Here is an essay on the ‘Profit and Loss Account of a Company’ for class 11 and 12. Find paragraphs, long and short essays on the ‘Profit and Loss Account of a Company’ especially written for school and college students.

Essay Contents:

- Essay on the Introduction to Profit and Loss Account

- Essay on the Various Types of Profit

- Essay on the Preparation of Profit and Loss Accounts from Trial Balance

- Essay on Managerial Remuneration

- Essay on the Determinations of Net Profits

- Essay on the Requirements as to Profit and Loss Account

Essay # 1. Introduction to Profit and Loss Account:

Section 210 of the Companies Act, 1956 requires the Board of Directors of every company to lay at every annual general meeting held under section 166 – (i) a balance sheet as at the end of the accounting period, and (ii) a profit and loss account for that period. The accounting period is legally termed as “financial year”. The financial year may be less or more than the calendar year, but its maximum duration is fifteen months. On obtaining a special permission from the Registrar of Companies, it is possible to extend the duration of a financial year up to eighteen months.

ADVERTISEMENTS:

In the Part II of the Schedule VI certain disclosure requirements have been specified. No form of profit and loss account has been prescribed in the Companies Act. Accordingly, a company can design its profit and loss account suitably provided it satisfies the disclosure requirements specified in Part II of the Schedule VI.

Central Government may exempt any class of company from compliance with any requirements of Schedule VI in the public interest. Also the Central Government may modify the requirements of Schedule VI on an application made by the Board of Directors or with the consent of the Board of Directors.

Vertically presented profit and loss account:

Profit and loss account is prepared to find out the performance of the company in financial terms. It is required to be made out clearly to disclose the working result of the company covered by the account. It is to disclose every material feature, including credits or receipts and debits or expenses in respect of non-recurring and exceptional transactions. In other words, it is necessary to disclose separately non-recurring and exceptional items.

ADVERTISEMENTS:

The Companies Act does not require preparation of any manufacturing account or trading account. Accordingly, it is sufficient to include all expenses under the heading “Operating Expenses”. Also the Companies Act does not specify any format for the preparation of profit and loss account. However, clause 3 of Part II of the Schedule VI requires that various items of income and expenditure are to be arranged under the most convenient heads. Now-a-days almost all the listed companies prepare profit and loss account in vertical format.

Essay # 2. Various Types of Profit:

Profit and loss account reflects financial performance of a company.

i. Profit before Interest and Tax (PBIT):

ADVERTISEMENTS:

This is measure of gross performance of the company with reference to its total capital employed. As the term suggests, interest and tax are not deducted while computing PBIT. Interest is reward of borrowed capital and tax is a compulsory deduction imposed by law. Generally, PBIT is used to measure managerial performance.

ii. Profit before Tax (PBT):

This is a measure of net profit before charging tax. Since tax is a compulsory and non-discretionary charge on the company, net profit is first presented before charging tax. By this the users can understand profit earning ability of the company and the tax impact separately.

iii. Profit after Tax (PA T):

ADVERTISEMENTS:

This is a measure of net profit. This is used to understand the profit earned after tax charge.

iv. Distributable Profit:

This is given by PAT plus balance of Profit and Loss Account standing from previous years. Generally, the whole amount of profit is not used during the year. A small amount is left which can be used in the subsequent year for maintaining uniform rate of dividend.

ADVERTISEMENTS:

v. Profit Available to the Equity Shareholders:

This is distributable profit minus dividend paid to preference shareholders.

vi. Operating Profit:

Profit and Loss Account includes elements of non- operating items. For example, income from investments is non-operating income which arises out of investment outside the business. Related expense is non-operating expense. Similarly, profit or loss on sale of fixed assets or investments is also categorized non-operating income/expense.

ADVERTISEMENTS:

vii. Appropriations:

After computation of the profit available for distribution or disposable profit, appropriations are shown at the bottom of the vertical profit and loss account. Appropriations include – (i) transfer to general reserve (ii) transfer to debenture redemption reserve and (iii) proposed dividends.

Para 3 (viii) of Part II of Schedule VI requires disclosure of proposed transfer to reserves and withdrawals from the reserve, if any. The Companies (Transfer of Profits to Reserves) Rules, 1975 specifies percentage of profit to be transferred to reserve in case dividend is proposed. Percentage of profit to be transferred to reserve is applied to “current profit”. The current profit is arrived at after providing for depreciation and arrears depreciation. Current profit implies profit after tax.

ADVERTISEMENTS:

Percentage of profit to be transferred to reserve is as follows:

A company can voluntarily transfer higher percentage of current profits to reserve.

However, before such a higher transfer it is necessary to ensure:

i. Maintenance of dividends to shareholders at a rate equal to the three-yearly average rate of dividends declared by the company;

ii. If there is issue of bonus shares, maintenance of three-yearly average amount of dividend declared by the company.

ADVERTISEMENTS:

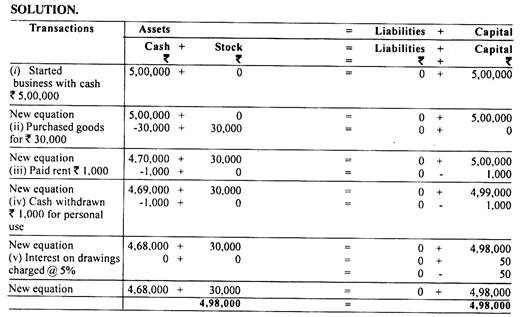

Let us understand various concepts of profit taking an Illustration.

Illustration 1:

A Ltd. provides the following information for the year ended on 31-12-2002. You are required to prepare Profit and Loss Account in vertical form showing PBIT, PBT, PAT, Distributable Profit and Profit Available to the Equity Shareholders. How much balance of Profit and Loss Account will remain after the desired appropriations?

Solution:

Note:

1. Increases in stock: Closing Stock – Opening stock = Rs.120 Lacs – Rs 100 Lacs

2. Expenses:

3. Interest = 10% of Rs.2000 lacs. = Rs.200 lacs.

4. Transfer to Reserve = 60% of Rs.675 lacs = Rs.405 lacs.

5. Dividend to Preference shareholders = 10% of Rs.200 lacs = Rs.20 lacs Distribution tax = 10% of Rs.2 lacs = Rs.2 lacs

6. Dividend to Equity Shareholders = 20% of Rs.1000 lacs = Rs 200 lacs Distribution tax = 10% of Rs.200 lacs = Rs.20 lacs

Illustration 2:

Using the data given in Illustration 1, find out operating profit of the company. Assume that 95% of the total funds available are used in the business. What is the return on operating assets?

Operating profit is used to understand the profitability of the operating assets used in the business. It may be mentioned that a company often invest outside the business which are non-operating assets. Also profit/ loss arising out of sale of fixed assets and investments is only incidental to the business activities. It is not regarded as an operating item.

Essay # 3. Preparation of Profit and Loss Accounts from Trial Balance:

Before reading this Para, you are advised to go through Appendix I: Accounting Process. All items of revenue/income have credit balance and all items of expense/loss have debit balance. Assets are having debit balance. Liabilities and shareholders’ funds are having credit balance.

In fact, for the preparation of Profit and Loss Account, we need to identify items of re venue/income and expense/loss.

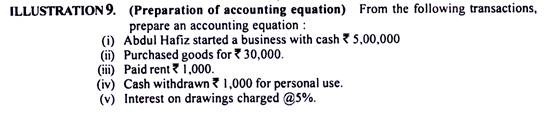

Illustration 3:

Given below a Trial Balance of XYZ Ltd.

Other Information: Closing Stock Rs.180 lacs. Assume 35% corporate tax. Company proposes equity dividend @ 20%. Distribution tax 10%. Transfer to Reserve 20% of PAT.

Identify revenue/income, expense/loss, assets, liabilities and shareholders’ funds.

Prepare vertical Profit and Loss Account for the year ended 31st March, 2002.

Solution:

(1) Identification of accounting elements:

(2) Profit and Loss Account for the year ended on 31 March, 2002

Analysis of Interest and Tax Impact:

Now let us analyze the interest impact and tax impact from the Profit and Loss Account.

Convert all relevant data in terms of % of revenue. PBIT is 22.64% of revenue whereas PBT is 18.09% of revenue. This reflects 4.55% interest impact on profit. Again PAT % is only 11.76% of revenue. This is because of 6.33% tax impact.

Interest impact – 4.55%

Tax impact – 6.33%

Analysis of Profit and Loss Account of Asian Paints (India) Ltd:

Trend analysis is an important technique for understanding financial performance of a company. In this para we shall discuss long term trend.

Given below extracts of profit and loss account information of Asian Paints (India) Ltd. How to analyze the same to understand the performance of the company over a six year period.

i. Understanding compound growth rate: This is given by

The company could achieve better profit growth than sales growth because of lower expense growth. Although average expense growth is higher, growth in raw material cost, power fuel, other manufacturing expenses were below 10%. There was a substantial rise in employee cost (17. 69%) that pulled up the average cost. Otherwise the company could have registered still better profit growth. Negative growth in the interest cost has improved its PBT growth but a 17.11% growth in the corporate tax expense arrested the PAT growth at 15.8%.

Essay # 4. Managerial Remuneration:

2.7 Para 4 of Part II of Schedule VI requires disclosure of payments provide for or made to:

a) The directors including managing directors and managers of the company;

b) The directors including managing directors and managers of the subsidiaries of the company.

The following payments to directors including managing directors or managers require disclosure:—

i. Managerial remuneration paid or payable under section 198;

ii. Any other perquisites or benefits in cash or kind stating approximate money value where practicable;

iii. Pensions, gratuities, payment from provident funds in excess of own contribution and interest thereupon;

iv. Compensation for loss of office;

v. Consideration in connection with retirement from office.

Section 198 prescribes the maximum percentage of profit that can be paid as managerial remuneration. For this purpose profit is to be calculated as specified in section 349. It is required to include a statement showing computation of profit in accordance with section 349 and calculation of amount payable to directors including managing directors and managers.

Computation of managerial remuneration is guided by the provisions of sections 198, 309, 310, 311, 352 and 387 of the Companies Act and the Schedule XIII to the Companies Act. The directors, whole time and managing directors and managers are considered as managerial personnel for this purpose. Overall ceiling for managerial remuneration is based on the net profit which is to be computed as per sections 349 and 350 of the Companies Act.

Meaning of managerial remuneration – In addition to salary and commission, the term “remuneration” includes:

a) Expenditure in relation to rent free accommodation or any benefit or amenity free of charge in relation to accommodation;

b) Expenditure in relation to any other benefit or amenity provided by the company free of cost or at concessional rate;

c) Any expenditure incurred by the company in respect of obligation to be met by the directors and managers;

d) Any expenditure incurred by the company to effect life insurance or for annuity, pension or gratuity for the directors and managers or their spouse and children.

Overall Limit:

Section 198 of the Companies Act requires that total managerial remuneration payable by a public company or a private company which is subsidiary of a public company to its directors and its manager in respect of any financial year shall not exceed eleven per cent of the profits of the company for that financial year. This is the overall restriction on the maximum amount of the managerial remuneration. Net profit for this purpose shall be computed in the manner laid down in sections 349, 350 and 351. Remuneration of the directors shall not be deducted from the gross profit.

The aforesaid eleven per cent maximum limit does not include fees payable to directors under section 309.

It may be mentioned that section 309 states that the remuneration payable to the directors of a company including managing or whole time directors does not include:

i. Any remuneration for services rendered by any such director which are of professional nature, and in the opinion of the Central Government the director possesses requisite qualifications for the practice of the profession;

ii. Remuneration by way of fees for each meeting of the Board or a committee thereof.

Part II of Schedule XIII to the Companies Act states that subject to the provisions of sections 198 and 309, a company having profits in a financial year may pay any remuneration by way of salary, dearness allowance, perquisites, commissions and other allowances, which shall not exceed 5% of its net profit for one such managerial person and 10% for all of them together. This means for all the directors maximum ceiling of managerial remuneration is 10% of the net profit and for directors as well as managers together the maximum ceiling is 11%.

Ceiling for Managerial remuneration stated in Schedule XIII in case profit of the company is not adequate:

(A) A company not having any profit or adequate profit may pay remuneration to its managerial personnel by way of salary, dearness allowance, perquisites and any other allowances not exceeding ceiling limit of Rs.24,00,000 p.a. or Rs.2,00,000 per month calculated in a scale based on effective capital:

The ceiling stated above is applicable if – (i) payment of remuneration is approved by a resolution passed by the Remuneration Committee, and (ii) the company has not made any default in repayment of its debts.

(B) A company not having any profit or adequate profit may pay remuneration to its managerial personnel by way of salary, dearness allowance, perquisites and any other allowances not exceeding ceiling limit of Rs.48,00,000 p.a. or Rs.4,00,000 per month calculated in a scale based on effective capital:

The ceiling stated above is applicable if – (i) payment of remuneration is approved by a resolution passed by the Remuneration Committee, (ii) the company has not made any default in repayment of its debts, (iii) a special resolution has been passed at the general meeting of the company for the payment of such remuneration for a period not exceeding a period of three years, and (iv) a detailed statement about the business of the company submitted to the shareholders’ along with the notice of the meeting.

A company may pay managerial remuneration exceeding the ceiling stated in (B) when its effective capital is negative after obtaining prior approval of the Central Government.

In addition, the managerial personnel are entitled to perquisites in the form of contribution to provident funds, gratuity and leave encashment, children education allowance (maximum Rs.5,000), holiday passage for children studying outside India/family members staying outside India (once in a year by economy class or twice in a year by first class) and leave travel concession.

Effective capital means share capital (excluding share application money or advance against shares), share premium account balance, reserves and surplus (excluding revaluation reserve), long term loans and deposits repayable after one year (excluding working capital loans, overdrafts, interest during loans which are not funded, bank guarantee, etc. and other short term arrangement) as reduced by investments (except in case of investment company), accumulated losses and preliminary expenses.

Monthly or quarterly payment of remuneration:

Section 198(3) clarifies that within the overall limit of maximum remuneration, a company may pay monthly remuneration to managing or whole time directors in accordance with section 309 or to the managers as per section 387.

Section 309(3) explains that whole time or managing director can be paid remuneration by monthly payment or by way of specified percentage of net profits or partly by one and partly by the other. However, payment to one managing or whole time director shall not exceed 5% of the net profit and payment to more than one managing or whole time directors shall exceed more than 10% of net profit.

Other directors (i.e. who are not managing or whole time directors) may be paid remuneration – (i) either by way of monthly, quarterly or annual payment with the approval of Central Government, or (ii) by way of commission on authorisation by the company through a special resolution.

In fact, in the Press Note 1/94 dated 2-2-1994 issued by the Department of Company Affairs it has been clarified that approval of the Central Government is not required by the companies in regard to managerial remuneration which is not in excess of the prescribed percentage. So it appears that for payment of remuneration on monthly, quarterly or annual basis within the prescribed percentage no specific approval of the Central Government is required.

Section 387 of the Companies Act states that a company can pay its managerial remuneration either by way of monthly payment or by way of specified percentage of the net profits computed in the manner laid down in sections 349,350 and 351 of the Companies Act or partly by one and partly by the other.

Essay # 5. Determinations of Net Profits:

i. While computing net profit, bounties and subsidies received from the Government or any public authority should added to revenue;

ii. While computing net profit the credit should be given to the following items :

a) Premium on issue of shares or debentures;

b) Profits on sale of forfeited shares;

c) Profit on sale of immovable property or fixed assets (how-ever, if the fixed assets are sold above the WDV calculated as per section 350, credit shall be given for the difference between the original cost and WDV);

iii. While computing net profit the following items shall be deducted:

a) All the usual working charges;

b) Directors’ remuneration;

c) Bonus or commission paid or payable to various categories of staff;

d) Tax on abnormal profits, if any notified by the Central Government;

e) Any special tax on business profit;

f) Interest on debentures;

g) Interest on mortgages, loans and advances;

h) Expenses on repairs which are not of the capital nature;

i) Any contributions for charitable purposes as mentioned in section 293(l)(e);

j) Depreciation to the extent specified in section 350;

k) Any compensation or damages as a legal liability;

l) Insurance;

m) Bad debts written off

iv. While computing net profit the following items shall not be deducted:

a) Income-tax and super tax;

b) Compensation and damages paid voluntarily;

c) Loss of capital nature

Section 350 requires depreciation charge at the rates specified in the Schedule XIV of the Companies Act,

Essay # 6. Requirements as to Profit and Loss Account:

1. The provisions of this Part shall apply to the income and expenditure account referred to in sub-section (2) of section 210 of the Act, in like manner as they apply to a profit and loss account, but subject to the modification of, references as specified in that sub-section.

2. The profit and loss account:

(a) Shall be so made out as clearly to disclose the result of the working of the company during the period covered by the account; and

(b) Shall disclose every material feature, including credits or receipts and debits or expenses in respect of non-recurring transactions or transactions of an exceptional nature.

3. The profit and loss account shall set out the various items relating to the income and expenditure of the company arranged under the most convenient heads; and in particular, shall disclose the following information in respect of the period covered by the account:

(i) (a) The turnover, that is, the aggregate amount for which sales are effected by the company, giving the amount of sales in respect of each class of goods dealt with by the company, and indicating the quantities of such sales for each class separately.

(b) Commission paid to sole selling agents within the meaning of section 294 of the Act.

(c) Commission paid to other selling agents.

(d) Brokerage and discount on sales, other than the usual trade discount.

(ii) (a) In the case of manufacturing companies,

(1) The value of the raw materials consumed, giving item-wise break-up and indicating the quantities thereof. In this break-up, as far as possible, all important basic raw materials shall be shown as separate items. The intermediates or components procured from other manufacturers may, if their list is too large to be included in the break-up, be grouped under suitable headings without mentioning the quantities, provided all those items which in value individually account for 10% or more of the total value of the raw material consumed shall be shown as separate and distinct items with quantities thereof in the breakup.

(2) The opening and closing stocks of goods produced, giving break-up in respect of each class of goods and indicating the quantities thereof.

(b) In the case of trading companies, the purchases made and the opening and closing stocks, giving break-up in respect of each class of goods traded in by the company and indicating the quantities thereof.

(c) In the case of companies rendering or supplying services, the gross income derived from services rendered or supplied.

(d) In the case of a company, which falls under more than one of the categories mentioned in (a), (b) and (c) above, it shall be sufficient compliance with the requirements herein if the total amounts are shown in respect of the opening and closing stocks, purchases, sales and consumption of raw material with value and quantitative break-up and the gross income from services rendered is shown.

(e) In the case of other companies, the gross income derived under different heads.

Note 1: The quantities of raw materials, purchases, stocks and the turnover, shall be expressed in quantitative denominations in which these are normally purchased or sold in the market.

Note 2: For the purpose of items (ii)(a), (ii)(b) and (ii)(d), the items for which the company is holding separate industrial licences, shall be treated as separate classes of goods, but where a company has more than one industrial licence for production of the same item at different places or for expansion of the licensed capacity, the item covered by all such licences shall be treated as one class. In the case of trading companies, the imported items shall be classified in accordance with the classification adopted by the Chief Controller of Imports and Exports in granting the import licences.

Note 3: In giving the break-up of purchases, stocks and turnover, items like spare parts and accessories, the list of which is too large to be included in the break-up, may be grouped under suitable headings without quantities, provided all those items, which in value individually account for 10% or more of the total value of the purchases, stocks, or turnover, as the case may be, are shown as separate and distinct items with quantities thereof in the break-up.

(iii) In the case of all concerns having works-in-progress, the amounts for which such works have been completed at the commencement and at the end of the accounting period.

(iv) The amount provided for depreciation, renewals or diminution in value of fixed assets.

If such provision is not made by means of a depreciation charge, the method adopted for making such provision.

If no provision is made for depreciation, the fact that no provision has been made shall be stated and the quantum of arrears of depreciation computed in accordance with section 205(2) of the Act shall be disclosed by way of a note.

(v) The amount of interest on the company’s debentures and other fixed loans, that is to say, loans for fixed periods, stating separately the amount of interest, if any, paid or payable to the managing director and the manager, if any.

(vi) The amount of charge for Indian income-tax and other Indian taxation on profits, including, where practicable, with Indian income- tax any taxation imposed elsewhere to the extent of the relief, if any, from Indian income-tax and distinguishing, where practicable, between income-tax and other taxation.

(vii) The amounts reserved for:

(a) Repayment of share capital; and

(b) Repayment of loans.

(viii) (a) The aggregate, if material, of any amounts set aside or proposed to be set aside, to reserves, but not including provisions made to meet any specific liability, contingency or commitment known to exist at the date as at which the balance sheet is made up.

(b) The aggregate, if material, of any amounts withdrawn from such reserves.

(ix) (a) The aggregate, if material, of the amounts set aside to provisions made for meeting specific liabilities, contingencies or commitments.

(b) The aggregate, if material, of the amounts withdrawn from such provisions, as no longer required.

(x) Expenditure incurred on each of the following items, separately for each item:—

(a) Consumption of stores and spare parts.

(b) Power and fuel.

(c) Rent.

(d) Repairs to buildings.

(e) Repairs to machinery.

(f) (1) Salaries, wages and bonus.

(2) Contribution to provident and other funds.

(3) Workmen and staff welfare expenses to the extent not adjusted from any previous provision or reserve.

Note 1: Information in respect of this item should also be given in the balance sheet under the relevant provision or reserve account.

(g) Insurance.

(h) Rates and taxes, excluding taxes on income,

(z) Miscellaneous expenses:

Provided that any item under which the expenses exceed 1 per cent of the total revenue of the company or Rs.5,000, whichever is higher, shall be shown as a separate and distinct item against an appropriate account head in the Profit and Loss Account and shall not be combined with any other item to be shown under ‘Miscellaneous expenses’.

(xi) (a) The amount of income from investments, distinguishing between trade investments and other investments. (b) Other income by way of interest, specifying the nature of the income.

(c) The amount of income-tax deducted if the gross income is stated under sub-paragraphs (a) and (b) above.

(xii) (a) Profits or losses on investments showing distinctly the extent of the profits or losses earned or incurred on account of membership of a partnership firm to the extent not adjusted from any previous provision or reserve.

Note / Information in respect of this item should also be given in the balance sheet under the relevant provision or reserve account.

(b) Profits or losses in respect of transactions of a kind, not usually undertaken by the company or undertaken in circumstances of an exceptional or non-recurring nature, if material in amount.

(c) Miscellaneous income.

(xiii) (a) Dividends from subsidiary companies.

(b) Provisions for losses of subsidiary companies.

(xiv) The aggregate amount of the dividends paid, and proposed, and stating whether such amounts are subject to deduction of income-tax or not.

(xv) Amount, if material, by which any items shown in the profit and loss account are affected by any change in the basis of accounting.

4. The profit and loss account shall also contain or give by way of a note detailed information, showing separately the following payments provided or made during the financial year to the directors (including managing directors) manager, if any, by the company, the subsidiaries of the company and any other person:

(i) Managerial remuneration under section 198 of the Act paid or payable during the financial year to the directors (including managing directors), or manager, if any;

(ii) Expenses reimbursed to the managing agent under section 354;

(iii) Commission or other remuneration payable separately to a managing agent or his associate under sections 356, 357 and 358;

(iv) Other allowances and commission including guarantee commission (details to be given);

(v) Any other perquisites or benefits in cash or in kind (stating approximate money value where practicable);

(vi) Pensions, etc.,:

(a) Pensions,

(b) Gratuities,

(c) Payments from provident funds, in excess of own subscriptions and interest thereon,

(d) Compensation for loss of office,

(e) Consideration in connection with retirement from office.

4A. The profit and loss account shall contain or give by way of a note a statement showing the computation of net profits in accordance with section 349 of the Act with relevant details of the calculation of the commissions payable by way of percentage of such profits to the directors (including managing directors), or manager (if any).

4B. The profit and loss account shall further contain or give by way of a note detailed information in regard to amounts paid to the auditor, whether as fees, expenses or otherwise for services rendered:

(a) As auditor;

(b) As adviser, or in any other capacity, in respect of—

(i) Taxation matters;

(ii) Company law matters; (lit) management services; and

(c) In any other manner.

4C. In the case of manufacturing companies, the profit and loss account shall also contain, by way of a note in respect of each class of goods manufactured, detailed quantitative information in regard to the following, namely :—

(a) The licensed capacity (where licence is in force);

(b) The installed capacity; and

(c) The actual production.

Note 1: The licensed capacity and installed capacity of the company as on the last date of the year to which the profit and loss account relates, shall be mentioned against items (a) and (b) above, respectively.

Note 2: Against item (c), the actual production in respect of the finished products meant for sale shall be mentioned. In cases where semi-processed products are also sold by the company, separate details thereof shall be given.

Note 3: For the purposes of this paragraph, the items for which the company is holding separate industrial licences shall be treated as separate classes of goods but where a company has more than one industrial licence for production of the same item at different places or for expansion of the licensed capacity, the item covered by all such licences shall be treated as one class.

4D. The profit and loss account shall also contain by way of a note the following information, namely:

(a) Value of imports calculated on C.I.F. basis by the company during the financial year in respect of:

(i) Raw materials;

(ii) Components and spare parts;

(iii) Capital goods;

(b) Expenditure in foreign currency during the financial year on account of royalty, know-how, professional, consultation fees, interest, and other matters;

(c) Value of all imported raw materials, spare parts and components consumed during the financial year and the value of all indigenous raw materials, spare parts and components similarly consumed and the percentage of each to the total consumption;

(d) The amount remitted during the year in foreign currencies on account of dividends, with a specific mention of the number of non-resident shareholders, the number of shares held by them on which the dividends were due and the year to which the dividends related;

(e) Earnings in foreign exchange classified under the following heads, namely:

(i) Export of goods calculated on F.O.B. basis;

(ii) Royalty, know-how, professional and consultation fees;

(iii) Interest and dividend;

(iv) Other income, indicating the nature thereof.

5. The Central Government may direct that a company shall not be obliged to show the amount set aside to provisions other than those relating to depreciation, renewal or diminution in value of assets, if the Central Government is satisfied that the information should not be disclosed in the public interest and would prejudice the company, but subject to the condition that in any heading stating an amount arrived at after taking into account the amount set aside as such, the provision shall be so framed or marked as to indicate that fact.

6. (1) Except in the case of the first profit and loss account laid before the company after the commencement of the Act, the corresponding amounts for the immediately preceding financial year for all items shown in the profit and loss account shall also be given in the profit and loss account.

(2) The requirement in sub-clause (1) shall, in the case of companies preparing quarterly or half-yearly accounts, relate to the profit and loss account for the period which entered on the corresponding date of the previous year. Note: Reference to managing agents, secretaries & treasurers should be omitted.

Interpretation:

7. (1)For the purposes of Parts I and II of this Schedule, unless the context otherwise requires,—

(a) The expression “provision” shall, subject to sub-clause (2) of this clause, mean any amount written off or retained by way of providing for depreciation renewals or diminution in value of assets, or retained by way of providing for any known liability of which the amount cannot be determined with substantial accuracy;

(b) The expression “reserve” shall not, subject as aforesaid, include any amount written off or retained by way of providing for depreciation, renewals or diminution in value of assets or retained by way of providing for any known liability;

(c) The expression “capital reserve” shall not include any amount regarded as free for distribution through the profit and loss account; and the expression “revenue reserve” shall mean any reserve other than a capital reserve; and in this sub-clause the expression “liability” shall include all liabilities in respect of expenditure contracted for and all disputed or contingent liabilities.

(2) Where:

(a) Any amount written off or retained by way of providing for depreciation, renewals or diminution in value of assets, not being an amount written off in relation to fixed assets before the commencement of this Act; or

(b) Any amount retained by way of providing for any known liability; is in excess of the amount which in the opinion of the directors is reasonably necessary for the purpose, the excess shall be treated for the purposes of this Schedule as a reserve and not as a provision.

8. For the purposes aforesaid, the expression “quoted investment” means an investment as respects which there has been granted a quotation or permission to deal on a recognised stock exchange, and the expression “unquoted investment” shall be construed accordingly.