Everything you need to know about the classification of overheads. Classification is the process of grouping like facts under a common designation on the basis of similarities of nature, attributes or relations.

Classification of Overheads is the process of grouping of indirect costs on the basis of common characteristics and clear objectives.

All overhead expenses are grouped together under common heads and are further classified according to their fundamental differences.

Suitable classification of overheads is of utmost importance, so that overhead costs can be classified and appropriately used by the management to exercise better control, to plan the future activities in advance and to take important decisions in time.

ADVERTISEMENTS:

Overhead can be classified on the basis of:- 1. Element 2. Controllability 3. Behaviour 4. Nature 5. Variability 6. Normality 7. Function.

Some of the types of overheads are:-

1. Indirect Materials 2. Indirect Labour 3. Indirect Expenses 4. Controllable Overheads 5. Uncontrollable Overheads 6. Fixed Overheads 7. Variable Overheads

8. Semi-Variable Overheads 9. Normal Overheads 10. Abnormal Overheads 11. Manufacturing Overhead 12. Administrative Overhead 13. Selling Overhead 14. Distribution Overhead.

Classification and Types of Overheads: On the Basis of Element, Control, Behaviour, Nature, Variability, Normality and Function

Classification of Overheads – Element-Wise, Controllability-Wise and Behaviour-Wise: Indirect Materials, Controllable Overheads, Fixed Overheads and a Few Others

Overheads cost can be classified under various basis. The basis of classification of overheads costs depends upon the type and nature of business, nature of product or services rendered.

ADVERTISEMENTS:

The classification of overheads are given below:

Classification # 1. Element-Wise:

i. Indirect Materials:

Indirect materials are not exclusively incurred for a particular product, job or cost centre. Indirect materials do not form part of the body of finished products. It cannot be identified with a product, job or cost centre. Indirect materials cannot be allocated but can only be apportioned over products or cost centres.

ADVERTISEMENTS:

They are- stores consumed in repairs and maintenance, lubricants, cotton waste, stationery, packing materials, normal loss of materials, tools for general use etc. Some materials of small value may be directly identified with a product but for convenience and economy in accounting they are treated as indirect materials e.g., sewing threads in garments, rivets, glues, washers, bolts, nuts etc.

ii. Indirect Labour:

Wages paid to workers who are not engaged in conversion of raw materials into finished products is indirect labour cost. They cannot be allocated to a product but can be apportioned over products or cost centres. They are- works manager’s salary, foremen’s salary, salary to people working in general office, sales department, stores department, labour department, security department etc.; leave pay, and employer’s contribution to P.F, ESI, and labour welfare expenditures.

iii. Indirect Expenses:

ADVERTISEMENTS:

All indirect expenses other than indirect materials and indirect labour are classified as indirect expenses. They are rent, rates, insurance, taxes, advertisement, depreciation, lighting etc.

Classification # 2. Controllability-Wise:

i. Controllable Overheads:

These overheads come under the influence of the management. The management can at its discretion either increase or reduce these expenditures. All direct expenses and some overheads are controllable.

ii. Uncontrollable Overheads:

ADVERTISEMENTS:

These overheads do not come under the influence of management. These are mostly determined by external factors. They are rent, insurance, tax, etc.

Controllability-wise classification is not rigid or permanent. They may change depending upon variation in corporate policies, level of activity and length of time. Expenditure may be uncontrollable in short periods but may be controllable in the long run.

Classification # 3. Behaviour-Wise:

i. Fixed overheads

ii. Variable overheads

ADVERTISEMENTS:

iii. Semi-variable overheads.

i. Fixed Overheads:

Expenses which remain constant in total irrespective of changes in volume of activity are called fixed overheads. They do not change when volume of production changes within the present capacity. Even if there is no production these expenses are incurred. They are – rent, insurance, office salary, security staff salary, etc.

ADVERTISEMENTS:

These expenses are incurred in relation to time factor. So they are called time cost or period cost. These expenses are mostly uncontrollable.

Fixed overheads in total will change if rate of these expenses are revised like, salary scale, rate of premium, rent charges etc. Fixed overheads per unit will change in inverse proportion to changes in production volume. When production increases fixed overheads are borne by larger number of units and fixed overheads per unit will decrease as the amount of expenses is borne by larger number of units and vice versa.

ii. Variable Overheads:

Variable overheads change in total in direct proportion to changes in volume of production. If production increases variable overheads also increase proportionately. If production decreases variable overheads will also decrease in the same proportion. Variable overheads per unit will be same at all levels of production.

But practically variable overheads per unit at lower level of production will be more. Variable overheads per unit will be lower at higher levels of production due to economy in large scale production. As variable overheads are related to production, they are also called product cost or production cost.

iii. Semi-Variable Overheads:

ADVERTISEMENTS:

There are certain expenses which are partly variable and partly fixed. They have the characteristics of both fixed and variable costs. They are supervisor salary, telephone charges and electricity. Semi-variable expenses are further classified into two groups.

They are:

a. Some semi-variable expenses change in relation to change in production level but they change less than proportionately to changes in production e.g. – repairs & maintenance, store handling etc.

b. Some semi-variable expenses remain stable within a certain range of production, then increases to next level when production range increases to next level. So semi-variable expenses are also called stage costs or step costs.

Classification of Overheads – According to Nature, Variability, Control and Normality

There are various methods of classifying grouping overheads which depends on the objectives of classification.

Generally the overheads may be classified according to:

1. Nature

2. Variability

3. Control, and

4. Normality.

1. Classification According to Nature:

Under this method, the classification is made according to the nature and source of the expenditure.

On the basis of the nature of overheads, expenses are classified into:

i. Indirect Material,

ii. Indirect Labour and

iii. Indirect Expenses.

i. Indirect Materials – Material cost which cannot be allocated to a particular unit and does not form a part of finished product but which are to be apportioned to or absorbed by cost centers or cost units. Examples are fuel, lubricants, cotton waste, tools for general use, etc.

ii. Indirect Labour – Indirect labour are those which cannot be allocated to a particular unit of cost but which are to be apportioned to or absorbed by cost centers or cost units. Examples are Overtime, idle time wages, wages of foreman, maintenance and repair work wages, leave pay, employer’s contribution to ESI, etc.

iii. Indirect Expenses – Expenses which cannot be allocated but which are to be apportioned to or absorbed by cost centers or cost units are indirect expenses. For example, power, welfare, deprecation, insurance, canteen, taxes, rates and rent etc.

2. Classification According to Variability:

Expenses are also classified on the basis of variability or behaviour. Different overhead costs behave in different ways when volume of production changes.

One the basis of variability, overheads may be classified into:

i. Fixed overhead

ii. Variable overhead, and

iii. Semi-fixed or semi-variable overhead.

i. Fixed Overhead:

Fixed overheads also known as period cost remain unaffected or fixed in total amount and do not vary with changes in the volume of output. These expenses accrue over a period of time and are also known as period cost. These expenses remain constant even if the output changes. Examples are rent and rates, managerial salaries, building depreciation, postage, stationery, legal expenses etc.

ii. Variable Overhead:

This is the cost which, in aggregate, tends to vary in direct proportion to changes in the volume of output. In other words it changes in the same ration in which output changes. Total variable cost tend to vary directly with the volume of output while it is likely to remain fixed per unit at all the levels of output. Examples are indirect materials, indirect labour, salesman’s commission, power, light, fuel, etc.

iii. Semi-Variable Overhead:

This overhead is partly fixed and partly variable. In other words, costs vary in part with the volume of production and in part they are constant, whatever be the volume of production. Semi variable or semi fixed overheads may remain constant at certain level of output while they vary at other levels, but not in the proportion of changes in the output. Example – supervisory salaries, depreciation, repairs and maintenance etc.

3. Classification According to Control:

According to this, cost are classified into controllable cost and uncontrollable cost Controllable costs are those which can be controlled by the management through the efficient use of resources like Idle Time wastages etc. uncontrollable cost on the other hand are those costs which is not under the control of management. All fixed expenses are uncontrollable costs.

4. Classification According to Normality:

According to this classification costs are divided into normal overheads and abnormal overheads. Normal overheads are expected to be incurred in the process of output and generally are unavoidable. Normal cost is a part of production cost and is added to the cost of good units Abnormal costs are those costs which are not expected to occur in the process of production. They cannot be included in the cost of production and are transferred to costing profit and loss account.

Classification of Overheads – Indirect Material, Indirect Labour, Indirect Expenses, Controllable Costs, Uncontrollable Costs, Fixed Costs, Variable Costs and Semi-Variable Costs

Indirect Costs or On-costs or Overheads, incurred by a business entity, are of different types.

The following are the bases on which overhead costs are classified:

1. On the basis of element of cost

2. On the basis of controllability

3. On the basis of behaviour

The types of overheads under each criterion are explained as follows:

1. On the Basis of Elements of Cost:

Elements of Cost refer to the factors or aspects due to which the cost is incurred.

Based on the elements of cost, overheads are classified into the following:

i. Indirect Material

ii. Indirect Labour

iii. Indirect Expenses

It refers to the material, which does not form a part of the finished product. Examples of Indirect Materials are- Stores used in Maintenance of Machinery, like Lubricants, Cotton Waste, etc., Stores used by Service Departments like Power House, Boiler House, Canteen, etc.

It refers to the Wages or Salaries paid for all purposes, other than for conversion of raw material into finished goods. Examples of Indirect Labour are- Wages paid for loading and unloading, Wages paid for Maintenance Personnel, Supervisor’s Salary, Salary of office staff, Salary of Accountant, Salary of Drivers, Salary of Watchman, Salary and Commission to Salesmen, etc.

They refer to the expenses other than Direct Expenses i.e., expenses that cannot be directly or conveniently allocated to Cost Centers. Examples of Indirect Expenses are- Rent, Rates, Insurance, Depreciation, Advertisement Expenses, etc.

2. On the Basis of Controllability:

On the basis of the ability to control costs, overheads are classified into the following:

i. Controllable Costs

ii. Uncontrollable Costs

They are those costs, which can be controlled, managed and reduced by implementation of appropriate policies and systems. Examples of Controllable Costs are- Material Costs, Wages and Salary, Power and Fuel, etc.

They are those costs, which cannot be controlled or managed or reduced even with implementation of control measures. Examples of Uncontrollable Costs are- Depreciation, Rates, Insurance, Interest on borrowings, etc.

3. On the Basis of Behaviour of Costs:

Behaviour of costs refers to how cost behaves for a particular change in production.

On this basis, overheads are classified into the following:

i. Fixed Costs

ii. Variable Costs

iii. Semi-variable Costs

It refers to the cost, which remains the same in total, but varies inversely per unit, with production. For example, let us assume that the monthly rent for a factory building is Rs.10,000. The Total Rent remains the same each month, irrespective of the quantum of production.

However, the Rent per unit will vary inversely with production. For a production of 1 unit in a month, the Rent per unit would be Rs.10,000. For a production of 100 units in a month, the Rent per unit would be Rs.100. For a production of 1000 units in a month, the Rent per unit would be Rs.10 and so on.

It refers to the cost, which remains the same per unit, but the total varies proportionately with the production or sales. For example, let us assume that the Raw Material Requirement per unit of a finished product is 2 kg and each kilogram costs Rs.5. So, the Per-unit Raw Material Cost is Rs.10. For producing 10 units, the Total Raw Material Cost would be Rs.100. For producing 1000 units, the Total Raw Material Cost would be Rs.10,000 and so on.

It refers to the cost, which is partly fixed in nature and partly variable with production or sales. For example, Electricity Bills, Water Bills, Internet Bills, etc., have a fixed charge for the period and additional charges based on usage.

Classification of Overheads – On the Basis of Behaviour and Elements

Overheads can be classified on the following basis:

1. On the basis of Behaviour

2. On the basis of Elements.

1. On the Basis of Behaviour:

(a) Fixed Overheads – Fixed overheads are the overheads which do not change with the change in volume of production within certain limit. Examples are, rent, insurance, salary of works manager, municipal taxes etc. Fixed overheads per unit decrease as the production increases.

(b) Variable Overheads – Variable overheads are indirect cost which changes in direct proportion to the units of production. In other words, total variable overheads increase as the production increases. Examples are commission on sales, consumable stores etc.

Variable overheads per unit remains fixed.

(c) Semi-Variable Overheads – These are those indirect costs which are fixed up to given limit and the variable beyond that limit. Examples are telephone expenses (some part of call charges is fixed & further charges are variable as per the talk time), repair and maintenance etc.

2. On the Basis of Elements:

There are three elements of costs i.e., material, labour and other expenses. All indirect material, indirect labour, and indirect expenses are called overheads.

(a) Indirect Material – Material which cannot be identified and directly allocated to a cost centre and cost unit is known as indirect material. E.g., consumable stores.

(b) Indirect Labour – Labour which cannot be identified and allocated to a cost centre or cost unit is known as indirect labour cost. E.g., salaries of security staff etc.

(c) Indirect Expenses – They are the expenses other than indirect material or indirect labour which cannot be identified and allocated to a cost centre or cost unit. E.g., rent, repairs, insurance etc.

Classification of Overheads – Element Wise, Behaviour Wise, Control Wise and Normality Wise Classification

Classification is the process of grouping like facts under a common designation on the basis of similarities of nature, attributes or relations. Classification of Overheads is the process of grouping of indirect costs on the basis of common characteristics and clear objectives.

All overhead expenses are grouped together under common heads and are further classified according to their fundamental differences. Suitable classification of overheads is of utmost importance, so that overhead costs can be classified and appropriately used by the management to exercise better control, to plan the future activities in advance and to take important decisions in time.

The basic need for overhead classification arises because of the requirement of different types of cost data for a number of purposes. Hence, overhead costs must be suitably arranged and sub-classified in such a manner that they can be utilised analytically in different ways to serve different purposes.

Classification # 1. Element Wise:

The main classes under this head are:

i) Indirect materials,

ii) Indirect labour, and

iii) Indirect expenses.

i) Indirect Materials:

In the course of manufacturing of a product, indirect materials do not form part of finished product. The indirect materials are consumable items, electrodes, coolants, cotton waste etc., which are required for completion of a finished product. Indirect materials cost is the cost which cannot be allocated, but which can be apportioned to or absorbed by cost centres or cost units.

ii) Indirect Labour:

Indirect labour are the actual wages and overtime wages paid for all labour, other than direct labourers, in the factory, viz.- helpers in factory, foremen, supervisors, inspection staff and production manager etc. who do not help directly in converting the raw materials into a finished product. It also includes salary paid to office and selling and distribution staff.

iii) Indirect Expenses:

Indirect expenses are all expenses of the factory such as – rent, rates, taxes and insurance of factory, repairs of factory machinery, power etc., including depreciation of plant, machinery, equipment, loose tools and factory buildings. It also includes indirect expenses incurred for office and selling and distribution.

Classification # 2. Behaviour Wise Classification:

Different overhead costs behave in different ways when volume of production increases or decreases.

On the basis of behaviour or variability, overheads may be classified as follows:

i) Fixed Overheads:

These overheads remain unaffected or fixed in total amounts by fluctuations in volume of output, e.g., rent and rates, managerial salaries, buildings depreciation, postage, stationery, legal expenses etc.

Fixed overheads have the following important characteristics:

a. Total fixed overheads do not vary with the change in the volume of production up to a given range.

b. Fixed overheads per unit vary with change in the volume of production i.e., fixed overheads per unit decreases as the production increases and vice-versa.

c. Fixed overheads are uncontrollable in nature.

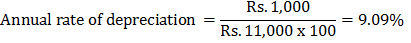

d. They are classified into – (i) Cash fixed overheads e.g., rent and taxes and (ii) Non-cash fixed overheads i.e., depreciation on buildings.

Graphically the important features of fixed overheads may be shown below in Figure 3.3:

Thus, the above mentioned example clarifies that, Fixed Overheads per unit goes on decreasing as the total number of output increases.

ii) Variable Overheads:

This is the cost which, in aggregate, tends to vary in indirect proportion to changes in the volume of output. Variable overhead per unit remain fixed, e.g., indirect materials, indirect labour, salesman’s commission, power, light, fuel etc.

Variable overheads have the following important characteristics:

a. Total variable overheads vary in direct proportion to the volume of production i.e. total variable overheads decrease as the production decreases and vice-versa.

b. Variable overheads per unit remains fixed.

c. Variable overheads are controllable in nature.

d. They are classified into – (i) Material variable overheads e.g., indirect material and (ii) Labour variable overheads e.g., indirect labour.

Graphically, the important features of variable overheads may be shown below in Figure 3.4:

Thus, the above mentioned example clarifies that Variable Overheads per unit remains constant as the total number of output increases.

iii) Semi-Variable Overhead:

These overheads are also termed as – semi-fixed overheads, mixed overheads or step overheads.

This type of overhead is partly fixed and partly variable. In other words, such costs vary in part with the volume of production and in part they are constant, whatever be the volume of production, e.g., supervisory salaries, depreciation, repairs and maintenance, electricity charges, telephone charges, delivery van expenses, material handling, storage costs etc.

Semi-variable overheads have the following important characteristics:

a. These overheads stand mid-way between fixed overheads and variable overheads.

b. They change by small steps.

c. They change in the same direction as change in the level of activity but not in the same proportion.

d. They remain fixed in total over a short range of variation in output.

e. The per unit semi-variable overheads decline with increase in output, and vice-versa.

f. These overheads are controllable in nature.

Graphically, the important features of semi-variable overheads may be shown below in Figure 3.5:

Thus, the above mentioned example clarifies that Semi-Variable Overhead costs vary in part with the volume of production and in part they are constant.

Behavioural classification of overheads is highly helpful to the management for effective and efficient running of the business enterprise.

Classification # 3. Control Wise Classification:

There are two aspects in control of overheads; one is accounting aspect of control which consists of classification, collection, apportionment and absorption of overheads and also analysis according to function and variability. This is helpful for ascertainment of overheads with accuracy and control thereof.

According to control wise classification, overheads are classified as follows:

i) Controllable Overheads:

These are the indirect costs which may be directly controlled at a given level of management authority. Variable overheads are generally controllable by the departmental heads e.g., indirect material cost may be controlled by purchasing these materials in larger quantities.

ii) Un-Controllable Overheads:

These are the indirect costs which cannot be influenced by the action of a specific member of an organisation e.g., rent and taxes, office salaries, etc.

Classification # 4. Normality Classification:

According to normality classification overheads are classified as follows:

i) Normal Overheads:

These are the expenses which are expected to be incurred in producing a given output. They cannot be avoided. They are included in production cost e.g., indirect material cost.

ii) Abnormal Overheads:

These are the expenses which are not expected to occur in producing a given output, e.g., abnormal idle time, abnormal wastage etc. These expenses are transferred to costing profit and loss account.

The classified cost data as collected from the methods discussed above, is further analysed and interpreted by the cost accounting department on scientific basis and finally submitted to the management. The cost accountant does not make any pricing decisions of the products.

Actually, pricing is the domain of top management, as it is based on demand and supply forces available in the market. The cost accountant only helps the management in providing significant cost data and determines the financial effects of price fixation or change in prices on the overall profitability of the manufacturing unit.

Therefore, classification of overhead cost is of utmost importance, as it helps the management to perform their peculiar functions of planning, controlling and decision-making more effectively and efficiently.

Classification of Overheads – On the Basis of Elements, Behaviour, Controllability and Function

There are various ways in which the overheads can be classified. The Classification overheads is the process of grouping of the overheads according to their common characteristics.

Overheads are classified on the basis of:

(i) Elements

(ii) Behaviour

(iii) Controllability

(iv) Function

(i) Element Wise Classification:

(a) Indirect material

(b) Indirect labour

(c) Indirect expenses

(ii) Behaviour/Variability Wise:

(a) Fixed Overheads

(b) Variable Overheads

(c) Semi-Variable Overheads

(iii) Controllability Wise:

(a) Controllable Overheads

(b) Uncontrollable Overheads

(i) Element Wise Classification:

(a) Indirect Materials:

All those materials which do not form a part of the finished product or cannot be identified with the product conveniently are known indirect materials.

For example- Consumable stores, loose tools, waste cotton, lubricating oil, fuel, stationery, postages, etc. There are some materials which, even though, form a part of the finished product are treated as indirect I materials because they contribute a very small part of the total expenses. For example: nuts, bolts, screws, threads, nails, etc.

(b) Indirect labour:

The labour costs which are not directly engaged in production of goods and services. For example salary of supervisor, works manager; wages to coolie, watchman, electrician, storekeeper, timekeeper, director’s fees, overtime payments, cost of idle time, etc.

(c) Indirect Expenses:

Indirect expenses are those costs other than indirect materials and indirect labour which cannot be directly identified with a job or product.

The examples of indirect expenses are canteen expenses, repairs, depreciation, insurance, rent, rates, taxes, factory telephone, telegram and postage expenses, lighting, heating, advertisement, first aid and hospital expenses.

The above are broadly divided into cash expenses and non-cash expenses. Depreciation on plant, machinery, factory building, notional rent and interest outstanding expenses are the examples of non-cash expenses, whereas amount paid in cash are cash expenses.

(ii) Classification by Behaviour / Variability:

Overheads can be classified on the basis of their tendency to vary with the volume of production or sales or activity level.

Behaviour-wise, the overheads are grouped as under:

(a) Fixed overheads

(b) Variable overheads

(c) Semi-variable overheads

(a) Fixed Overheads:

Fixed overheads are those indirect costs which do not change even though there is a change in levels of production. In other words, if the level of output goes up or comes down these overheads remain constant.

For instance the salary of a manager or the rent of a building does not vary even if we increase or decrease the volume of production.

Fixed overheads are also known as period cost, policy cost; stand by cost or shutdown cost. The examples fixed overheads are rent of building, plant and machinery; depreciation of building, plant and machinery; salary of Directors, Managers, clerks, accountants, office expenses such as postages, printing, stationary, bank charges legal fees, etc.

The feature of fixed overhead cost is that the total fixed overheads remain same irrespective of the level of output within a certain limit. But the fixed overheads per unit vary with the level of production.

(b) Variable Overheads:

Variable overheads are those indirect costs which vary in direct proportion to the volume of output. In other words, when the output increases, the total variable overheads increases proportionately and vice versa. But the variable overhead per unit remains fixed at different levels of activity.

The examples of variable overheads are fuel, power, maintenance, depreciation, lubricants, idle time cost, commission to sales man, spoilage, etc.

(c) Semi-Variable Overheads:

Semi-variable overheads are those indirect costs which remain constant to a certain extent and proportionately vary thereafter.

These overheads are partly fixed and partly variable. For instance, telephone expenses include fixed charge plus variable charge according to the number of calls. Some, times the sales representatives are entitled to a fixed salary plus a commission beyond a certain level of sales. This is a semi-variable overhead.

The examples of semi variable overheads are repairs, maintenance, depreciation of plant and machinery, telephone charges,

(iii) Classification According to Controllability:

Controllable cost is regulated at a given level of management authority. Variable costs are generally the controllable costs. For example cost of purchase of raw material. Uncontrollable cost cannot be regulated or controlled by the management. For example- salaries and other administration expenses.

(iv) Classification According to Functions:

The main group of overheads on the basis of this classifications are:

i. Manufacturing overhead.

ii. Administrative overhead.

iii. Selling overhead.

iv. Distribution overhead.

i. Manufacturing Overhead:

It is also known as factory overheads, works overhead or manufacturing overhead. It is the aggregate of factory indirect materials cost, indirect wages and indirect expenses. Unlike direct materials and direct labour, production overhead is an invisible part of the finished product.

Examples of these costs are lubricants, consumable stores, indirect wages, factory power and light, depreciation of plant and machinery, depreciation of factory building, insurance of plant and factory building, store-keeping expenses, repairs and maintenance, etc.

ii. Administrative Overhead:

It is the cost of formulating the policy, directing the organisation and controlling the operations which are not directly related to the production, selling and distribution functions. In other words it includes all expenses of direction, planning and control functions. Examples of administrative overhead include general management salaries, audit fees, legal charges, postage and telephone, stationery and printing, office rent and rates, office lighting and salaries of office staff etc.

iii. Selling Overhead:

These are the costs of seeking to create and stimulate demand or of securing orders. In other words, they are overheads which are incurred to promote sales. Examples – advertising, salaries and commission of sales personnel, showroom expenses, traveling expenses bad debts, catalogues and price etc.

iv. Distribution Overhead:

It comprises of all expenditure incurred from the stage the product is completed in the factory until reaches its destination. These expenses include warehouse rent, packing costs, carriage outward, delivery van costs, etc. Both selling and distribution costs are incurred after the production work is over and thus taken together. These expenses are known as “After Production Costs”.

Classification of Overheads

The overheads can’t be conveniently identified with any cost unit or cost centre. They need to be absorbed into the production costs. For this purpose there is a need for classifying the overheads.

Classification of overheads refers to the process of grouping the costs according to their common characteristics and establishing a series of special groups on the basis of main classification.

The methods classification of overheads depends on the nature and size of the business.

The overheads can be classified into four types on the following bases:

1. On the Basis of Elements:

The overheads may be classified on the basis of element wise in the following ways:

(a) Indirect Materials:

In the production process some materials are used, which cannot be easily traced in the end product. The cost of such material is insignificant and cannot be considered as worth for analyzing. This type of material is called indirect material. For example- Threads and buttons used in stitching cloths and lubricants used in maintenance of plant and machinery.

(b) Indirect Labour:

Some workers are employed for the purpose of helping the main workers in production of goods and services. These workers are not permitted to engage in the production process directly. This type of labour is called indirect labor.

For example- Salaries and wages paid to store keepers, sales representatives, personnel manager, accountant, supervisors, and the like. These indirect labor costs cannot be identified with any particular job, process, cost unit or cost centre.

(c) Indirect Expenses:

These are the expenses that are incurred for all those activities other than production. Such expenses are inevitable for every business concerns irrespective of the nature of business activity. These include- Rent, rates, postage, insurance, light, depreciation and the like are the examples of indirect expenses.

2. On the Basis of Behavior:

The overheads can be classified on behavior basis also.

They are presented below:

(a) Fixed Overhead:

Fixed overheads are the expenses that remain constant irrespective of production volume. They must be incurred whether there is production of goods and services or not. These vary per unit of production but remain constant in total. For example- Rent of building, depreciation of plant and machinery, salaries and remuneration of management executives, legal fees, audit fees and the like are included under fixed overheads.

(b) Variable Overhead:

Variable overheads are the expenses that vary directly with production. These expenses increase with the increase in production and decreases with the decrease in production. These remain constant per unit but vary in total. For example- indirect materials, power, fuel, transport expenses, lubricants, tools and spares and the like are the examples of variable overhead.

(c) Semi-Variable Overhead:

Semi-variable overhead is a portion of indirect cost, which is partly fixed and partly variable. It means that this type of overhead has the characteristics of both fixed overhead and variable overhead. Semi-variable overheads may remain fixed up to a certain level of production and vary after that level of production. For example- Electricity bills, Telephone Bills, etc.

3. On the Basis of Controllability:

Overheads may be classified on the control wise basis in the following ways:

(a) Controllable Overhead:

Overheads, which can be easily controlled by management through exercising various steps, are called controllable overhead. For example- Direct labour cost, direct material cost, direct expenses controllable by the shop level management.

(b) Uncontrollable Overhead:

Overheads, which cannot be, controlled whatever the steps taken by the management are called uncontrollable overhead. For example- a foreman in charge of a tool room can only control costs pertaining to the same department and the matters which come directly under his control, not the costs apportioned to other department.

4. On the Basis of Function:

The main groups of overheads on the basis of functional classification are as follows:

(a) Factory Overheads:

These are the costs associated with manufacturing activities, the sequence of which begins with the procurement of materials and ends with primary packing of the product. Factory overheads are also termed as production overheads, works overheads or manufacturing overheads, and so on. It means indirect expenditure incurred in connection with production operations.

It is the aggregate of factory indirect material cost, indirect wages and indirect expenses. Unlike direct material and direct labour, production overhead is an invisible part of the finished product, e.g., lubricants, consumable stores, indirect wages, factory power and light, depreciation of plant and machinery, depreciation of factory buildings, insurance of plant and factory building, storekeeper expenses, repairs and maintenance etc.

(b) Administration Overheads:

These are the cost of formulating the policy, directing the organisation and controlling the operations of an undertaking which is not related directly to production, selling, distribution research or development activity. Administration overheads are also termed as office overheads or management overheads or establishment overheads, etc.

For example, General Manager’s salaries, audit fees, legal charges, postage and telephone, stationery and printing, office rent and rates, office lighting, and salaries of office staff, management expenses, etc.

Though Cost of Training and Education to administrative staff is accounted as Office Overhead, it is much more beneficial to treat the same as an investment in human assets.

(c) Selling Overheads:

These are the costs of seeking to create and stimulate demand or of securing orders. It is the cost incurred for transferring the ownership of goods to the buyer. These are the expenses incurred for promoting sales and retaining customers, e.g., advertising, salaries and commission of sales personnel, showroom expenses, travelling expenses, bad debts, catalogues and price lists etc.

(d) Distribution Overheads:

It comprises of all expenditure incurred from the time, product is completed in the factory, until it reaches its destination or customer, e.g., packing cost, carriage outward, delivery van costs, warehousing costs etc.

Both selling and distribution costs are incurred after the production work is over and thus taken together, these are known as – “After Production Costs”.

The distinction between selling overheads and distribution overheads can be shown as follows:

Selling Overheads:

a) It includes the costs incurred in selling the product.

b) It includes the costs of the selling department and involves primarily the marketing costs.

c) It may also be divided into fixed and variable overheads.

d) Showroom rent, electricity, advertisement, salary and commission to salesman, bad debts, travelling and market research expenses are the examples of Selling Overheads.

e) They are incurred for promoting the product or securing and executing orders.

Distribution Overheads:

a) It includes costs incurred for the distribution of the finished product.

b) It also includes all costs incurred for making products available to the customers.

c) It may also be divided into fixed and variable overheads.

d) Warehouse rent, electricity, salary and wages paid to delivery van driver, warehouse keeper, carriage outwards, packing charges, insurance, and depreciation of delivery van are the examples of Distribution Overheads.

e) They are incurred in relation to the delivery and despatch of the products from the factory to the warehouse and from warehouse to the customers.

Factory Overheads are the part of manufacturing operations cost, the Selling and Distribution Overheads are the results of policy.

Classification of Overheads – Element or Nature Wise Classification and Behaviour Wise Classification

Classification of overheads means grouping of overheads according to their common characteristics. ICMA (London) defines classification as “the arrangement of items in logical groups having regard to their nature or the purpose to be fulfilled”.

Overheads may be classified on the following bases:

1. Elements or nature wise classification.

2. Behaviour wise classification.

1. Element Wise Classification of Overheads:

This classification is based on the definition of overheads. The classification of overheads on the basis of nature or sources is called as element -wise classification.

The overheads, under this classification are grouped into following three major groups-

(i) Indirect Material:

The materials which do not normally form a part of the finished product are called as indirect materials. These are the materials which cannot be conveniently identified or allocated but apportioned to or absorbed by cost units or cost centers, e.g. consumable stores, cotton waste, lubricants, loose tools, gum, sundry stores of negligible value etc.

(ii) Indirect Labour:

It is the labour not directly engaged in production operations but assisting and helping the direct labour in production operations. It is of general nature and therefore cannot be conveniently identified or allocated but apportioned to or absorbed by cost units or cost centers, e.g. wages and salaries of supervisors, foreman, instructors, timekeeping staff, apprentices, leave pay, over and idle time wages, provident fund contributions etc.

(iii) Indirect Expenses:

All indirect costs other than indirect materials, indirect labour costs are termed as indirect expenses. These expenses cannot be directly identified or allocated but apportioned to or absorbed by cost units or cost centers, e.g. rent and rates, repairs, depreciation, lighting, heating, power insurance etc.

2. Behaviour Wise Classification of Overhead:

The overheads, under this classification are classified on the basis of their tendency to change with volume of production.

Based on Behaviour the overheads can be classified as follows:

(i) Fixed Overheads:

The overheads which remain constant in total, irrespective of changes in the volume of production, are termed as fixed overhead. These overheads are also called as period costs as they accrue on the basis of time e.g. rent, rates and taxes, insurance, management salaries, legal expenses, depreciation on building, plant and machinery etc.

(ii) Variable Overhead:

The overheads that tend to change in total directly with changes in volume of production are called as variable overheads. These overheads are also called as product costs as they accrue on the basis of production rather than time. e.g. Power, fuel, lubricants, lighting, packing materials, consumable stores etc.

(iii) Semi-Variable or Semi-Fixed Overhead:

This overhead is partly variable and partly fixed, these overheads remain constant up to a certain level of output and thereafter tend to vary with change in output up to certain level of output and again remain constant thereafter e.g. supervisors salary, repairs and maintenance, office expenses like postage, stationery etc.

Classification of Overheads – With Examples

At present, overhead costs are significant for any product or service. To keep cost of production under control, the control of overheads costs are very important. It is the goal of every management to secure control of overhead costs.

Classification on the Basis of Behaviour:

Some overhead costs vary directly with the volume of output (for example, drilling soap will vary directly with the number of units produced), while others remain more or less fixed in amount. It will not vary with the output. (For example, rent, rates and taxes of the factory or salary of the security staff are not varying with the number of units produced.)

Classification of overheads (whether manufacturing or administrative or selling and distribution) according to its behavior is very important for controlling, budgets and accumulation of overhead costs.

On the basis of behavior, overheads are classified into three categories:

(i) Variable overhead;

(ii) Fixed overhead; and

(iii) Semi-variable overhead.

(i) Variable Overhead:

Variable overheads are varying in amount in direct portion to units produced. Cost Accounting Standards -3 (CAS-3) has defined variable overhead as – “variable overheads comprise of expenses which vary in proportion to change of volume of production”.

The following are the characteristics of variable overhead:

a. Variable overhead cost per unit is constant.

b. Variable overhead cost in amount will change in direct proportion to production.

c. Variable overhead cost is easy to trace to a particular department.

d. Controlling of variable overhead cost is easier and it is the responsibility of departmental head.

Examples of variable overhead are:

a. Materials handling cost;

b. Packaging cost

c. Power;

d. Fuel;

e. Overtime premium;

f. Supplies;

g. Loose tools;

h. Spoilage, salvage, etc.

(ii) Fixed Overhead:

Fixed overheads are not affected by the change in output. Fixed overheads remain constant in total within a relevant output range. However, fixed overheads per unit will decrease with the increase in output or vice versa. CAS-3 has defined fixed overhead as – “fixed overheads comprise of expenses whose values do not change with the change of volume of production such as – salaries, rent, etc.”

The following are the characteristics of fixed overhead:

a. Fixed overhead per unit will decrease with the increase in output or vice versa.

b. Fixed overhead in amount will remain same within a relevant range of output.

c. Fixed overhead apportionment is arbitrary.

d. Controlling of fixed overhead is difficult because most of the costs are based on time.

(iii) Semi-Variable Overhead:

Semi-variable overheads include both fixed and variable elements. Fixed portion will remain constant but variable portion will change with activity. CAS-3 has defined semi-variable overhead as – “semi-variable overheads are partly affected by change in the production volume. They are further segregated into variable overheads and fixed overheads.”

Examples of semi-variable overhead are:

a. Telephone expenses (minimum rental is fixed but cost of call is variable);

b. Delivery van costs (depreciation is fixed but running costs are variable);

c. Electricity cost (factory lighting cost is fixed but electricity used for running the machinery is variable).

It is to be observed that the fixed portion of semi-variable overhead represents the basic, minimum cost of just having a service ready and available for use. The variable portion represents the costs incurred for actual consumption of the service.

Classification of Overheads – According to Nature, Variability, Normality and Control

There are various methods of classifying or grouping overheads, which greatly depend upon the objectives of classification, the type or the size of the firm.

Generally, the following is the classification according to:

1. Nature

2. Variability

3. Normality

4. Control.

1. Classification According to Nature:

Overhead is defined in the Terminology of Cost Accountancy as “the aggregate of indirect material cost, indirect wages and indirect expense”. Here the definition is followed.

According to this classification, overhead can be classified into:

(a) Indirect material

(b) Indirect labour and

(c) Indirect expenses.

(a) Indirect Material – The cost of materials, which cannot be allocated to a particular unit and does not form a part of the finished product, is termed as indirect materials. For example, consumable stores fuel, small tools for general use, lubricating oil, cotton waste, losses and deterioration of stores etc.

(b) Indirect Labour – Labour charges which cannot be allocated to a particular unit of cost is called indirect labour or wages. For example, salary of the foreman, wages for maintenance workers, overtime, holiday pay, idle time, employer’s contribution to provident fund etc.

(c) Indirect Expense – Most items of expenditure are classified as indirect, since they are incurred for the business as a whole, rather than in regard to a particular product. For example, rent, rates, insurance, taxes, canteen and welfare expenses, lighting and heating, hospital and dispensary, training, depreciation of plant, machine building etc.

2. Classification According to Variability:

Expenses are also classified on the basis of behaviour or variability; it can be found that all items of overhead do not vary in sympathy with production.

Based on this behaviour, the expenses can be divided into:

(a) Fixed

(b) Variable, and

(c) Semi-variable or semi-fixed.

(a) Fixed Overhead:

Fixed overhead or constant charges or period costs remain fixed in their nature and do not vary with changes in the volume of output. There are certain expenses which must be paid, whether the factory is working or not. These expenses accrue over a period of time, hence known as time or period costs.

Such expenses remain constant even if the volume of production changes; when there is more production, and the fixed overhead is true only for a shorter period, and in the long run, there occurs the change. Examples for this context are salaries of staff, taxes etc. Examples of fixed costs are – depreciation of plant, rent of storage-house and building, postage, stationery, salaries, insurance etc.

(b) Variable Overhead:

Variable or fluctuating overhead is a cost which, in the aggregate, tends to vary in direct proportion to changes in the volume of output or turnover. In other words, these costs change in the same ratio in which output changes. Total variable cost will tend to vary direct with volume, while unit variable cost is likely to remain constant at all levels. For example, indirect material, indirect labour, power and fuel, spoilage, stores handling, overtime etc.

(c) Semi-Variable Overhead:

This type of overhead varies with a change in the volume of output, but not in such a proportion as the output changes. This type stands mid-way between fixed and variable overhead. Semi-variable or semi-fixed overheads may remain fixed at certain levels of output, while they vary at other levels, but not in the proportion of output changes. For example, repairs and maintenance, depreciation of plant and machinery, telephone, salary to supervisors etc.

3. Classification According to Normality:

According to this class the costs are divided into two types—normal overhead and abnormal overhead. Normal expenses are expected to be incurred in attaining a given output. These are unavoidable. These can be included in production cost. Abnormal costs are those which are not expected to occur in attaining a given output; for example, abnormal idle time, abnormal wastage etc. Such expenses may be transferred to costing profit and loss account.

4. Classification According to Control:

It is also known as control-wise classification. It can be divided into two types— controllable costs and uncontrollable costs. Controllable costs are those which can be controlled by an efficient management. For example, idle time, wastage etc. can be controlled. Uncontrollable costs are those which cannot be controlled. All types of fixed costs are the best example.

In the light of the above discussion, there are a number of advantages which are helpful for an efficient running of a firm.

In brief the usefulness of cost classification on the basis of variability is as follows:

(a) Cost Control:

When cost is classified as controllable and uncontrollable, generally all fixed costs like rent, rate, insurance etc., fall under the uncontrollable classification; the costs cannot be controlled and remain constant even at the level of zero output. The controllable costs are variable costs which can be controlled. Variable costs can be controlled by lower levels of the management. By splitting the expenses, one can know the type of expenses, which can be controlled. Therefore, for the purpose of cost control, this type of classification is very useful.

(b) Fixation of Selling Price:

As far as the pricing policy is concerned, this type of classification is helpful in fixing the price. It may happen, sometimes that different prices are charged for the same article on the basis of competition in different markets. Whatever it may be, the lowest price may cover at least cost plus variable expenses.

(c) Marginal Cost:

Costs are divided into fixed and variable cost. The variable costs are taken into account in marginal costing. Marginal costing is a technique used in industries for profit planning, cost control etc. It also discloses whether it is profitable to manufacture a product or to buy it from the market. For preparation of break-even charts and the study of cost-volume-profit relationship, distinction between fixed cost and variable cost is essential.

(d) Decision-Making:

Managerial decisions greatly depend on fixed and variable costs, mainly dealing with fixation of price at depression, introducing new lines, alternative methods of production, replacement of old machines by new ones, introduction of new products etc.

(e) Overhead Absorption:

There are many methods to absorb overheads; and rates are different on fixed and variable overheads. If the absorption rate is pre-determined, there arises a variation between the cost absorbed and the cost incurred. This variation may lead to a problem of under or over absorption. The variation arises out of the two types of overheads. Therefore, it is necessary to divide the overhead into fixed and variable, in order to compute separate rates of absorption.

(f) Unit Cost of Production:

When production increases, the fixed overhead cost per unit decreases. But variable cost per unit remains constant. To analyse the cost of production and its fixation, it is essential to find out the fixed cost per unit and variable cost per unit.

Classification of Overheads

Overhead costs are also termed as indirect or supplementary costs. These are costs which cannot be wholly debited directly to a particular job. These are neither direct material nor direct wages nor are these expenses of a direct nature and, therefore, these cannot enter the direct cost of manufacture.

But such expenses constitute an essential element of cost as they are incurred for manufacturing a commodity or making it ready for sale. They may arise either inside or outside the factory, e.g., foreman’s salary is an overhead charge occurring within the factory while office manager’s salary is an overhead charge occurring outside the factory.

Overheads may be classified according to their nature, variability, function and a number of other characteristics.

The classification can be summarised as follows:

1. According to Nature-

(i) Indirect Material.

(ii) Indirect Labour.

(iii) Indirect Expenses.

2. According to Normality-

(i) Normal Overheads.

(ii) Abnormal Overheads.

Normal overheads refer to such overheads which are expected to be incurred in attaining a given output. These overheads are unavoidable. They are, therefore, included in production costs.

Abnormal overheads refer to those overheads costs which are not expected to be incurred in attaining a given output e.g., cost of abnormal idle time. Such costs are charged to costing profit and loss account.

3. According to Controllability-

(i) Controllable Overheads.

(ii) Uncontrollable Overheads.

Controllable overheads are those which can be controlled by executive action at the point of their incurrence. Overheads which are not so controllable are termed as uncontrollable. For example, cost of power used in a particular department can be controlled by the departmental manager, but the share of general lighting costs in the factory to be borne by his department, cannot be controlled by him. The former is, therefore, controllable item of overheads while the latter is an uncontrollable item so far as the departmental manager is concerned.

4. According to Variability –

1. Fixed Overheads:

These costs are not affected in monetary terms during a given period by a change in output. But this will be true only when the change in output is not substantial. If the change in output is substantial these will also increase and will remain constant after such an increase till a certain level of activity is reached. The examples of such costs are—rent and rates; insurance of buildings, plant and fittings, salaries etc.

2. Variable Overheads:

These costs change in the same ratio in which the output changes. The examples of such costs are—power, selling commission etc.

3. Semi-Variable Overheads:

These costs are partly fixed and partly variable. They do not change in the same ratio in which the output changes. The examples of such costs are—depreciation, cost of repairs and maintenance etc. In case the factory output is doubled, the depreciation would not normally be doubled. It may increase by 50% only as the amount of depreciation depends upon (i) efflux of time and (ii) wear and tear. That part of depreciation which is due to passage of time is fixed, while that part which is due to wear and tear is variable, and that is why depreciation is a semi-variable expense.

Classification of Overheads – According to Elements and Behaviour

Classification is /the process of grouping costs according to their common characteristics.

Overhead cost may be classified according to:

I. Elements and

II. Behaviour.

I. Element-Wise Classification:

This method of classification follows the definition of overhead.

In this method, overhead is broken down into three elements:

(1) Indirect material,

(2) Indirect labour and

(3) Indirect expenses.

(1) Indirect Material:

It includes those materials which do not normally form a part of the finished product. It has been defined as ‘materials which cannot be allocated but which can be apportioned to or absorbed by cost centres or cost units’.

Examples are:

i. Fuel

ii. Lubricating oil

iii. Stores consumed for repair and maintenance work.

iv. Sundry stores of small value expended for factory use.

v. Small tools for general use.

vi. Cotton waste, etc.

vii. Deficiencies, loss and deterioration of stores.

(2) Indirect Labour:

Labour charges which cannot be allocated to a particular unit of cost are called indirect labour or wages.

Examples are:

i. Wages for maintenance workers.

ii. General indirect labour salary of store-keeper and foreman.

iii. Idle time

iv. Workmen’s compensation

v. Overtime and night-shift bonus.

vi. Employer’s contribution to funds.

vii. Holiday Pay/Leave Pay.

(3) Indirect Expenses:

These are expenses which cannot be allocated but which can be apportioned to or absorbed by cost centres or cost units.

Examples are:

i. Salary of factory staff.

ii. Training expenses

iii. Depreciation of Plant, Machinery and Buildings.

iv. Insurance

v. Taxes.

vi. Rates and rents, lighting, heating of factory.

vii. Hospital, Dispensary and Canteen expenses.

II. Behaviour-Wise Classification:

All items of overhead do not vary in sympathy with production. Some expenses increase with an increase in production volume, some remain constant irrespective of the changes in the level of production, whereas others do not change up to a certain volume but change after that.

Based on this behaviour, the overhead expenses may be classified into:

(1) Fixed overheads,

(2) Variable overheads, and

(3) Semi-fixed overheads or semi-variable overheads.

(1) Fixed Overheads:

Fixed overheads are period costs. They remain constant irrespective of changes in the volume of production. These must be paid whether the factory is working or not. They accrue over a period of time hence known as time costs. Examples of fixed costs are depreciation of plant and machinery, rent and rates, insurance, depreciation of buildings, legal expenses, bank charges, pay and allowances of managers etc.

Another important point to be noted in respect of fixed cost is that it is not a constant quantity permanently. The firm, when it increases its capacity, might have to acquire additional buildings, plants, equipments and other facilities in the long run. Then the fixed expenses which were constant begin to increase. Thus, fixed changes are fixed only within a certain range of plant capacity.

(2) Variable Overheads:

Variable overheads tend to vary directly with variations in volume of production. These expenses change in the same ratio in which output changes. Total variable cost will tend to very directly with changes in volume, while unit variable cost is likely to remain constant at all production levels. The examples are – Indirect labour, indirect material, power and fuel, overtime, stores handling etc.

(3) Semi-Variable Overheads:

There are certain overhead items which neither fall in the category of fixed costs nor of variable costs. These are known as semi-variable or semi-fixed overheads. They remain fixed at certain levels of output, while they vary at other levels, but not in the proportion of output changes.

Examples are repairs and maintenance, depreciation of plant and machinery, salary payable to a supervisor etc. For instance, in the case of depreciation, a certain percentage can be attributable to lapse of time and hence fixed; another percentage can be attributable to use.

Classification of Overhead – Element Wise and Behaviour Wise Classification

Overhead costs can be classified as under:

(1) Element Wise:

When the classification is made according to the nature and source of expenditure, it is known as element wise classification.

These expenses are classified under the main 3 groups as under:

i. Indirect Materials

ii. Indirect Wages

iii. Indirect Expenses.

(2) Behaviour Wise Classification:

It includes the following expenses:

(i) Fixed Overhead – It includes those expenses which are fixed and does not change with the increase or decrease of output, such as rent of factory, manager salary etc.

(ii) Variable Overhead – These expenses vary in direct proportion to output. Per unit variable overhead remains fixed.

(iii) Semi-Variable Overhead – These expenses vary in part with the volume of production and in part they are constant.