Here is a compilation of top seven accounting problems on company final accounts with its relevant solutions.

Problem 1:

The Alfa manufacturing Company Limited was registered with a nominal capital of Rs 6, 00,000 in Equity Shares of Rs 10 each.

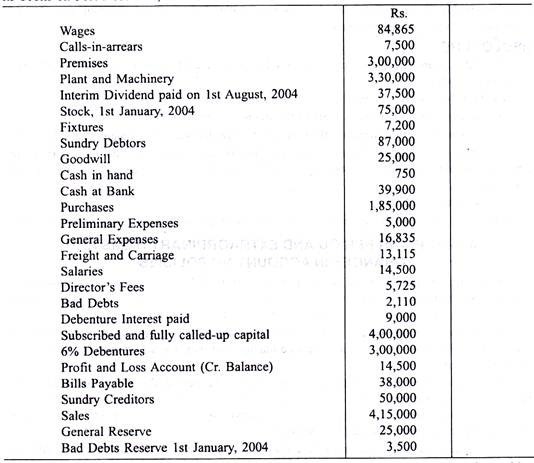

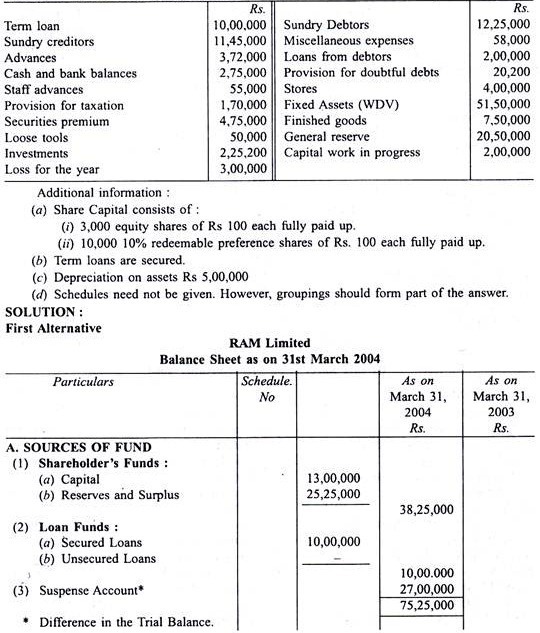

The following is the list of balances extracted from its books on 31st December, 2004:

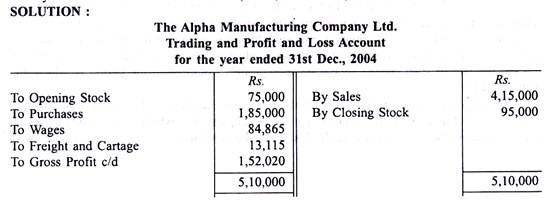

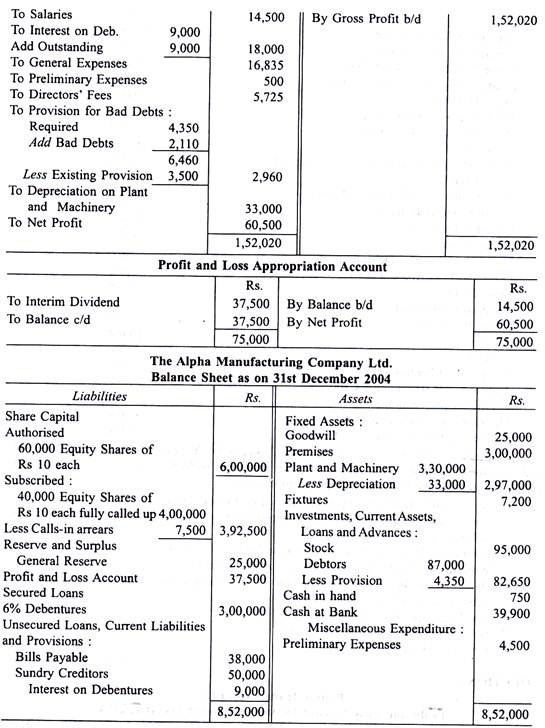

Prepare Trading and Profit and Loss Account and Balance Sheet in proper form after making the following adjustments:

Depreciate Plant and Machinery by 10%. Write off Rs 500 from Preliminary Expenses. Provide half year’s Debenture interest due. Leave Bad and Doubtful Debts Reserve at 5% on Sundry Debtors. Stock on 31st December, 2004, was Rs. 95,000.

Problem 2:

ADVERTISEMENTS:

The authorised capital of Inter-State Distributors Ltd. is Rs 7, 50,000 consisting of 3,000 6% cumulative preference shares of Rs 100 each.

The following is the trial balance drawn up on 31st December 2004:

(a) The value of stock on 31st December 2004 was Rs 2, 15,000.

ADVERTISEMENTS:

(b) Depreciation on freehold properties is to be provided at 2 ½ A% and on furniture at 6%.

(c) The directors propose to pay the second half year’s dividend on preference shares and a 10% dividend on equity shares.

(d) Shares have been forfeited on non-payment of Rs. 35 per share. You are required to prepare final accounts of the company.

ADVERTISEMENTS:

Solution:

ADVERTISEMENTS:

Problem 3:

The authorised capital of X Limited is Rs. 5, 00,000 consisting of 2,000 6% preference shares of Rs. 100 each and 30,000 equity shares of Rs. 10 each.

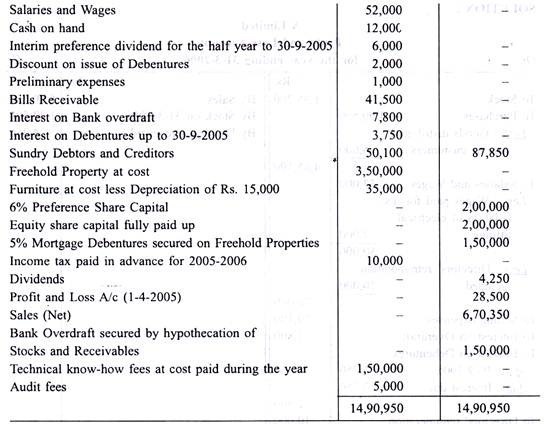

The following was the Trial Balance of X Limited as on 31-3-2006:

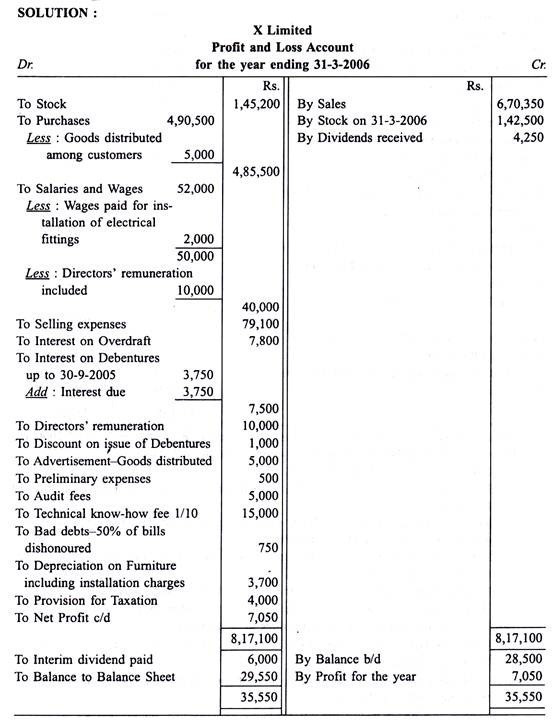

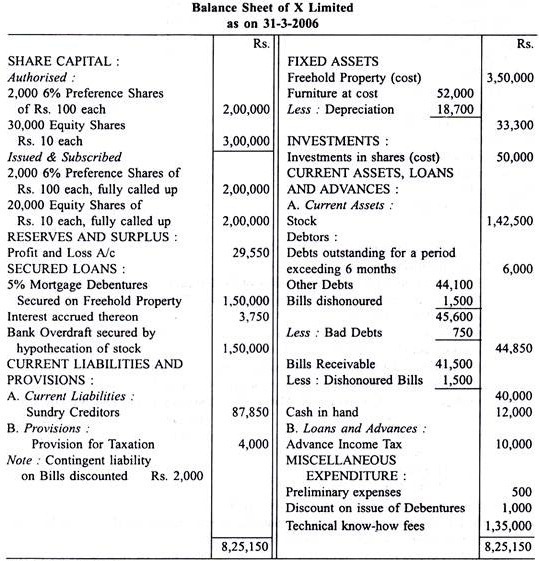

You are required to prepare the Profit and Loss Account for the year ended 31 -3-2006 and the Balance Sheet as on that date after taking into account the following:

(a) Closing stock was valued at Rs. 1, 42,500.

(b) Purchases include Rs. 5,000 worth of goods and articles distributed among valued customers.

(c) Salaries and Wages include Rs. 2,000 wages incurred for installation of electrical fittings which were recovered under ‘Furniture’.

ADVERTISEMENTS:

(d) Bills Receivable include Rs. 1,500 being dishonoured bills, 50% of which had been considered irrecoverable.

(e) Bills Receivable of Rs. 2,000 maturing after 31-3-2006 were discounted.

(f) Depreciation on furniture to be charged at 10% on written down value.

(g) Rs. 1,000 discount on issue of debentures to be written off.

(h) Interest on Debentures for the half year ending on 31-3-2006 was dye on that date.

(i) Provide for Taxation Rs. 4,000.

ADVERTISEMENTS:

(j) Technical know-how fees is to be written off over a period of 10 years. Rs. 500 of preliminary expenses to be written off.

(k) Salaries and Wages include Rs. 10,000 being the Directors’ remuneration.

(l) Sundry Debtors include Rs. 6,000 Debts due for more than six months.

Keeping in mind the requirements of Schedule VI Part I and Part II of the Companies Act, 1956, draw up the Profit and Loss Account and Balance Sheet of X Limited as close thereto as possible. Figures for the previous year can be ignored.

Problem 4:

Sunshine Limited was incorporated on 1st April 2004 to take over from 1st January 2004 the existing business of the Moon-light and Company, a partnership firm. Under the takeover agreement all profits made from 1st January are to belong to the Company. The purchase consideration was Rs 10, 00,000. The vendors were allotted 5,000 shares of Rs 100 each at a premium of Rs 10 per share in part payment of the purchase price and balance was paid on 1st July 2004 together with an interest at 10% per year.

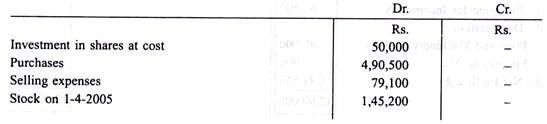

The following balances appear in the Company’s stock as on 31st December 2004:

The stock-in-trade as on 31st December 2004, at lower cost and market value, amounted to Rs 5, 06,000. Bad debts amounting to Rs 1,500, out of which Rs 750 related to the book debts taken over by the company, have to be written off, and a provision of Rs 6,000 has to be made for doubtful debts as on 31st December 2004.

Depreciation has to be written off: Buildings at 7.5%, Furniture and Fixtures at 10%, Transport vehicles at 15%.

Vehicles include one Tempo (second-hand) purchased on 1st July 2004 at Rs 15,000. The business is seasonal to some extent, the sales in the second half of the year being twice the sales in the first half, but sales during the two seasons are spread evenly. Preliminary expenses are to be wholly written off.

Prepare the Profit and Loss Account of the Company for the year ended 31 st December 2004 and the Balance Sheet as at that date in accordance with the requirements of the Companies Act, 1956.

Problem 5:

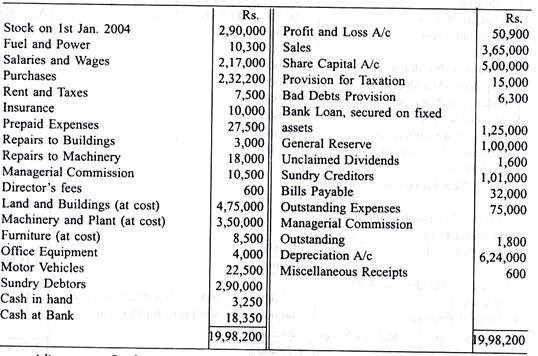

Prepare a Balance Sheet in Vertical form as on 31st March 2004 from the following information of RAM Ltd. required under Part 1B of Schedule VI of the Companies Act, 1956.

Problem 6:

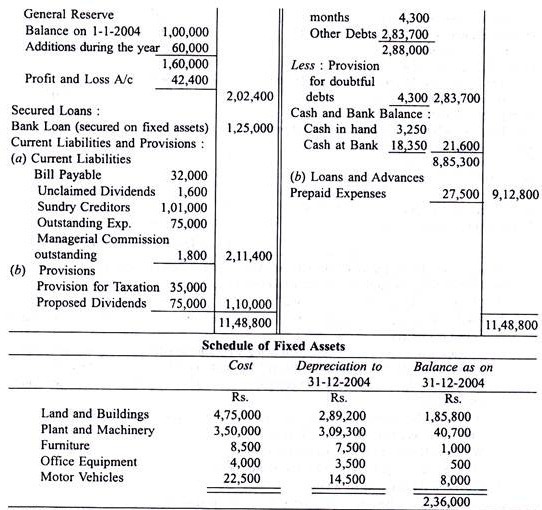

The following are the balances extracted from the books of Earth Movers Ltd. as on 31st December 2004:

Adjustments:

Stock at cost on 31st December 2004 was Rs 5, 80,000.

You are required to prepare the Profit and Loss Account for the year ended 31st December 2004 and a Balance Sheet on that date in the prescribed form, taking into account the following facts:

1. Provide Rs 20,000 for further taxation.

2. The depreciation written off to 31st December 2003 was as follows:

3. No depreciation is to be provided for the year 2004.

4. The debts due to the Company are all unsecured. Debts for Rs 6,300 are over 6 months old of which Rs 2,000 are bad and to be written off now, the rest are doubtful. All other debts are considered good.

5. The directors transfer Rs 60,000 to General Reserve and recommend a dividend of Rs 7.50 per share for the year ended 31st December 2004.

6. The authorised share capital is 10,000 shares of Rs 100 each, all of which have been issued and subscribed for, and Rs 50 per share is paid up.

Problem 7:

The authorised capital of Great will Ltd. is Rs 6,00,000 consisting of 3,000 6% Preference Shares of Rs 100 each and 3,000 Equity Shares of Rs 10 each.

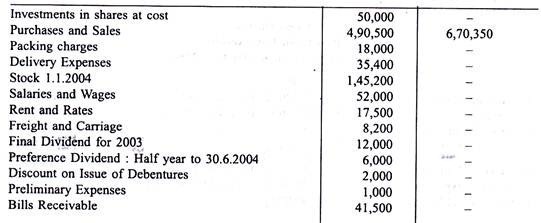

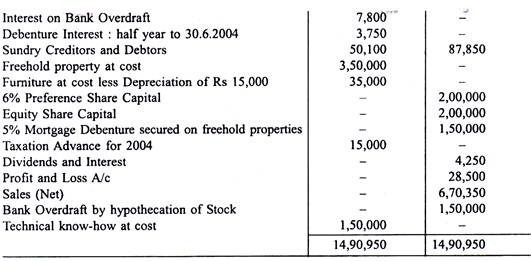

The balances appearing in the books of 31st December 2004 were as shown below:

You are required to prepare Profit and Loss Account for the year ended 31st December 2004 and the Balance Sheet as on that date, after taking into account the following:

1. Closing Stock valued at Rs 1, 42,500.

2. Purchases include Rs 5,000 worth of goods and articles for free distribution among valued customers.

3. Salaries and wages include Rs 2,000 being wages incurred for installation of electrical fittings in the factory. Electrical fittings have been recorded under “Furniture”.

4. Bills Receivable include Rs 1,500 being dishonoured. 50% of the same considered to be irrecoverable.

5. Bill of Rs 2,000 maturing after December 2004 were discounted.

6. Charge depreciation @ 20% on Furniture.

7. Write off Discount on Debentures Rs 1,000.

8. Dividend at 5% proposed on Equity Share Capital.

9. Provision for taxation Rs 8,000.

10. Technical know-how is to be written off over a period of 15 years.

11. Salaries and wages include Rs 10,000 being the Director’s Remuneration.

12. Previous year’s figures not to be mentioned.

Prepare Profit and Loss Account for the year ended 31st December 2004 and a Balance Sheet as on that date.

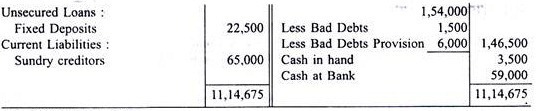

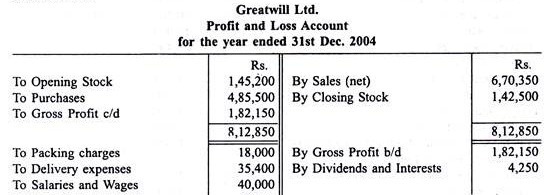

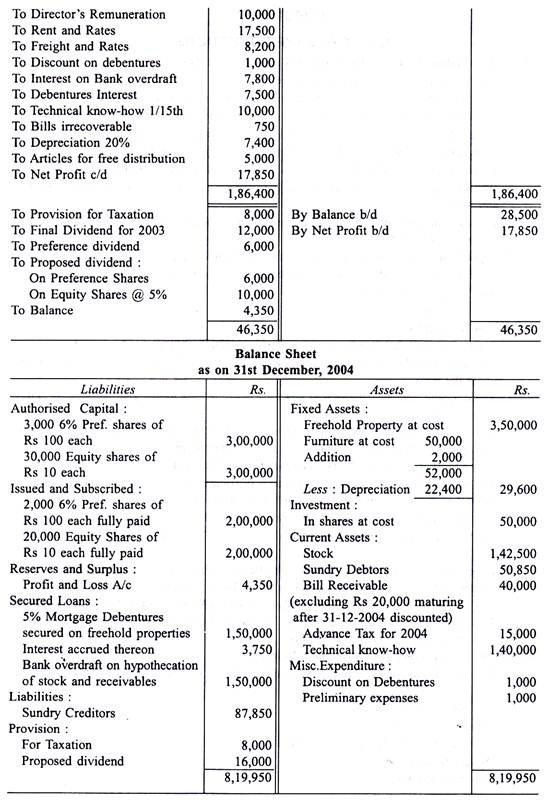

Solution: