This is a detailed method and is immensely helpful in identifying scrap values in case of every job, process or operation.

Classification # 4. Defectives:

‘Defectives’ signify units or portion of production which can be rectified and turned out as good units by the application of additional materials, labour or other services. Defectives arise due to sub-standard materials, inadequate equipment, inefficient supervision, defective planning, and poor workmanship etc.

Usually, it is possible to avoid defects in the units produced but to some extent defectives may be unavoidable. The basic difference between ‘defectives’ and ‘spoilages’ is that the former can be sold after rectifying them whereas the latter has got to be rejected or sold as sub-standard or rejected articles.

A “Defective Work Report” is prepared by the inspector specifying information pertaining to defective units, normal defectives, abnormal defectives, cost of rectification, disposal value of defectives and reasons and actions suggested. Following is the specimen of defective work report.

The normal defectives are unavoidable and can be identified with specific jobs and their cost of rectification can be attributed to the job. But if the defective production cannot be identified with the specific jobs, the cost of defectives should be added to the factory overheads. In case of defectives arising due to abnormal circumstances, the cost of rectification is treated as an abnormal loss and charged to the Costing Profit and Loss Account.

Material Losses in Cost Accounting – Waste, Scrap, Spoilage, Defectives and Obsolete Materials

1. Waste:

Waste may be defined as ‘the portion of basic raw material lost in the process having no recoverable value.’ Wastage occurs not merely in storage and handling of materials but in the manufacturing process also. It may, either be visible or invisible.

Visible wastage is that which could be seen, handled and collected. Such wastage arises because of the very nature of the job or operation. Sawdust, for instance, in a wood-working plant, ash in the coke industry, sand, dust, etc., is the examples of visible wastage. Although visible, cannot be sold or used again.

Invisible wastage, on the other hand, is the disappearance of a portion of the raw material either in handling or in the course of manufacture. It represents loss in weight due to evaporation or shrinkage. It may also be because of breaking the bulk when a portion of the material is carried away by winds in the form of dust.

Since wastage increases product cost, it is necessary for accounting and control purposes, to classify the same into normal and abnormal wastage. Considering the nature of material and nature of operations, it is possible to determine the amount of wastage in advance.

This may be done by a series of tests or by the input-output ratio. Such a pre-determined wastage is an allowance made for normal wastage. On comparison of the actual wastage and anticipated wastage, if there is any excess of actual wastage, the same is considered to be abnormal wastage.

The cost of normal wastage is made to be borne by the good units produced. If normal wastage occurs either in the course of handling or storage or materials, the cost of the same should be charged to materials by inflating the issue rate. Cost of abnormal wastage, however, is not a part of cost. As such, the same should be transferred to costing profit and loss account.

It is not out of place to mention in this context that abnormal loss arises because of pilferage, theft, negligence, carelessness, theft, accident, bad storage, improper handling. Abnormal wastage may be minimised by making a periodical report of wastage by the person authorised in this behalf and suitable action by management.

2. Scrap:

Scrap is a portion of visible wastage of materials having a low money or use value. It is defined by the CIMA Official Terminology as “discarded material having some value.” Chippings of wood, off-cuts of sheet metal, small pieces of cloth, etc., which are left over after the completion of manufacturing operations are some examples of scrap.

Material loss of the nature of scrap is quite normal in the case of engineering industries due to lathe operations. The same is true of industries such as wood-working, leather, ready-made garments, etc.

Scarp may be classified as – (a) legitimate scrap, (b) administrative scrap, and (c) defective scrap. Legitimate scrap is normal loss of materials. This type of scrap is always predetermined. Administrative scrap arises because of some administrative action such as, change in the method of production, design, etc. Defective scrap arises owing to the use of an inferior quality material or bad workmanship.

Scrap may be valued either at cost, or actual market value, or estimated market value. Of these, cost basis is the best provided scrap could identify with the materials out of which it arose, and the scrapped units are capable of being counted or measured. Such identification and measurement help in the ascertainment of cost on the basis of the issue price of materials. However, identification in this manner, being difficult in practice, scrap is sometimes valued on the basis of the actual market price.

Even in this case, ascertainment of market price is not possible unless the scrap is sold. But accounting cannot be postponed until such a stage. It is, for this reason, that scrap is, in most cases, valued on the basis of the estimated market price. When it is not possible even to make an estimate of the market price, especially when scrap has no definite market, the same may be valued on an arbitrary basis also.

Accounting Treatment:

The accounting treatment of scrap is more or less the same as that of waste. Loss of the nature of scrap, which is normal, becomes a part of cost of production. Any income from the sale of scrap will go to reduce the cost. If additional expenses are incurred in disposing of the scrap, the same are added to departmental factory overhead costs and the sale proceeds are credited to the same.

When the actual scrap is in excess of the normal quantity allowed, the cost of excess scrap is transferred to profit and loss account, after adding the expenses of sale, and deducting therefrom the sale proceeds.

There is also an alternative accounting method for scrap. If scrap cannot be identified with a particular job, the sale proceeds may be deducted from the material cost of the concerned job. If such identification is not possible, the sale proceeds can also be credited to departmental manufacturing overhead. If scrap of one department can be used as direct material by some other department, the cost of the scrap is deducted from the material cost of the department giving rise to scrap.

The same is then added to material cost of the department using the scrap as direct material. If the transferee department uses scrap as indirect material, the cost is treated as manufacturing overhead of that department, when the sale value of scrap is negligible, the same may be transferred to profit and loss account as other income.

Control of Waste and Scrap:

Both wastage and scrap increase cost of production. Hence, it is necessary to make maximum utilisation of material, and keep wastage and scrap as low as possible. Although scrap may realise a nominal amount, the amount so realised will be much less than the cost of materials. It is, therefore, necessary to exercise proper control over material losses of this nature.

Any scheme of control should start with establishing a standard for scrap for each department or process. While doing so, it is necessary to take into consideration the nature of materials, nature of manufacturing operation, use of proper equipment, employment of proper personnel, and defining areas of responsibility. It is equally necessary to establish a scheme of scrap reporting.

Actual wastage and scrap should be compared with the pre-determined standard. Reasons for difference between the actual and standard should be investigated. Corrective action should also follow whenever the actual wastage or scrap is more than what is pre-determined.

3. Spoilage:

Materials, which are badly damaged in the course of manufacture, and which cannot be rectified, are known as ‘spoilage’. Such units as are fit to be called spoilage, are taken out of manufacturing process either for purposes of sale as scrap, or used again as raw material.

Spoilage may either be normal or abnormal. The accounting treatment of spoilage is the same as that of scrap. Where, however, the spoiled units are used again as raw materials in the same manufacturing process, no separate accounting becomes necessary. On the other hand, if they are used for any other process or job, a proper credit should be given to the process giving rise to spoilage. In this method of treatment, it is necessary to take into consideration the utility value of spoilage to the process for which the same is used.

4. Defectives:

These are, generally, finished or semi-finished products which fail to satisfy standard specifications, but can be rectified by incurring additional expenses. In other words, defectives are those products that are not up to the standard quality, or do not meet the prescribed specification.

The CIMA Official Terminology defines the term ‘defectives’ calling the same rejects/defects as “units of output which fail a set quality standard and are subsequently rectified, sold as sub-standard or disposed of as scrap.”

The expenses incurred in applying additional material or additional labour or both, are known as costs of re-operation of the defectives. Sometimes, the term ‘defective’ is used for materials in a raw state, products returned by customers, and also good products which may turn out to be defective because of lapse of time, as in the case of medicines and tonics.

Although defectives appear to come close to spoilage, there is the difference between the two. Defective can be reworked and reconditioned by incurring additional expenses. In such a case they may become standard or substandard products. However, spoilage cannot be reworked or reconditioned.

Accounting Treatment:

Defectives may be disposed of either as scrap or sub-standard products or seconds. Alternatively, they may be re-used as raw materials. They may also be rectified by incurring additional expenses. The accounting treatment of defectives thus depends upon the mode of disposal. The cost of normal defectives is made to be borne by good units, when defective work is normal and sold as seconds.

Any income from the sale of such seconds will be credited to the cost of the job or process. If defective work arises owing to bad material, bad workmanship, inefficient supervision or defective tools, the cost of the same, less its value, is treated as manufacturing overhead.

If the cost of defective work is considerable, and defects are due to abnormal causes, the same is transferred to profit and loss account. When defective units are used as raw materials, the accounting treatment will be the same as that of spoilage.

When the defective units are rectified by the application of materials and labour, the re-operation cost may either be added to the total cost of manufacture, increasing at the same time the number of units produced, or the same may be treated as departmental manufacturing overhead.

5. Obsolete Materials:

Obsolete materials are to be distinguished from slow-moving and dormant items. Materials having a very low turnover ratio are known as slow-moving items. However, materials that have no immediate demand are known as dormant materials. Obsolete items, on the other hand, are those for which there is no demand at all owing to the fact that the finished product, in which they are used, is no longer being produced. The reasons may be changed in fashion or the use of substitute materials.

Slow-moving and dormant materials need not be obsolete. A particular item may be slow-moving in relation to other. Yet, it is still in demand for purposes of production. Similarly, there is the possibility of the demand for dormant materials increasing with the increase in demand for the finished product in which they are used. In the case of obsolete materials, however, the finished product itself having gone out of production, the materials in question are no longer needed.

Further, with industrial progress, there is absolutely no possibility of production of the same article for which the materials were formerly used. Obsolescence is thus linked to industrial progress.

Minimisation of Loss:

Since obsolescence depends upon industrial progress, loss occasioned by some items of material becoming obsolete cannot be avoided. It can only be minimised.

The steps to be taken in the direction of minimisation of loss are:

a. Changes in design should be brought to the notice of all the concerned personnel by the production controller. He should also suggest methods of disposing of the obsolete items.

b. The purchase manager should anticipate changes in design. He should also find out the stock of materials and components which have become obsolete.

c. The store-keeper should send reports of slow-moving items regularly to the sales and production departments and seek information regarding alternative uses of such items.

d. Items which have been superseded or, have become surplus to current requirements should be made a note of on stock verification sheets.

e. Separate code number should be given to such items, and they should be kept separate from the other active items.

f. A separate ledger should be maintained for such items by the storekeeper and particulars such as the date on which they have become obsolete, the date of receipt into the stores and their value should be entered therein.

g. Materials which have become obsolete should be used by the same plant for some other work order.

h. If possible, the items should be modified to meet the current requirement.

i. If the obsolete items cannot be modified, they should be scrapped and sold by auction.

J. If there is no scrap value, they should be discarded.

k. Whether scrapped or discarded, the loss should be written off the abnormal loss account, and any scrap value received should be credited to this account.

I. The incidence of obsolescence can also be minimised by exercising effective control over the different stock levels of materials and avoiding excessive stock.