The following points highlight the four major types of variance analysis. The types are: 1. Material Variances 2. Labour Variances 3. Variable Overhead Variances 4. Sales Variances.

Variance Analysis: Type # 1.

Material Variances:

Some Definitions:

ADVERTISEMENTS:

1. Direct Materials Usage Variance:

“The difference between the standard quantity specified for actual production and the actual quantity used at standard purchase price.”

2. Direct Materials Price Variance:

“The difference between the standard price and actual price for the actual quantity of materials.”

3. Direct Materials Total Variance:

“The difference between the standard direct material cost of the actual production volume and the actual cost of direct material.”

How to find out?

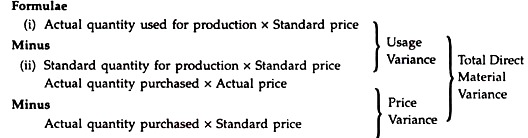

Formulae:

(i) Actual quantity used for production x Standard price Minus

(ii) Standard quantity for production x Standard price Actual quantity purchased x Actual price

Minus:

ADVERTISEMENTS:

Actual quantity purchased x Standard price

Note:

The actual usage is to be calculated as follows:

Opening stock + Purchase – Closing stock = USAGE

ADVERTISEMENTS:

Causes of Material Variances:

(i) Price Variances:

(a) Buying lower or higher quality of materials than planned.

(b) Losing or gaining quantity discounts by purchasing in smaller or larger quantity of materials than planned.

ADVERTISEMENTS:

(c) Paying higher or lower price than planned.

(d) Close substitute materials are bought due to unavailability of planned material,

(ii) Usage variance:

(a) Buying of substitute materials because of unavailability of standard materials.

ADVERTISEMENTS:

(b) Greater or lower yield from materials than expected or planned.

(c) Greater or lower rate of scrap than anticipated.

Alternative Approach:

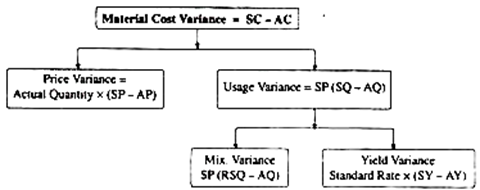

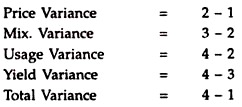

Material Cost Variance:

1. Actual Quantity x Actual Rate

2. Actual Quantity x Standard Rate

ADVERTISEMENTS:

3. Standard Mix of Actual Quantity x Standard Price

4. Standard Quantity for Actual Output x Standard Rate.

Problem 1:

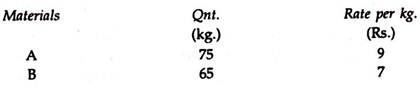

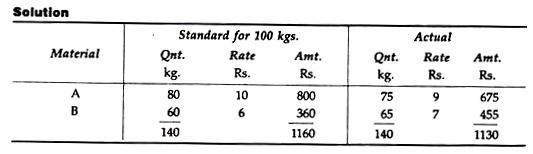

Sanrare Perfumery Ltd. provides the following information from their records:

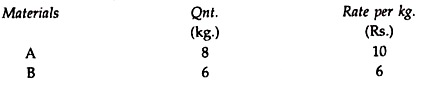

The standard material requirements for 10 kg. of a product are :

During March, 1999, 100 kgs. of the product were produced. The actual consumptions of materials were as under:

Calculate:

(i) Material Cost Variance

(ii) Material Price Variance

(iii) Material Usage Variance

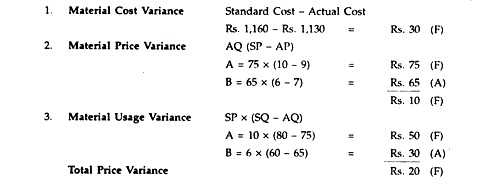

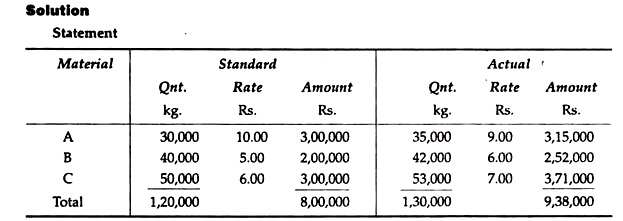

Problem 2:

The Standard Material cost to produce a tonne of chemical is:

300 kgs. of material A @ Rs.10 per kg.

400 kgs. of material B @ Rs. 5 per kg.

500 kgs. of material C @ Rs. 6 per kg.

During a period, 100 tonnes of mixture X were produced from the usage of:

35 tonnes of material A at a cost of Rs.9,000 per tonne

42 tonnes of material B at a cost of Rs.6,000 per tonne

53 tonnes of material C at a cost of Rs.7,000 per tonne

Calculate material price, usage and mix variances.

1. Material Cost Variance:

Standard Cost for Actual Quantity – Actual Cost

= Rs.8,00,000 – Rs.9,38,000 = Rs.1,38,000 (A)

2. Material Price Variance = AQ (SP – AP):

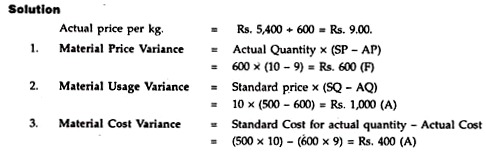

Problem 3:

From the following data compute:

(i) Material Cost Variance

(ii) Material Price Variance

(iii) Material Usage Variance

Standard quantity required 500 kgs.

Standard price @ Rs.10 per kg.

Actual quantity used 600 kgs.

The above quantity was bought at Rs. 5,400.

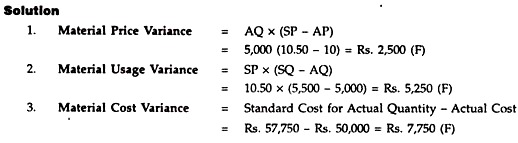

Problem 4:

From the following particulars compute:

(i) Material Cost Variance

(ii) Material Price Variance

(iii) Material Usage Variance

Quantity of material purchased: 5,000 units

Value of materials purchased: Rs,50,000

Standard Quantity of materials required for the product 5,500 units

Standard rate of material per unit Rs.10.50

Variance Analysis: Type # 2.

Labour Variances:

Labour variance analyses the variance of actual labour cost from standard labour cost due to the following factors:

(a) Rate of pay;

(b) Labour efficiency;

(c) Labour mix; and

(d) Idle time etc.

Labour Variance may be classified as follows:

Some definitions:

(i) Direct Labour Rate Variance:

Definition:

“The difference between the standard and actual direct labour hour rate per hour for the total hours worked” —Terminology.

(ii) Direct Labour Efficiency Variance:

“The difference between the standard hours for the actual production and the hours actually worked valued at the standard labour rate”—Terminology.

(iii) Direct Labour Total Variance:

“The difference between the standard direct labour cost and the actual direct labour cost incurred for the production achieved”—Terminology.

Types:

(i) Labour Cost Variance:

Formulae:

(i) (Actual Labour Hours x Actual Rate)

Minus (Actual Labour Hours x Standard Rate)

Causes:

Labour cost may arise due to changes in the following factors:

(i) Actual Wage Rate may be more or less than Standard Wage Rate.

(ii) Actual Labour Hours may be more or less than Standard Labour Hours.

(iii) There may be some idle hours due to abnormal situation like strike, lockout, shortage of power which were not considered at the time of fixing the standard labour cost.

(iv) There may be shortage of workers having standard level of efficiency.

(v) Actual Output may be more or less than Standard Output or yield.

(ii) Labour Rate Variance:

According to I.C.M.A., London, Labour Rate Variance “is that portion of labour (wages) variance which is due to the difference between the Standard Rate of pay specified and Actual Rate paid.”

Labour Rate Variance:

= (SR x AH) – (AR x AH)

= (SR – AR) x AH

Causes:

Labour Rate variance may be caused by the following factors:

(i) Employment of more skilled and efficient workers who demand higher wages.

(ii) Scarce supply of labour might have raised the wage rates.

(iii) On the contrary, excess supply of labour might have lowered down the wage rate.

(iv) Overtime allowances, bonus and extra shift allowances might have been paid.

(v) Change in method of wage payment.

(vi) Due to government policy general wage rate might have gone up.

(vii) Due to an agreement with the trade unions there may be modification of terms and conditions of wage payment and as a result the rate of wages may go up.

(viii) Faulty recruitment and placement of workers.

(ix) New workmen now paid though not included in the standards.

(iii) Labour Time (efficiency) Variance:

This is like Materials Quantity Variance. According to I.C.M.A., London “it is that portion of labour (wages) variance which is due to the difference between standard labour hours specified for the output achieved and actual hours expended”.

This variance reflects the efficiency or inefficiency of the workers. Labour Efficiency Variance = (SH x SR) – (AH x SR) = SR x (SH – AH) It is to be noted carefully that actual labour hours used in the formula should be labour hours actually taken for production.

Causes:

Labour Efficiency Variance may be caused by:

(i) Go-slow tactics adopted by the trade unions.

(ii) Absence of maintenance up to standard level.

(iii) Poor quality of raw materials.

(iv) Loss in waiting time.

(v) Lack of proper and efficient supervision.

(iv) Idle-Time Variance:

Sometimes workers may remain idle in the factory due to strike, power failures, machine break-down, etc. The hours for which workers are not provided with work facilities are known as idle hours. They get wages for these idle hours. Obvious idle hours do affect the labour cost variance.

This kind of variance is undesirable and that is why reasons for these variances are to be identified and measures should be taken to control them.

Idle Time Variance = Idle Hours x S.R.

(v) Labour Yield Variance:

This variance arises on account of the difference between Standard Yield and Actual Yield : Labour Yield Variance = (AY – SY) x SLC per unit

(vi) Labour Mix. Variance:

Labour Mix. Variance = (Revised Hours – Actual Hours) x S.R.

Revised Hours will be calculated:

RH = Actual Hours x Standard Mix Ratio. Alternative Approach Labour Cost Variances

Alternative Approach:

1. Actual Hours x Actual Rate

2. Actual Hours x Standard Rate

3. Standard Hours for Actual Output x Standard Rate

Or, Earned Standard Hours

4. Standard Hours is Standard Mix. for Actual Output x Standard Rate :

1. Rate of Pay Variance = 2-1

2. Efficiency Variance = 3-2

3. Labour Mix. Variance = 4-2

4. Total Variance = 3-1

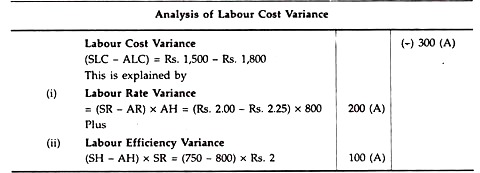

Problem 5:

The following information is obtained from a Standard Cost Card.

Labour Rate Rs.2 00 per hour

Hours — 3 hours per unit

Actual production data are:

Units produced are 250

Labour rate Rs.2-25 per hour

Hours worked—800

Calculate Labour Cost Variance and analyse it.

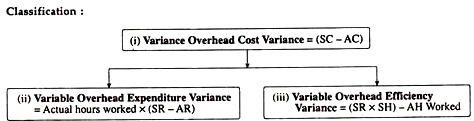

Variance Analysis: Type # 3.

Variable Overhead Variances:

Types:

(i) Variable Overhead Variance:

The difference between the actual overheads incurred and the variable overheads absorbed. This variance is simply the under-absorption of overheads.

(ii) Variable Overhead Expenditure Variance:

Definition:

The difference between the actual overheads incurred and the allowed variable overheads based on the actual hours worked is known as Variable Overhead Expenditure Variance (VOEV).

(iii) Variable Overhead Efficiency Variance:

Definition:

The difference between the variable overheads and the absorbed variable overheads is known as Variable Overhead Efficiency Variance.

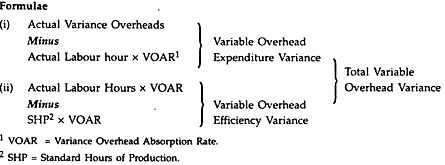

Formulae:

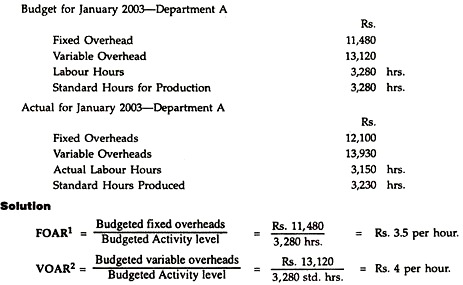

Problem 6:

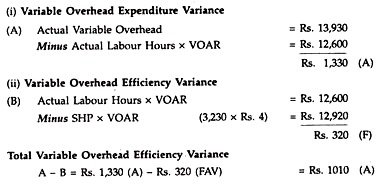

Problem 7:

Calculate variable overhead expenditure variance from the following particulars:

Variance Analysis: Type # 4.

Sales Variances:

A number of standard costing systems have been designed to present Material, Labour and Overhead cost variances as discussed earlier. No doubt, these variables are invaluable, but many accountants do think that a system will remain incomplete if sales variances are not included in the presentation of information to the management.

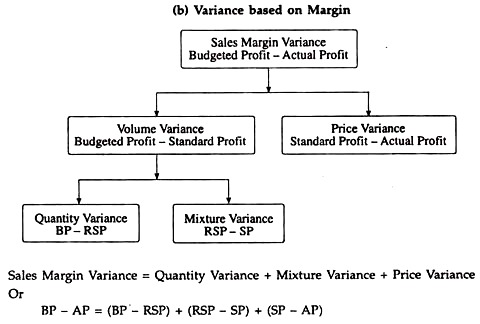

Methods of Sales Variances:

There are two methods of calculating sales variances namely:

(i) The Turnover Method:

This method shows the effect of a change in sales on turnover.

(ii) The Margin Method:

This method shows the effect of a change in sales on profit margin. Both the methods are very useful and should be understood by management accountants for taking managerial decisions.

Causes of Sales Variance:

Sales variances are basically caused by two changes which may occur when comparing budgeted sales with actual sales:

(i) Those due to price and

(ii) Those due to volume.

The change in volume may be caused by:

(i) Changes due to a change in quantity and

(ii) Changes due to a change in ‘mix’ of sales.

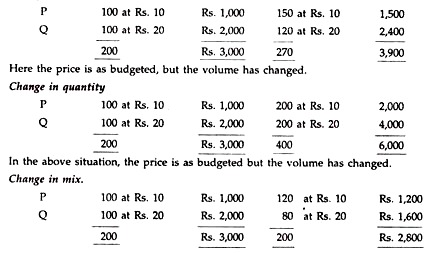

An example will clarify the matter:

In the above case, the volume of sales is as budgeted, but the selling prices have changed in both the products:

Change in volume:

Here, the price and quantity are as budgeted but the ‘mix’ of products has changed from A 50%, and B 50% to A 60% and B 40%.

(i) Sales Value Variance:

(Actual Value of Sales – Budgeted Vale of Sales)

Actual Sales = Actual Quantity sold x Actual selling price.

Budgeted Sales = Standard Quantity x Standard selling price.

If actual sales are more than the budgeted sales, there is favourable variance and if actual sales < budgeted sales the variance will be unfavorable.

(ii) Sales Price Variance:

(Actual selling price – Budgeted selling price) x Actual Quantity

If actual sales price < budgeted sales, the variance is favourable and vice versa.

(iii) Sales Volume Variance:

(Actual Quantity – Budgeted Quantity) x Budgeted selling price

If the actual quantity sold exceeds the budgeted sales quantity then the variance is favourable and if the actual quantity sold is less than budgeted sales quantity, the variance is taken as unfavorable.

(iv) Sales Mix Variance:

(Actual mix quantity sold – Actual quantity in standard proportion) x standard selling price. (Budgeted price per unit of actual mix – Budgeted price per unit of budgeted mix) x Total actual quantity.

(v) Sales Quantity Variance:

(Total actual quantity – Total budgeted quantity) x Budgeted price per unit of budgeted mix.

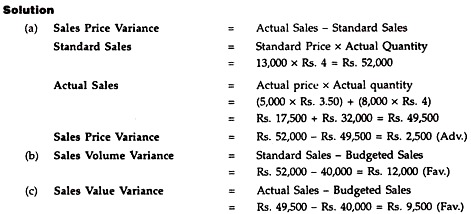

Problem 8:

The budgeted and actual sales of a concern manufacturing and marketing a single product are furnished below:

Budgeted sales 10,000 units at Rs.4 per unit.

Actual sales 5,000 units at Rs.3.50 per unit

8,000 units at Rs.4 per unit

Calculate:

(a) Sales Price Variance

(b) Sales Volume Variance

The revised terminology of cost accounting published in 1966 by the Institute of Cost and Management Accountants favours this method of calculating sales variances.

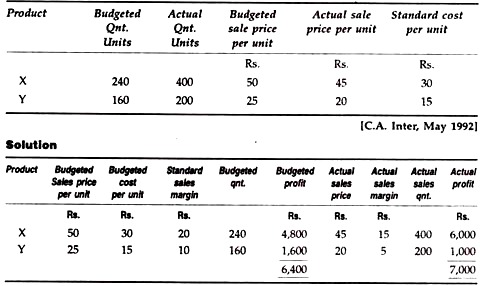

Problem 9:

Compute the following variances from the data given below:

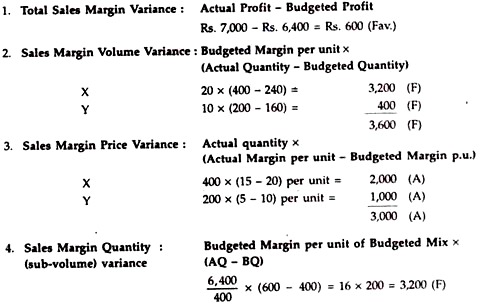

(i) Total sales margin variance,

(ii) Sales volume variance,

(iii) Sales margin price variance,

(iv) Sales margin quantity variance.