Read this essay to learn about Book-Keeping. After reading this essay you will learn about:- 1. Meaning of Book Keeping 2. Necessity of Book Keeping 3. Systems 4. The Journal and the Theory of Journalising 5. Explanation of Journalising Rules for Various Accounts 6. The Ledger 7. Trial Balance (T/B) 8. Trading Account 9. Profit and Loss Account 10. Balance Sheet 11. Cash Book.

Contents:

- Essay on the Meaning of Book Keeping

- Essay on the Necessity of Book Keeping

- Essay on the Systems of Booking Keeping

- Essay on the The Journal and the Theory of Journalising

- Essay on the Explanation of Journalising Rules for Various Accounts

- Essay on the The Ledger

- Essay on the Trial Balance (T/B)

- Essay on the Trading Account

- Essay on the Profit and Loss Account

- Essay on the Balance Sheet

- Essay on the Cash Book

Essay # 1. Meaning of Book Keeping:

It may be defined as science and art of recording all merchandise transactions of the business in the books of accounts.

The knowledge of book keeping and accounts is very essential for engineers. In future an Engineer would either own a commercial concern or would serve under government or a commercial organization.

ADVERTISEMENTS:

Book keeping is the technique of recording business transactions systematically. It may be considered an art of reducing each transaction to its simplest form.

“Transaction” is the exchange of money or money’s worth between various parties.

A business transaction involves:

i. Transfer of money or its equivalent from one party or person to another.

ADVERTISEMENTS:

ii. Two parties or persons for its performance.

It means either taking benefit or giving benefit. Benefit may be in the form of cash, goods or services.

Book keeping or Account keeping tells:

(a) The financial effect of each business transaction of the concern.

ADVERTISEMENTS:

(b) Combined impact of all transactions of the unit,

(c) Net result of trading of the enterprise.

(d) All sales, purchases and returns if any transacted in a financial year.

(e) Quantity and value of items/goods available with the concern.

ADVERTISEMENTS:

(f) Accounts of assets and liability of the firm.

(g) Accurate financial status of the organization or individual trader as the situation may be.

(h) Cash available with the firm.

Essay # 2. Necessity of Book Keeping:

The main objective of keeping the accounts in a methodical and scientific manner is to enable the management to assess the financial position of the enterprise. The financial effect of each transaction can also be known from it.

ADVERTISEMENTS:

All this can be of immense help in framing a progressive business policy owing to the following factors:

(i) Accounting provides an analysis and interpretation of account.

(ii) From that analysis and interpretation we can draw certain definite conclusions regarding business policy. This may help in putting the concern on more sound footing by taking suitable steps, required.

(iii) Accounts are the index of the present financial soundness of the enterprise as well as future trends.

Essay # 3. Systems of Book Keeping:

There are two systems of book keeping:

ADVERTISEMENTS:

(1) Single Entry System of Book Keeping

(2) Double Entry System of Book Keeping.

(1) Single Entry System of Book Keeping:

This is an old and obsolete system. As the name suggests, in this system only one part of the transaction was recorded but as a matter of fact each transaction effect two parties. Hence it was incomplete system and could not serve the purpose of modem business which needs complete information about all the transactions.

(2) Double Entry System of Book Keeping:

ADVERTISEMENTS:

Modem business requires complete information regarding all business transactions hence scientific system of accounting was required. Double entry system serves this purpose. Each transaction if this system implies two parties and hence affects both sides.

This system records both aspects of the transaction i.e. the receiving side or debit side and the giving side or the credit side. Thus each transaction is split up into two debit and credit sides and both these side are recorded in this system hence the name double entry system.

Example 1:

A firm purchases a plant for Rs. 200,000. In this case plant is received and be debited and cash is given and so credited.

Advantages of Double Entry System:

ADVERTISEMENTS:

(i) Both aspects of every transaction i.e., personal and impersonal are recorded in this system.

(ii) It provides day to day status regarding amounts owing to and by trader.

(iii) The details of any transaction are readily available when required.

(iv) Comparison of purchases and sales between corresponding periods of two successive years provides idea regarding the progress or deterioration in the business.

(v) Trading Account provides the degree of realization of anticipated profit of the firm.

(vi) A check could be imposed on the accuracy of books with this system.

(vii) The trader’s financial position can be ascertained by preparing Balance Sheet in such a manner so that all assets, liabilities and capital of the proprietor are classified and recorded separately.

(viii) Chances of fraud by changing the accounts become very difficult if double entry is adopted.

Essay # 4. The Journal and the Theory of Journalising:

This is an important book of accounts. This is sometimes called ‘ORIGINA RECORDS’. A transaction has two aspects (a) giving of a benefit and (b) taking or receiving of a benefit. In journal giving and taking takes place between accounts.

Therefore, in a journal two entries are made for each transaction. Thus for each transaction one entry being made in the receiving accounts called debit side and the other into the giving account called credit side. This technique of entering business transaction into journal is known as journalising.

From Journal the transactions or entries related to same person or enterprise are sorted out and classified separately, (i.e. for each person or enterprise a separate class is formed) and entered in a ledger. The ledger is divided into two halves, the left side is known as Debit side (Dr) and right side is called Credit (Cr) side. The pages are known as folios.

So regarding the working of a firm properly classified and condensed information is available in the ledger.

Example 2:

Suppose a firm Purchases an equipment or plant for Rs. 500,000. How it would be entered on 1 Jan., 1996?

Guidelines to Fill the Entries:

1. Column no. 1 is meant for date.

2. Column no. 2 is that of particulars and is meant for recording the names of two accounts being affected by that transaction. The amount to be debited is followed by the word Dr. (e.g. plant machinery A/c Dr.) and the amount to be credited is preceded by the word To (To cash A/c) as shown in above example.

3. Column no. 3 is meant to write folio number. It is the reference of the page on which account is transferred into ledger A/c.

4. Column no. 4 shows debit or Dr. side’s amount.

5. Column no. 5 shows credit or Cr. side’s amount.

6. After each entry a description about the nature of transaction may be given in order to avoid confusion. For simple entries the narration is not required. In above example description may be sum paid for purchase of plant.

7. After each transaction a thick line is drawn upto the folio column.

Classification of Accounts for Journalising:

Various accounts are classified in to personnel and impersonal account as mentioned below:

1. Personal Accounts:

The accounts concerning with persons.

2. Impersonal Accounts:

The accounts which do not deal with persons are called impersonal accounts.

These may be of two types:

(i) Real Accounts:

These include cash, goods, plant, machinery, furniture and building like assets.

(ii) Nominal Accounts:

These deal with expenses, gains or losses. Separate account is opened for each head of expenses or income such as salaries and wages, interest, consumables expenditure like on stationery and commission etc.

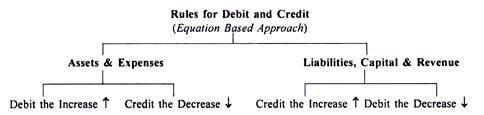

Rules for Debit and Credit:

(i) For Personal Accounts:

Debit the receiver and credit the giver.

(ii) For Real Accounts:

Debit what comes in and credit what goes out.

(iii) For Nominal Accounts:

Debit loss and expenses and credit gains or income.

Example 3:

Mr. X pays Rs. 50000 to the firm. X is giver so will be credited and firm is taker and shall be debited.

X pays Rs. 50000/- due to him

Example 4:

Bought furniture for Rs. 3000 for Y on cash.

Accounts affected are furniture accounts and cash account therefore, debit furniture A/c and credit cash A/c

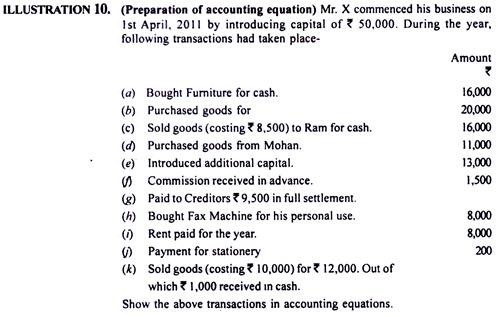

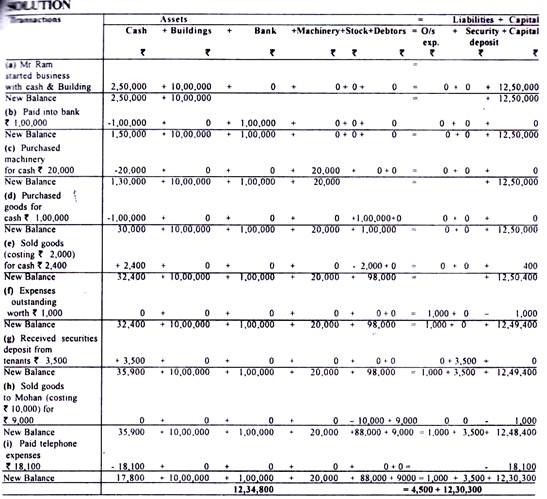

Essay # 5. Explanation of Journalising Rules for Various Accounts:

Example 5:

Treatment of capital brought in the business. Whenever a new business is started, the amount of capital is brought by the owner is not credited to his personal account but to capital accounts e.g. Krishna started his business with Rs. 5000 then the entry in his books will be like as shown below.

Suppose it is a partnership firm with three partners bring Rs. 3000/- each the entry would be such so as to distinguish each other’s capital e.g.

(Being the amount of capital in three partners this is called combined entry)

Sometimes cash is not brought in business but is started with goods say wheat of 5000/-.

The entry would be as follows:

Enter the following transaction in to the Journal book of Mr. X

Solution :

Example 7:

Good/Equipment brought as capital .The entry in the journal shall be as follows:

Example 8:

Suppose Rs. 5000 due Sunil have gone bad. Journal entry shall as follows:

Essay # 6. The Ledger:

It is a principal book of Account. It contains in a summarized form of all the transactions of a business and hence all accounts are shown separately in a classified manner. Thus a final picture about an account i.e. the total of the debit and credit side and the balance if any is available. The various entries are posted in the ledger book from the journal.

In ledger book, one account usually occupies one page but it varies with the requirements of the trade. The pages are known as folios and these are consecutively numbered and an index is provided at the beginning to make reference easily available.

Rules of Ledger Entries:

The commonly used rules of the ledger are as follows:

So the ledger A/c is divided into two halves left half is known as Debit or Dr. side and the right half is known as Credit or Cr side. Both the sides have four columns. Column 1 is meant for date, col. 2 for particulars, col. 3 for back reference of Journal i.e. J.F. and column 4 for Amount in rupees being debted or credited.

In the particular column of the Dr side the A/c which is being debted is preceded by the work. To e.g. To cash and on Cr. side the amount which is being credited is preceded by the word By e.g. By Krishna.

Posting of Entries form Journal to Ledger:

Example 9:

After making entries in the Journal book the next job is the posting of these entries into ledger A/c from the Journal book.

The following entry in the Journal is to be posted to ledger Account.

The posting of this entry in ledger shall be as follows:

This shows that the debit amount of an account is put on debit or Dr. side and vice versa so that you may have a final picture about an account.

At the end of a given period the accounts are closed and if the amount shows any debit or credit balance, it will be shown To or By accordingly as indicated in above accounts.

Example 10:

The following transactions took place in a sugar mill on 1st & 2nd October 1986.

1. 1.10.1986 Purchased sugarcane worth rupees two lakh from contractor X.

2. 1.10.1986 Purchased sugarcane worth rupees two lakh from contractor X.

3. 1.10.1986 Paid wages to workers Rs. 50000

4. 1.10.1986 Paid for purchase of chemical Rs. 1000.

5 . 2.10.1986 Made payment to contractor X Rs. 100000.

6 . 2.10.1986 Paid factory Rent Rs. 2000

7. 2.10.1986 Paid electricity bill of factory Rs. 10000.

The transactions given above may be explained as follows:

1. Purchase A/c receives and X gives so purchase is to be debited and X is to be credited.

2. Payment is received in cash. So Cash A/c receives and Sales A/c gives.

3. Wages are paid in cash. Wages account receives and cash account gives.

4. Payment made for chemicals or Expenses A/c receives and gives.

5. Contractor X receives payment and Cash A/c gives.

6. Rent A/c receives and Cash A/c gives.

7. Electricity A/c receives and Cash A/c gives.

The amount which is received is debited and which gives is credited in Journal.

The Journal entries of the above transactions are as ahead:

So in the journal books so many accounts have been given and taken. For each account, it is necessary to know as to how it has received and how much it has paid. This is achieved by posting each Journal entry in the ledger. For each account a page is allotted in the ledger. Debit entry in the journal is posted on the debit side and credit entry on the credit side. The Journal entries made above are posted in the ledger as follows.

Example 11:

The following particulars are given for the month of Jan. 1989 of Mr. A. Make the entries of Mr. A and post these in the respective ledger book.

Note on Balance carried over:

If while posting the accounts, the whole page on which the account is written is filled, the total is credited to the next page, on which the account is carried and if in the folio, brought down or b/d is written to show that it is carried over. Also on the previous page in the same column against the amount carried is written carried forward or c/f meaning brought forward.

Indexing in Ledger Book:

To be able to find out any account easily and quick by an index is prepared in the beginning of the Ledger Book.

Journal transactions of the above example are transferred into the ledger book as follows:

Ledger-Book (1)

Essay # 7. Trial Balance (T/B):

The statement called Trial Balance (T/B) is a list of both debit and credit totals and it is a balance of the accounts in the ledger including the cash and bank balances.

Under the double entry system, there is a credit balance or debit balance. In the Trial Balance, only these balances are entered. If the postings are correct, the debit and credit sides of T/B must be same. The main object of this is to prove the accuracy of the postings and to prepare background or material for profit and loss accounts and Balance Sheet.

1. Mis-posting:

If instead of debiting a particular account, another account is debited or posting is done under a wrong head, the T/B will agree.

2. Omission of Entries:

If an entry is altogether omitted (i.e. not shown on credit or debit both sides.) the T/B will agree i.e. it will indicate same total on both sides.

3. Compensating Error:

If a mistake or the same amount on either side is committed, then this error will not disturb the balancing of the two sides of the T/B.

These are the types of errors which are not likely to be detected. If however we make T/B in such a manner that besides balances the totals of Debit and Credit sides are also indicated then last two errors may not occur.

A Trial balance can reveal the following types of errors:

(i) An item posted on wrong side

(ii) An item posted twice in the ledger

(iii) Errors in addition to compensating error

(iv) An item omitted in posting

(v) Figures entered wrongly e.g. Rs. 6.50 instead of Rs. 650.

Corrective Measure for Trial Balance:

In case a T/B does not agree, the following procedure may be followed:

(i) The re-checking of totals of T/B and the difference between Debit and credit total ascertained.

(ii) The totals of the ledger A/c s be checked and balances written in the T/B compared with various accounts.

(iii) Check if all the items in the Journal and other books have been posted or not. This should be done by going through the folio columns of various A/c books.

(iv) Posting of all opening balances should be checked.

(v) If the error still exists repeat the posting and check.

Essay # 8. Trading Account:

In order to find out the result of trading for a given period of time, the various nominal accounts of a business pertaining to gains or losses which appear in the ledger A/c are shown in Trading and Profit & Loss (P/L Account) Account. Trading Account is prepared to ascertain the gross profit earned by trading.

Debit Side:

On the debit side of this account appear the balance of goods in the starting of trade/business i.e. purchases made (less the goods/items returned) and direct expenses too.

These direct expenses are those, which are incurred in the process of manufacturing or in the process of putting the goods in a saleable condition e.g. charges incurred such as freight, carriage, import duties, commission, brokerage, cost of repacking and wages etc.

Credit Side:

On the credit side of this account appear the sales less, sales returned and stock of goods in hand.

Ruling of this account is as follows:

(i) If salaries and wages is mentioned, it should go to Profit and Loss account.

(ii) One styled salaries and wages should go to P/L account.

(iii) If debit side is less than credit side the balance is gross profit.

(iv) If debit side is more than credit side the balance is loss.

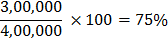

Trading A/c gives the figures of the gross profit of the firm for a given period. By having the figure of such profit of a number of years, we can ascertain the ratio of gross profit to turn over (i.e. total sales) during a given period and it will help us to see whether it is increasing or decreasing.

Closing Stocks:

This can be determined by actual counting of the stock available at the end of the period under consideration and then pricing it. It is usually valued at the cost price or market price whichever is lower.

Entry for closing stock is as follows:

Essay # 9. Profit And Loss Account:

In this account all losses and expenses are shown on the debit side and all the gains on the credit side so that the total profit or loss of the firm during a particular period can be ascertained. Following the old principle we debit all losses and expenses and credit the gains.

We show all the sales and distribution costs as well as establishment charges in this account e.g. salaries, wages, the carriage other office expenses, rent, advertisement costs, all directs or indirect manufacturing costs and fuel charges are shown in trading A/c.

Taking the above points into consideration, we may have a profit and loss account from the trial balance and trading A/c given above. Net profit is transferred to the capital A/c.

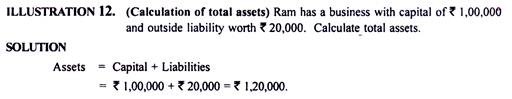

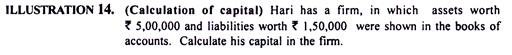

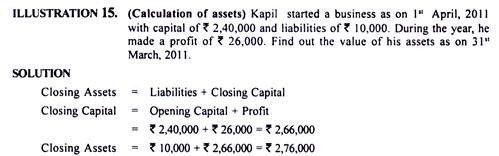

Essay # 10. Balance Sheet:

As a result of business transactions the assets and liabilities change with the passage of time and we prepare balance sheet at the end of the period (e.g. 31st March or 31st Dec.) On the right hand side we put all assets and properties and on left hand side all the liabilities.

Balance sheet is a statement concerned with the balances of all the real and personal accounts in the ledger. Thus it is the measure of the exact financial position of business at the end of a certain period. It is not an account but simply a statement of assets and habilities divided into two halves, the left one is called Liabilities and the other is Assets. This is according to English method.

In American method we put Assets on left side and the liabilities on the right. Hence there is no debit and credit side or the prefix to and By.

The debit balances of all the real and personal accounts are called Assets and credit balances as Liabilities. Various individual debitors and creditors are not shown separately but collectively under the head Debitor and Creditor. If everything is o.k. the two sides of the B/S must be balanced.

The order of Assets in the B/S may be according to their liquidity or permanence. Liabilities are arranged in the order in which these are to be paid.

Balance sheet:

Profit and Loss A/c are to be prepared by Law.

Form of Balance Sheet is as follows:

Information Provided by Balance Sheet:

(i) It gives the nature of Assets and Liabilities and hence soundness or otherwise of business concern.

(ii) Degree of liquidity is known.

(iii) It provides information regarding solvency of the firm.

Trial Balance & Balance Sheet:

The following points provide the comparison:

1. Trial balance contains simply the list of all the ledger balances and thus includes all items of gains and losses as well as assets and liabilities while a B/S includes only Assets and Liabilities.

2. Trial Balance is prepared before the preparation of Profit & Loss A/c and Balance Sheet.

3. Balance Sheet shows financial position of the firm while Trial Balance shows the balances of all the accounts of all the concern.

Essay # 11. Cash Book:

In accountancy cash book and bank transactions are important. In short cash book is a statement or account of the cash transactions of the firm. On the Debt side cash receipts are recorded whereas credit side contains cash payment. On the credit side the last item is by balance indicating the amount of cash in hand at the closing period. Thus it forms the opening balance for the next period.

Example 12:

Prepare a cash book of a firm for the month of Dec. 1990 from the following transactions:

As shown above cash book at the end of the month, the balance is struck which is Rs. 4585/-. This shall be shown as the starting cash balance in the next month in the receipt side.

Example 13:

The following particulars are given for a partnership firm for the accounting year ending Dec. 31, 1998.

Prepare (i) Trading account (ii) Profit and Loss A/c (iii) Balance Sheet.