In this article we will discuss about:- 1. Definition of Service Costing 2. Application of Service Costing 3. Forms of Service Costing.

Definition of Service Costing:

CIMA defines Service Costing as ‘cost accounting for services or functions (e.g., canteens, maintenance, personnel). These may be referred to as service centres, departments or functions.’ Service Costing is also known as ‘operating costing’ is used for establishing costs of services rendered or services offered for sale and no items are produced.

Service costing is used in service organizations like transport companies, hotels, hospitals, power generation, colleges, boiler houses etc. The method of costing is similar to output costing.

Service Cost Unit:

ADVERTISEMENTS:

All the costs incurred during a period are collected and analyzed and then expressed in terms of a cost per unit of service.

The cost unit to be applied needs to be defined carefully and it is frequently a composite figure such as tonne-kilometer, kilowatt-hour, patient day etc. The costing should be comprehensive enough to show the effects like off-season and peak-season demand, full time, part time, etc.

The service costs are usually collected under the following headings:

(1) Standing charges (fixed costs), and

ADVERTISEMENTS:

(2) Running expenses (variable costs).

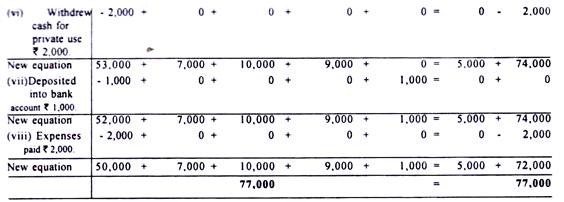

The cost per unit is calculated as follows:

Price for the service is fixed by adding a markup to the cost per unit. The cost per unit of service is used for control of costs by comparing costs month by month or period by period etc. Any discrepancies over the normal are investigated for corrective action.

ADVERTISEMENTS:

In practice, the cost units used by some service organizations are given below:

Operating costing is similar to output costing. All costs are suitably classified under fixed and variable. These costs are then collected, analyzed and expressed in terms of appropriate cost unit.

The classification of cost into fixed and variable is very important as it draws management’s attention to the fixed costs to which they are committed regardless of the units of services ultimately given. It also indicates the change in the cost structure in the operating level.

Application of Service Costing:

ADVERTISEMENTS:

Service costing is applied to the operations concerned in an organization which provide services to production departments. For example, Canteen for the staff, Hospital for the staff, Boiler house for supplying steam to production departments, Captive Power generation unit, operation of fleet of vehicles for transport of raw material to factory or distribution of finished goods to the market outlets, computer department services used by other departments etc.

When services are offered to outside customers with a profit motive and it is the business of the organization in offering services, like Transport organization, Hotel business, Power generation company etc., Service Costing is applied. The method of costing is similar to Output Costing. All costs incurred during a period are collected and analyzed and then expressed in terms of a cost unit of service.

Forms of Service Costing:

i. Transport Costing:

In transport undertakings most of the data required for cost finding are obtained from log books and other incidental records. The costs are divided into (i) Fixed costs, and (ii) Running costs (variable). The more the kilometers a vehicle travels, the cheaper the cost per kilometer travelled.

ADVERTISEMENTS:

This is due to spreading of fixed cost over the number of kilometers run. More the number of kilometers travelled, lesser will be the fixed cost per kilometer travelled. However, the variable cost per kilometer will not change.

The proforma Operating Cost Sheet of a Transport Company is given below:

Absolute and Commercial Ton-kms:

ADVERTISEMENTS:

The distinction between absolute and commercial ton-kms. are as follows:

(a) Absolute ton-kms. are the sum total of ton-kms. arrived at by multiplying various distances by respective load quantities carried.

(b) Commercial ton-kms. are arrived at by multiplying total distance kms. by average load quantity.

The following illustration will explain the above:

ADVERTISEMENTS:

Illustration 1:

A truck starts with a load of 10 tons of goods from station P. It unloads 4 tons at station Q and rest of the goods at station R. It reaches back directly to station P after getting reloaded with 8 tons of goods at station R. The distances between P to Q, Q to R and then from R to P are 40 kms, 60 kms. and 80 kms. respectively:

Compute ‘absolute ton-km.’ and ‘commercial ton-km’.

Solution:

Absolute Ton-kms

= (10 tons x 40 kms.) + (6 tons x 60 kms.)+ (8 tons x 80 kms.)

ADVERTISEMENTS:

= 400 + 360 + 640 = 1,400 ton-kms.

Commercial Ton-kms.

Average load x Total km. travelled = {10+6+8/3} tons x 180 kms. = 1,440 ton-kms.

Illustration 2:

From the following data calculate the cost per mile of a vehicle:

Illustration 3:

In view of increasing cost of operating own fleet of cars, your company is presently considering two proposals, viz., (i) To hire cars with drivers from an agency @ Rs. 800 per car per month. The company will bear the cost of petrol, oil and tyres. (ii) The executive will be given Rs. 25,000 interest-free loan repayable in 5 years to buy his own car. The company will, however, provide him with free petrol and Rs. 5,000 per month for maintenance and driver’s wages.

If the present cost of a car is Rs. 50,000 and monthly average running is 2,000 kilometers, find out the most economical way with the help of the following data:

Tax and Insurance Rs. 560 per year.

Diver’s wages and bonus Rs. 720 p.m.

Life of a car – 5 years

Resale value at the end of 5th year – Rs. 10,000

Assume interest @ 18% per annum

Solution:

1. Hotel Costing:

The proforma Operating Cost Sheet of a Hotel Firm is given below:

2. Canteen Costing:

The proforma Operating Cost Sheet of a Canteen Firm is given below:

Canteen Operating Cost for the month ……………….

Illustration 4:

MN Ltd. Canteen Cost Sheet for the month of April, 2009:

No. of meals served = 4,500

Cost per meals served = Rs. 67,000/4,500 meals = Rs. 14.90

3. Power House Costing:

The proforma Operating Cost Sheet of Power House/Boiler House is given below:

4. Hospital Costing:

The proforma Operating Cost Sheet of a Hospital Firm is given below: