Everything you need to know about Factory Overhead. Learn about – 1. Items of Factory Overhead 2. Examples of Factory Overhead 3. Factory Overhead Formula 4. Methods of absorption of factory overheads 5. Steps in dealing with factory overheads in cost accounts 6. Advantages and Disadvantages.

What is Factory Overhead: Examples, Formula, Items, Steps, Methods and Distribution

Top 15 Items of Factory Overhead

The items of factory overhead are as follows:

1. Rent – Area or volume of building.

2. Depreciation of Machinery – Percentage of original cost of machinery or machine hour rate.

ADVERTISEMENTS:

3. Power – Horse power multiplied by machine hours or KWH.

4. Electric lighting – Number of light points or areas.

5. Canteen expenses – Number of employees.

6. Store-keeping and materials handling – Number of stores requisitions.

ADVERTISEMENTS:

7. Indirect wages of the maintenance department or inspection etc. – Estimated or actual time spent.

8. Delivery expenses – Weight, volume or tonne-kilometre.

9. Repairs of plant – Value of plant.

10. Supervision – Direct wages.

ADVERTISEMENTS:

11. Fire Insurance – Value of Asset.

12. Machine shop expenses – Machine hours or labour hours.

13. General expenses – Direct Wages or No. of employees.

14. Audit Fees – Sales or total cost.

ADVERTISEMENTS:

15. Maintenance of building – Area or labour hours.

Factory Overheads – Steps: Collection, Classification, Allocation, Apportionment and Absorption

There are five main steps in dealing with factory overheads in cost accounts:

A. Collection;

B. Classification;

ADVERTISEMENTS:

C. Allocation;

D. Apportionment; and

E. Absorption.

A. Collection:

ADVERTISEMENTS:

There are seven main sources of cost data relating to factory overheads:

1. Purchase day book,

2. Invoices,

3. Stores requisitions.

ADVERTISEMENTS:

These three are meant for collection of indirect materials cost.

4. Wages analysis book for indirect wages,

5. Cash book and petty cash book,

6. Journal entries,

7. Other registers, like, plant and machinery.

These three are meant for collection of indirect expenses including depreciation of plant and machinery.

ADVERTISEMENTS:

B. Classification:

There may be three broad categories of factory overheads:

1. Plant overheads,

2. Overheads relating to production cost centres and

3. Overheads relating to service cost centres.

All the factory overheads are to be classified to suit the purpose of cost accounting, whether item wise, i.e., rent, insurance, depreciation etc., or function-wise. Standing order numbers are used for covering the factory overheads. Cost Account numbers are used for covering the Administration, Selling and Distribution overheads.

C. Allocation:

Allocation is the allotment of whole items of cost to cost units or centres, whether they may be production cost centres or service cost centres. For example, indirect wages of production department ‘A’ is to be allocated to Department ‘A’ only. Similarly, wages of service department ‘S’ is to be allocated to Department ‘S’ only.

D. Apportionment:

Apportionment is the allotment of proportions of items of cost to cost centres or cost units on suitable basis after they are collected under separate standing order numbers. It may be on the basis of services rendered by a particular item of expense to different departments or by survey method.

Sometimes, the basis will be the “Ability to pay method”, i.e., ability of the department to bear such share of items of overheads. Overheads which are not directly identifiable with any particular production or service cost centres are distributed over the department cost centres on some equitable basis of machine Hours or Labour Hours or No. of employees, etc.

Factory Overheads – Methods of Absorption (With Formulas, Advantages and Disadvantages)

The various methods of absorption of factory overheads are discussed below:

1. Percentage on direct material cost.

2. Percentage on direct wages.

3. Percentage on prime cost.

4. Direct labour hour rate.

5. Machine hour rate.

6. Rate per unit of production.

1. Percentage on Direct Material Cost:

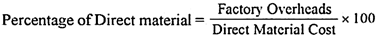

In this method overheads are absorbed on the total of direct materials consumed in producing the product. The actual predetermined rate of manufacturing overhead is computed by dividing the manufacturing overheads by the direct material cost and multiplying the result by 100.

Advantages:

i. Calculation of this rate is simple.

ii. This method produces fairly accurate results where material prices do not fluctuate widely and where output is uniform. It is easy to understand.

Disadvantages:

i. Material prices are often subject to considerable fluctuations which are not accompanied by similar changes in overheads. This causes misleading results.

ii. This method is quite illogical and inaccurate because overheads are in no way related to the cost of materials consumed. This amount of overheads does not change because the work is being done on copper instead of iron. Both metals are quite different in prices and by applying the same percentage for both will be obviously incorrect.

iii. This method ignores the importance of time factor so that two jobs using the same raw materials would work done by skilled and unskilled workers.

Suitability:

i. When only one kind of article is produced.

ii. When material cost forms a greater part of the cost of production.

iii. When price of materials are stable.

iv. When the same quantity of materials is used for all units.

2. Percentage or Direct Wages:

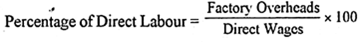

This is another simple and easy method. On the basis of this the actual or predetermined rate of manufacturing overhead absorption is computed by dividing the overhead to be absorbed or apportioned by the predetermined direct wages and multiplying the result by 100.

Advantages:

i. Unlike materials prices, labour rates do not fluctuate so frequently. Therefore, this method gives stable results.

ii. Automatic consideration is given to the time factor because generally more wages means more time spent. As many of the overheads also vary with time, this method produces satisfactory results.

iii. The method is simple and easy to use as all data required is easily available without keeping any extra records.

iv. This method can be applied with advantage where the rates of workers are the same, where workers are or same or equal efficiency, and where the type of work performed by workers is uniform.

Disadvantages:

i. Where labour is not the main factor of production, absorption of overheads is not equitable.

ii. When workers are paid on a piece basis, this method will not give satisfactory results because the time factor is ignored.

iii. This method does not distinguish between work done by skilled and unskilled workers, as unskilled workers take more time and thus give rise to more factory expense than skilled workers.

iv. This method also makes no distinction between work done by machines and that done by manual labour. Machines give rise to certain overheads like depreciation, power, etc., which should be charged only to the work done on machines.

Suitability:

i. When production is uniform.

ii. When labour forms the predominant part of the total cost.

iii. When there is no variation in the wage rates of pay.

iv. When the ratio of skilled and unskilled labour is constant.

3. Percentage on Prime Cost:

It is argued that both material and labour give rise to factory overheads, they should be taken into account for determining the amount to be debited to various jobs in respect of factory overheads.

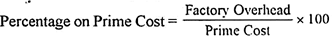

Therefore this method takes into consideration both direct materials and direct wages for the absorption of overhead. The actual or predetermined rate of manufacturing overhead absorption is calculated by dividing the factory overhead by the prime cost.

Advantages:

This method is also simple and easy. It does not require any special accounting records to be kept for its operation.

Disadvantages:

i. This method combines the limitations of both direct materials and direct labour methods.

ii. It does not give proper weight to time factor.

iii. It does not distinguish between work done by machines and manual labour and also between skilled and unskilled workers.

4. Direct Labour Hour Rate:

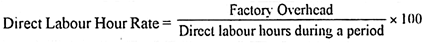

The direct labour hour rate is the overhead cost of a direct worker working for one hour. This rate is determined by dividing the overhead expenses by the total number of direct labour hours.

Advantages:

i. It gives due consideration to time factor.

ii. It is most suitable where labour constitutes the major factor of production.

iii. This rate is not affected by the method of wage payment i.e., time rate or piece rate method.

Disadvantages:

i. Additional records of labour must be maintained if this method is to be used. This may add to the cost of clerical work.

ii. This method does not take into account factors other than labour.

Suitability:

i. It is suitable when most of the work is done manually.

ii. It is suitable when the production is not uniform.

iii. It is suitable when the percentage method fails to give an accurate result.

5. Machine Hour Rate:

Machine hour rate is one of the methods of absorbing factory overhead. This method is commonly used in those industries where machines are primarily used because in these industries overheads are mostly concerned with machines.

The procedure adopted to determine the Machine Hour Rate is as follows:

i. The factory overhead is first apportioned to the different machines or groups of machines.

ii. The working hours of a machine are calculated for the period for which the machine is to run.

iii. If the overheads of a machine cost centre are divided by the effective machine hours, we get machine hour rate pertaining to the machine or the group of machines.

iv. Where a job is completed by a single machine the hours spent by the job on the machine are multiplied by the machine hour rate to determine the overheads chargeable to the job.

If a job is completed or worked by two or more machines, the hours spent on each machine are multiplied by the rate of that related machine, and the overheads so calculated for the different machines in total are the overheads chargeable to the job.

v. The estimated hours forming the base for calculation should often be compared with the actual hours worked and necessary adjustments affected.

vi. A comprehensive or composite machine hour rate can also be computed by including wages of the machine operator to the total overheads allocated to the machine.

Basis of Apportionment of Departmental Overheads to the Machine:

The Basis for allocation of departmental overheads are the following:

i. Rent, Rates, taxes etc. – Floor area occupied by the machines.

ii. Depreciation – Actual depreciation as per Plant Register.

iii. Lighting – No bulbs used for lighting by the machine.

iv. Heating – Floor area occupied or technical estimate.

v. Power – Horse Power of machine.

vi. Repairs & Maintenance – Actual repairs or hours worked by the Machines.

vii. Supervisory Expenses – No. of hours devoted by Supervisor.

viii. Labour Welfare expenses – No. of employees engaged on machines.

ix. Insurance – Machine value considering insurance period.

x. Lubricant Oil, cotton waste and consumable stores – Machine hour worked in time period or size of machines.

xi. Interest included in Hire Purchase – Original price of machine.

xii. Miscellaneous expenses – Should be apportioned on some suitable basis.

Top 3 Stages Involved in Distribution of Factory Overhead

Distribution of factory overheads involves three stages:

(i) Collection and classification of factory overheads.

(ii) Departmentalisation of factory overheads

(iii) Absorption of factory overheads.

(i) Collection and Classification of Factory Overheads:

All factory overheads would be collected and classified under appropriate accounting headings, e.g., factory rent, insurance, lighting, depreciation etc. Each heading will be given an appropriate standing order number.

(ii) Departmentalisation of Factory Overheads:

The term departmentalisation of overheads refers to the allocation and apportionment of overheads among various departments.

In case of factory overheads it involves:

(i) Allocation and apportionment of overheads among Production and Service Departments. Production Departments manufacture products while service departments help them in this process.

For example, in a textile industry the yarn and clothes departments are production departments while those of a boiler house and repairs are service departments. This is known as primary distribution of factory overheads.

(ii) Apportionment of Service Departments’ overheads among Production Departments. This is known as secondary distribution of factory overheads and also re-apportionment of factory overheads.

The above stages are explained below:

(i) Allocation of Overheads:

There are certain overheads which can be directly estimated for different departments. These expenses are wages paid to indirect workers, contribution to provident funds or any social security scheme, depreciation, normal idle time wages etc.

Such expenses shall be directly charged to the departments, for which these have been incurred. This is called “allocation of overheads.”

(ii) Apportionment of Overheads:

Certain expenses such as General Manager’s salary, rent of the factory etc. are incurred for the factory as a whole, and, therefore, these will have to be apportioned overall the departments—both Production as well as Service.

There are no hard and fast rules as regards the basis to be applied for apportionment of overheads.

Any one or more of the following methods may be used:

(a) According to departmental wages

Expenses which vary directly with the departmental wages paid can be apportioned on this basis, e.g., premium for workmen’s compensation insurance etc.

(b) According to capital values of the assets

Overheads such as depreciation of buildings, plant and machinery, fire insurance premiums on these assets, etc. may be apportioned on this basis.

(c) According to floor area occupied

Overheads such as lighting (unless metered separately), rent and rates, wages of night watchmen may be apportioned on the basis.

(d) According to number of workers employed

Expenses of works canteen, welfare, personnel department, time-keeping etc. can be apportioned on this basis.

(e) According to production hours of direct labour

Works management remuneration, general overtime expenses, cost of inter-department transport should be charged to various departments in the ratio which the departmental hours bear to the total factory direct hours.

(f) According to technical estimate

The advice of technical personnel may also be useful on the apportionment of certain expenses, e.g., the cost of steam consumed by a particular department can be arrived at on the basis of the engineer’s estimates.

(iii) Apportionment of Service Department Overheads:

After the overheads have been classified between production and service departments the costs of service departments are charged to such production departments which have been benefitted by their services.

Any one or more of the following methods may be adopted for this purpose:

(a) Service or Use Method:

Under this method overheads are distributed over various production departments on the basis of services actually rendered.

This criterion has the greatest applicability in cases where overheads costs can be easily and directly traced to departments receiving the benefits, e.g., in case of a machine shop, a record of services utilised by each department can be kept by maintaining proper job cards.

But this basis cannot be used in all cases, e.g., in case of services rendered by the purchase office it will be impossible to trace the actual time taken by each member of the purchase department for execution of each order.

(b) Potential Benefits:

Under this method service department overheads are charged to production departments on the basis of potential rather than actual services rendered. This method is particularly useful where the service department costs are largely fixed and services have been provided taking into consideration the potential requirements of the various departments.

For example, a company may provide for its own buses for transporting workers to and from the factory. The size of the fleet of buses have been fixed taking into consideration the potential number of users.

In such a situation it seems quite logical that the overheads of the transport department are charged to various production departments in proportion to the number of the potential users, regardless of the actual number of workers in each department.

(c) Ability to Pay Method:

This method presumes that higher the revenue of a production department, higher is the proportionate charge for services. For example, a textile mill may apportion its overheads between superfine quality and controlled quality of cloth on this basis.

The controlled cloth may have to be sold at a price fixed by the Government and its manufacture may be ‘must’ for manufacturing superfine cloth as per the orders of the Government. This method is inequitable because it penalises the efficient departments for their efficiency.

(d) Direct or Specific Criteria Method:

Under this method specific criteria are laid down after careful survey for apportionment of charge for different service functions. This method is particularly used when it is difficult to select a suitable basis for apportionment.

For example, manager’s salary may be apportioned on the basis of time and attention given by him to different cost centres or the charge for services of cost accounting department may be apportioned to different production departments on the basis of number of workers employed in each department etc.