The below mentioned article provides an overview on Divisible Profits:- 1. Meaning of Divisible Profits 2. Transfer to Reserve 3. Declaration of Dividend out of Reserve 4. Depreciation 5. Payment of Dividend 6. Profit from Subsidiary Companies 7. Dividends 8. Appropriation of Profits 9. Separate Bank Account for Dividends 10. Interest out of Capital 11. Bonus Shares 12. Public Deposits.

Contents:

- Meaning of Divisible Profits

- Transfer to Reserve

- Declaration of Dividend out of Reserve

- Depreciation

- Payment of Dividend

- Profit from Subsidiary Companies

- Dividends

- Appropriation of Profits

- Separate Bank Account for Dividends

- Interest out of Capital

- Bonus Shares

- Public Deposits

1. Meaning of Divisible Profits:

Profits available for dividend to shareholders are known as divisible profits. From the strict accountancy point of view, it is essential that dividends should be declared, unless there are compelling reasons otherwise, only if profits remain after meeting all expenses, losses, depreciation on fixed as well as on fluctuating assets, taxation, writing off past losses and after transferring at least legally minimum amount to reserves.

ADVERTISEMENTS:

Profits of extraordinary nature, that is, non-recurring profits of profits arising from sale of fixed assets or redemption of fixed liabilities, should not be distributed as dividend. Prudence demands that assets should not be revalued upwards. In respect of dividends, the Articles of the company concerned should be complied with unless these contravene the provisions of law.

Dividends cannot be declared except out of profits. If a company declares and pays a dividend in the absence of profits, the directors will have to make good the amount to the company from their own pockets. However, there is a certain amount of difference attached to the meaning of “divisible profits” under the law and under general accountancy practice.

The legal position in India is now clearly stated in section 205 of the Companies Act.

It is reproduced below:

ADVERTISEMENTS:

“(1) No dividend shall be declared or paid by a company for any financial year except out of the profits of the company for that year arrived at after providing for depreciation in accordance with the provision of sub-section (2) or out of the profits of the company for any previous financial year or years arrived at after providing for depreciation in accordance with those provisions and remaining undistributed or out of both or out of moneys provided by the Central Government or a State Government for the payment of dividend in pursuance of a guarantee given by that Government:

Provided that—

(a) if the company has not provided for depreciation for any previous financial year or years which falls or fall after the commencement of the Companies (Amendment) Act, 1960, it shall, before declaring or paying dividend for any financial year provide for such depreciation out of the profits of that financial year or out of the profits of any other previous financial year or years;

(b) if the company has incurred any loss in any previous financial year or years, which falls or fall after the commencement of the Companies (Amendment) Act, 1960, then the amount of the loss or an amount which is equal to the amount provided for depreciation for that year or those years whichever is less, shall be set off against profits of the company for the year for which dividend is proposed to be declared or paid or against the profits of the company for any previous financial year or years, arrived at in both cases after providing for depreciation in accordance with the provisions of sub-section (2) or against both;

ADVERTISEMENTS:

(c) the Central Government may, if it thinks necessary to do so in the public interest, allow any company to declare or pay dividend for any financial year out of the profits of the company for that year or any previous financial year or years without providing for depreciation:

Provided further that it shall not be necessary for a company to provide for depreciation as aforesaid where dividend for any financial year is declared or paid out of the profits of any previous financial year or years which falls or fall before the commencement of the Companies (Amendment) Act, 1960.

(1) For the purpose of sub-section (2), depreciation shall be provided either—

(a) to the extent specified in section 350; or

ADVERTISEMENTS:

(b) in respect of each item of depreciable asset, for such an amount as is arrived at by dividing ninety-five per cent of the original cost thereof to the company by the specified period in respect of such assets; or

(c) on any other basis approved by the Central Government which has the effect of writing off by way of depreciation ninety-five per cent of the original cost to the company of each such depreciable asset on the expiry of the specific period; or

(d) as regards any other depreciable asset for which no rate of depreciation has been laid down by this Act or any rules made there-under, on such basis as may be approved by the Central

Government by any general order published in the Official Gazette or by any special order in any particular case:

ADVERTISEMENTS:

Provided that where depreciation is provided for in the manner laid down in clause (b) or clause (c), then, in the event of the depreciable asset being sold, discarded, demolished or destroyed the written down value thereof at the end of the financial year in which the asset is sold, discarded, demolished or destroyed, shall be written off in accordance with the proviso to section 350.

(2A) Notwithstanding anything contained in sub-section (1), on and from the commencement of the Companies (Amendment) Act, 1974,* no dividend shall be declared or paid by a company for any financial year out of the profits of the company for that year arrived at after providing for depreciation in accordance with the provisions of sub-sections (2) except after the transfer to the reserves of the company of such percentage of its profits for that year, not exceeding ten per cent, as may be prescribed;

Provided that nothing in this sub-section shall be deemed to prohibit the voluntary transfer by a company of a higher percentage of its profits to the reserves in accordance with such rules as may be made by the Central Government in this behalf.

(2B) A company which fails to comply with the provisions of section 80A shall not, so long as such failure continues, declare any dividend on its equity shares.

ADVERTISEMENTS:

(3) No dividend shall be payable except in cash:

Provided that nothing in this sub-section shall be deemed to prohibit the capitalization of profits or reserves of a company for the purpose of issuing fully paid-up bonus shares or paying up any amount, for the time being unpaid, on any shares held by the members of the company.

(4) Nothing in this section shall be deemed to affect in any manner the operation of section 208.

(5) For the purposes of this section—

ADVERTISEMENTS:

(a) “specified period” in respect of any depreciable asset shall mean the number of years at the end of which at least ninety-five per cent of the original cost of that asset to the company will have been provided for by way of depreciation if depreciation were to be calculated in accordance with the provisions of section 350; and

(b) any dividend payable in cash may be paid by cheque or warrant sent through the post directed to the registered address of the shareholder entitled to the payment of the dividend or in the case of joint shareholders to the registered address of that one of the joining shareholders which is first named on the register of members, or to such person and to such address as the shareholder or the joint shareholders may in writing direct.”

2. Transfer to Reserve:

The Government compels companies to transfer to reserve a part of their profits (not exceeding 10%). The transfer to reserves is out of after-tax profits

The Government have promulgated the following rules about transfer to reserves:

(1) No dividend shall be declared or paid by a company for any financial year out of the profits of the company for that year arrived at after providing for depreciation in accordance with the provisions of sub-section (2) of section 205 of the Act, except after the transfer to the reserves of the company of a percentage of its profits for that year as specified below:—

ADVERTISEMENTS:

(i) Where the dividend proposed exceeds 10 per cent but not 12.5 per cent of the paid up capital, the amount to be transferred to the reserves shall not be less than 2.5 per cent of the current profits;

(ii) Where the dividend proposed exceeds 12.5 per cent but does not exceed 15 per cent of the paid up capital, the amount to be transferred to the reserves shall not be less than 5 per cent of the current profits;

(iii) Where the dividend proposed exceeds 15 percent, but does not exceed 20 per cent of the paid up capital, the amount to be transferred to the reserves shall not be less than 7.5 per cent of the current profits; and

(iv) Where the dividend proposed exceeds 20 per cent of the paid up capital, the amount to be transferred to reserves shall not be less than 10 per cent of the current profits.

(2) Nothing in (1) above shall be deemed to prohibit the voluntary transfer by a company of a percentage higher than 10 per cent of its profits to its reserves for any financial year, so however, that— (i) Where a dividend is declared,

(a) a minimum distribution sufficient for the maintenance of dividends to shareholders at rate equal to the average of the rates at which dividends declared by it cover the three years immediately preceding the financial year; or

(b) in a case where bonus share have been issued in the financial year in which the dividend is declared or in the three years immediately preceding the financial year, a minimum distribution sufficient for the maintenance of dividends to shareholders at an amount equal to the average amount (quantum) of dividend declared over the three years immediately preceding the financial year, is ensured:

Provided that a case where the net profits after tax are lower by 20 per cent or more than the average net profits after tax of the two financial years immediately preceding, it shall not be necessary to ensure such minimum distribution. (ii) Where no dividend is declared, the amount proposed to be transferred to its reserves from the current profits shall be lower than the average amount of the dividends to the shareholders declared by it over the three years immediately preceding the financial year.

3. Declaration of Dividend out of Reserve:

The Government have promulgated the following rules regarding utilisation of reserves for payment of dividend.

In the event of inadequacy or absence of profits in any year, dividend may be declared by a company for that year out of the accumulated profits earned by it in previous years and transferred by it to the reserves, subject to the conditions that:—

(i) The rate of the dividend declared shall not exceed the average of the rates at which dividend was declared by it in the five years immediately preceding that year or ten per cent of its paid-up capital, whichever is less:

(ii) the total amount to be drawn from the accumulated profits earned in previous years and transferred to the reserves shall not exceed an amount equal to one-tenth of the sum of its paid up capital and free reserves and the amount so drawn shall first be utilised to set off the losses incurred in the financial year before any dividend in respect of preference or equity shares is declared; and

(iii) the balance of reserves after such drawal shall not fall below fifteen per cent of its paid up share capital.

Explanation:

For the purpose of this rule, “profits earned by a company in previous years and transferred by it to the reserves” shall mean the total amount of net profits after tax, transferred to reserves as at the beginning of the year for which the dividend is to be declared; and in computing the said amount, all items of capital reserves including reserves created by revaluation of assets shall be excluded.

Illustration 1:

(a) Zed Ltd. closes its accounts on 31st March each year. Its paid up share capital consists of

(i) 50 lakh 11% Preference Shares of Rs 10 each fully paid, Rs 5 crore and

(ii) 2 crore Equity Shares of Rs 10 each, fully paid, Rs 20 crore.

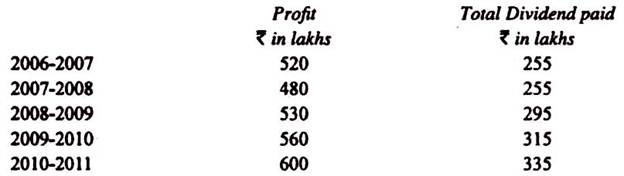

The profit earned after tax and dividends paid by the company have been the following:—

During 2011-2012 the company earned a profit of Rs. 522 lakh. The company desires to transfer Rs. 250 lakh to Reserves because of a contemplated project. Comment on the proposal. Will your answer differ if the profit earned during 2011-2012 was only 1450 lakh?

(b) Wye Ltd. has only one type of capital viz. 4 crore equity shares of Rs. 10 each. It also has got reserves totaling Rs. 20 crore. The company closes its books each year on 31st March. It has been paying dividends at the rate of 12½% up to 2008-09 and 15% thereafter. In 2011-2012 the company suffered a loss of Rs. 250 lakh therefore, it wishes to draw from reserves an amount to pay dividend at 12%. Advise the company.

Answer:

Under the Transfer to Reserve Rules, issued under the Companies Act, a company must have a minimum distribution to ensure dividend at a rate equal to the average for the three immediately preceding years (except where the profit earned is 20% less than the average for the two preceding years). Zed. Ltd has paid dividend for three years as shown below:—

The average of equity dividend for the three years is 13%. The minimum distribution required, therefore, is Rs.315 lakh i.e.

The average of the profit for 2009-10 and 2010-11 comes to Rs.580 lakh, profit for 2011-2012 Rs.522 lakh, is less than the average by only 10%.

If the company transfers Rs.250 lakh to reserves, it will be violating the Transfer to Reserves Rules. The company must pay Rs.315 lakh as dividend and transfer only Rs.207 lakh to Reserves.

If the profit earned is Rs.450 lakh, the company need not ensure the minimum distribution as computed above since the profit is below the average profit for two years by more than 20%.

(b) The Rules governing utilisation of reserves for payment of dividend restrict the withdrawals to the lower of:

(i) An amount sufficient to ensure dividend at the average rate for the previous five years or 10% whichever is less; and

(ii) 1/10 of paid up capital and free reserves, subject to the remaining balance in reserves being at least 15% of the paid up capital.

The average dividend for five years is 13.5%, i.e., (12!/2% * 3 + 15% x 2). Therefore, in the first instance only 10% dividend will be allowed. This will absorb Rs.650 lakh, i.e.,

But, more than 1/10 of the paid-up capital and free reserves cannot be withdrawn from reserves. The paid-up capital being Rs.40 crore and the reserves being Rs.20 crore, the amount that can be drawn is Rs.6 crore — the balance then left will be more than 15% of the paid-up capital. The withdrawal from reserves must first be used to set off the loss which is Rs.2.5 crore. The balance of’ 3.5 crore may be paid as dividend. The rate will then be 81/4 %. The company must be satisfied with paying this dividend.

4. Depreciation:

Section 205 has now brought legal and accountancy positions quite close Previously, it was possible to declare dividends without writing off depreciation on fixed assets (Venter vs. General Commercial Trust) and without providing for previous losses (Ammonia Soda Co. vs. Chamberlain) provided the Articles did not prohibit such a distribution.

Arrears of depreciation or accumulated losses in respect of financial years falling before the commencement of the Companies (Amendment) Act of 1960 need not be provided still. But for financial years falling after the commencement of the Companies (Amendment) Act of 1960, dividends cannot be declared unless—

(a) Depreciation has been written off the fixed assets in respect of the financial year for which dividend is to be declared according to section 205 (2);

(b) Arrears of depreciation on fixed assets in respect of any previous year [falling after the commencement of the Companies (Amendment) Act, 1960] have been deducted from the profits; and

(c) Losses incurred by the company in the previous year’s falling after the commencement of the Companies (Amendment) Act of 1960 or the amounts of depreciation provided whichever are less have been deducted.

Distinction has to be made between depreciation provided for (that is recorded in books) and not provided for.

In respect of financial years falling after 28th December, 1960 (the date of commencements of the Companies Amendment Act, 1960), depreciation not provided for (arrears) must first be deducted before paying dividend out of the profits of the year for which dividend is to be paid or out of profits of any of the previous yea?

But in case of depreciation provided for in a year in which there is a loss, it is sufficient if the amount of depreciation or the amount of the total loss is deducted out of subsequent profits before payment of dividend. Further, dividends may be declared out of past profits without providing for subsequent depreciation or losses.

However, the Central Government may, if it thinks necessary so to do in the public interest, allow any company to declare or pay dividend for any financial year out of the profits of the company for that year or any previous financial year or years without providing for depreciation.

For the sake of clarity, let us take an example. Suppose, the proper amount of depreciation to be written off for the year ended 31st March, 2011 comes out to be Rs 95 lakh out of which the company provides for only Rs 60 lakh, leaving depreciation amounting to Rs 35 lakh un-provided for and the Profit and Loss Account shows a loss of Rs 80 lakh.

Further assume that for the year ended 31st March, 2012, the Profit and Loss Account of the company shows a profit of Rs 1 crore 50 lakh after providing in full for the depreciation for the 2011-2012.

Now, if the company wants to declare a dividend out of the profits for the year 2011-2012, the company must deduct from the profits for the year the following:—

(i) Rs 35 lakh, the amount of depreciation not provided for in the year 2010-2011; and

(ii) Either Rs 80 lakh, the amount of loss for the year 2010-2011; or Rs 60 lakh, the amount of depreciation actually provided for in the final accounts of the company for the year 2010-2011. Prudence demands that the loss of Rs 80 lakhs be deducted leaving the profit for 2011-2.012 at Rs 35 lakh only.

However, the law permits, in the abovementioned case, a deduction of Rs 60 lakh only leaving the figure of profit for 2011-2012 at Rs 55 lakh. If the later course is adopted, the remaining amount of loss, Rs 20 lakh, should better be provided for as a matter of prudence, out of the profits for the year 2012-2013 or later years before a dividend for the year concerned is declared.

Section 205(2) lays down how depreciation is to be calculated.

According to it, depreciation should be provided either:

(a) To the extent specified in section 3 50, i.e. the amount of depreciation on assets as shown by the books of the company at the end of the financial year expiring at the commencement of this Act or immediately thereafter and at the end of cads subsequent financial year at the rate specified b Schedule XIV; or

(b) In respect of each item of depreciable assets for such an amount as is arrived at by dividing 95 per cent of the original cost thereof to the company be by specified period in respect of such assets; or

(c) On any other basis approved by the Central Government which has the effect of writing off by way of depreciation 95 per cent of the original cost to the company of each such depreciable assets on the expiry of the specified period; or

(d) As regards any other depreciable asset for which no rate of depreciation has been laid down by this Act or any rules made thereunder, on such basis as may be approved by the Central Government by any general order published in the Official Gazette or any special order in any particular case.

According to Section 350, if any asset is sold, discarded, demolished or destroyed for any reason before depreciation of such asset has been provided for in full, the excess, if any, of the written down value of such asset over its sale proceeds or, as the case may be, its scrap value, shall be written off in the financial year in which the asset is sold, discarded, demolished or destroyed.

The amount of depreciation charged on the fixed assets every year is debited to the Profit and Loss Account and credited to the Provision for Depreciation Account which is allowed to accumulate from year to year. The amount of depreciation may be debited to Depreciation Account and credited to Provision for Depreciation Account.

Depreciation Account is transferred to the Profit and Loss Account. In the Balance Sheet, the balance of Provision for Depreciation Account is shown by way of a deduction from the cost of the Fixed Asset.

If any asset is purchased during an accounting period, depreciation may be provided for the full year giving a note to this effect but according to sound principles of Accountancy, depreciation should be provided only for that part of the year for which the asset has been in use. If there is any change in an accounting year in the method of providing for depreciation, the fact must be d is closed along with the quantum of effect on the profit/loss of the company. If depreciation is provided for any previous year or years, it is to be treated as an appropriation of profits and not a charge against profits.

Part II of Schedule VI of the Companies Act requires that the Profit and Loss Account must disclose the amount provided for depreciation, renewals or diminution in value of fixed assets. If such provision is not made by means of a depreciation charge, the method adopted for making such provision shall be stated.

If no provision is made for depreciation, the fact that no provision has been made shall be stated and the quantum of arrears of depreciation computed in accordance with section 205(2) of the Act shall be disclosed by way of a note.

The law does not make it compulsory for a company to provide for depreciation on fixed assets All that it requires is that dividends must not be declared without providing for depreciation.

5. Payment of Dividend:

Any dividend payable in cash may be made by cheque or warrant sent through the post directed to the registered address of the shareholder entitled to the payment of dividend.

Unpaid Dividend Account:

Section 205A provides that where, after the commencement of the Companies (Amendment) Act, 1974, a dividend has been declared by a company but has not been paid or claimed, within thirty days from the date of the declaration to any shareholder entitled to toe payment of the dividend, the company shall within seven days from the date of expiry of the said period of thirty days, transfer the total amount of such dividend to a special account called ‘Unpaid

Dividend Account of……. Company Limited” in a scheduled bank. In case of default, interest on the amount not transferred to the said account at the rate of twelve per cent per annum from the date of default will have to be paid by the company. After the transfer has been made, naturally the dividend concerned will be paid out of Unpaid Dividend Account.

If any money transferred to this account remains unpaid or unclaimed for a period to seven years from the date of the transfer, it will be transferred by the company to the investor Education and Protection Fund established under sub-section (1) of section 205C. Such unpaid dividend cannot be later claimed by the shareholder concerned on or after the commencement of the Companies (Amendment) Act, 1999.

Goodwill previously written off may be written back, if the Articles permit, upto its cost. Tangible assets, previously written off, may also be written up to their reasonable value.

Preliminary expenses need not be written off (Bale vs. Cleland). But the same may also be charged to the statement of Profit and Loss.

Capital profits, as opposed to current or revenue profits arise in special circumstances and are connected with acquisition of business, fixed assets and long-term liabilities.

Capital profits can be used to write off fictitious assets like discount on issue of shares or debentures, underwriting commission, etc. Only in certain circumstances can they be used for declaring a dividend.

Capital profits can be distributed only if (1) they are realised in cash; (2) surplus remains after a revaluation of all assets, and (3) the Articles do not forbid such distribution. (Foster vs. New Trinidad Lake Asphalte Co. and Lubbock vs. British Bank of South America.) Capital profits available for dividends should not be included in Capital Reserve since by definition Capital Reserve means a reserve which cannot be used for paying a dividend.

The following are the examples of capital profits:

(a) Profit prior to incorporation.

(b) Premium on issue of shares. The amount is credited to Securities Premium Account and can be applied by the company only for those purposes which are laid down in Section 78 of the Companies Act.

(c) Profit remaining on reissue of forfeited shares. The amount is transferred to Capital Reserve and is not available for dividend.

(d) The credit to the Capital Redemption Reserve Account for redemption of redeemable preference shares. The amount is available only for issue of fully-paid bonus shares.

(e) Premium on issue of debentures. Not available for distribution of dividend

(f) Profit on redemption of debentures. Not available for distribution of dividend

(g) Profit on sale of fixed assets to the extent the sale proceeds exceeds the original cost of the fixed assets sold.

(h) Profit on acquisition of business – that is, excess of the value of tangible assets acquired over the liabilities taken over and the consideration.

6. Profit from Subsidiary Companies:

Profit of subsidiary companies must not be included in divisible profits unless the subsidiary company has declared a dividend (and only the dividend may be treated as divisible profit).

Losses of subsidiary companies need not be debited to the Profit and Loss Account of the holding company but it would be better if a provision is created to meet the holding company’s share of the loss of the subsidiary company. Dividends received out of profits existing on the date of acquisition of the controlling shares in the subsidiary company must be treated as a capital receipt.

7.

Dividends:

It is the general meeting of shareholders that declares a dividend but the rate of dividend cannot exceed the one recommended by the board of directors However, an interim dividend (that is, dividend pending finalization of accounts) may be declared by the Board of Directors, if the Articles authorize them to do so.

In the absence of any indication to the contrary (which indication will be found in the articles), the rate applies to the paid up capital.

Thus, if a company has issued 50 lakh shares of Rs 10 each on which Rs 7.50 per share has been paid up and if the dividend declared is at the rate of 10%, total dividend payable will be 10% of Rs 375 lakh (the paid up capital) or Rs 37,50,000. There is nothing to prevent a company from declaring dividend on the full nominal value of the share even if the paid up amount is less.

Calls in advance cannot be treated as part of paid up capital for declaration of dividends. Dividends on shares upon which there are calls in arrear should be calculated on the amount actually paid. However, a company has the power to forbid, by suitable provisions in the Articles, the payment of dividend on shares on which there are calls in arrears.

Further (according to Table A), unless otherwise provided in the terms of issue, the period also has to be taken into consideration. Suppose 1 crore equity shares of Rs 10 each were Rs 8 paid up on 1st April, 2011 and the call of Rs 2 was made and paid on 1st October, 2011, a dividend of 10% for 2011-2012 will mean Rs 90 lakh as shown below:

10% on Rs 8 crore for full year Rs 80 lakh; and

10%on Rs 2 crore for 6 months Rs 10 lakh

Table A also permits the Board of Directors to apply the dividend payable to a shareholder towards any amount due from him on account of calls or otherwise in relation to the shares of the company.

Under Section 206, a dividend can be paid only to the registered holder of shares or to his order or to his bankers. However, in case a share warrant has been issued in respect of fully paid up shares under section 114, the dividend may be paid to the bearer of the share current or to his bankers.

Under section 114 a public company, if authorised by its articles, may with the previous approval of the Central Government issue in respect of fully paid shares, share warrants for payment of dividend on those fully paid shares.

The dividend or the warrant for it must be posted to the registered address of the shareholder within 30 days of the declaration of the dividend except in certain circumstances (Section 207).

Every director of the company shall, if he is knowingly a party to the default, be punishable with simple imprisonment for a term which may extend to 3 years and shall also be liable to a fine of Rs 1,000 for every day during which such default continues and the company shall be liable to pay simple interest @ 18% per annum during the period for which such default continues.

Interim Dividend:

Directors usually have the power (Table A contains such a power) to pay dividend for the current year before the year is closed. Such a dividend is known as interim dividend. Since the profits of the company cannot be known exactly till the accounts are closed, the directors have to be extremely careful.

If an interim dividend is paid and it is found subsequently that the company’s profits are inadequate to cover the dividend, it will amount to payment of dividend out of capital which is forbidden by law. The directors will then have to make good the amount.

Usually therefore the directors get the accounts prepared upto a certain date and then declare a dividend on a very conservative basis. The interim dividend is usually paid for a period of six months. Thus if a company pays interim dividend of twenty per cent per annum on a capital of 7 5 crore, the total amount will be 7 50 lakh.

But if the resolution declaring the dividend were to simply state the rate to be 20%, the total dividend would be 7 1 crore, i.e., 20% of 7 5 crore. The directors may recommend another dividend when the final figures for the profit are available. Such dividend will then be termed as Final Dividend.

When final dividend is declared, interim dividend is not adjusted unless the resolution specified otherwise. A company pays interim dividend at the rate of 10% on 7 10 crore, i.e., 7 1 crore. At the end of the year, it declares a final dividend of 25%; the amount comes to 7 2.5 crore, i.e., 25% on 7 10 crore. Total dividend during the year will be 7 3.5 crore.

Section 205(1A) provides that the Board of directors may declare interim dividend and the amount of dividend Including interim dividend shall be deposited in a separate bank account within 5 days from the date of declaration of such dividend.

Income-tax Meaning of Dividends:

From the income-tax point of view, any release of assets in favour of the shareholders to the extent the company has profit, will be treated as dividend.

The most usual case is release of cash. But even if cash is paid, not as dividend but as return of capital, income-tax authorities will treat it as dividend to the extent it is covered by the accumulated profits. Consider the following liabilities side of the balance sheet of a company.

Suppose, the company decides to return Rs 3 to the shareholders as return of capital and obtains court sanction for it. The company will pay Rs 3 crore to the shareholder It will be treated as dividend. It makes no difference if instead of cash, other assets had been distributed.

But distribution of bonus shares will not be treated as dividend because it involves no release of assets. Bonus debentures will, however, be treated as dividend.

Dividend Distribution Tax:

A joint stock company is required to pay dividend distribution tax on interim dividend as well as final dividend. Like rates of income tax, the rate of dividend distribution tax may vary from one financial year to the other financial year.

Whenever a dividend is declared or proposed, provision has to be made for dividend distribution tax at the rate prevalent for the year. At present the rate of dividend distribution tax is 16.99%. Dividends from the domestic companies in the hand of shareholders are now exempt from income tax and hence the question of deduction of income tax at source from dividends by the companies no longer arises.

8. Appropriation of Profits:

This applies only to divisible profits, that is, to profits remaining after all charges against the current income have been taken into account. Once a surplus that can be shared by various parties is established, the question of its disposal arises. The directors may decided to retain a certain amount to strengthen the company’s finances and the shareholders will appreciate a share in the form of dividends.

The amount retained may take the form of transfer to various reserves or just a balance left. The transfers are shown in the balance sheet under is head, surplus. First of all, balance brought forward from previous year is put. Then net profit for the year is added to this balance.

From the total of the two, transfers are made, usually as follows:

(i) Transfer to General Reserve;

(ii) Transfer to Dividend Equalization Reserve: Dividend Equalization Reserve means a Reverse accumulated out of profits otherwise available for dividends with the purpose of making the rate of dividend uniform from year to year. If dividends fluctuate, speculators are encouraged. When good profits are made, a part of them is put to the Dividend Equalization Reserve which can be drawn upon to pay dividends when profits are small.

(iii) Transfer to Sinking Fund for Redemption of Debentures;

(iv) Dividends (paid and proposed); and

(v) Dividend Distribution Tax paid; and provision for the same on proposed dividend. The balance is carried forward.

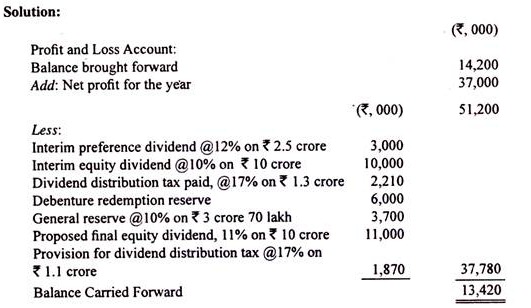

Illustration 2:

On 1st April, 2011 the subscribed share capital of Surya Ltd. stood at Rs 12.5 crore divided into 1 crore fully paid equity shares of Rs 10 each and 2.5 lakh fully paid 12% preference shares of Rs 100 each. On the same date, Profit and Loss Account showed an opening balance of Rs 1 crore 42 lakh.

During the year ended 31st March, 2012 the company paid an interim dividend @ 10% on its equity shares, paying preference dividend for the entire year 2011-2012. On 31st March, 2012 the company’s Profit and Loss Account showed that the company had earned for the year Rs 3 crore 70 lakh as profit after tax.

The Board of Directors decided to transfer Rs 60 lakh to Debenture Redemption Reserve and 10% of the net profit for the year to General Reserve. The Board also proposed a final dividend @ 11% on equity shares over and above the interim dividend already distributed. The company is required to pay dividend distribution tax @ 17%.

Show Profit and Loss Account in the company’s balance sheet as on 31st March, 2012.

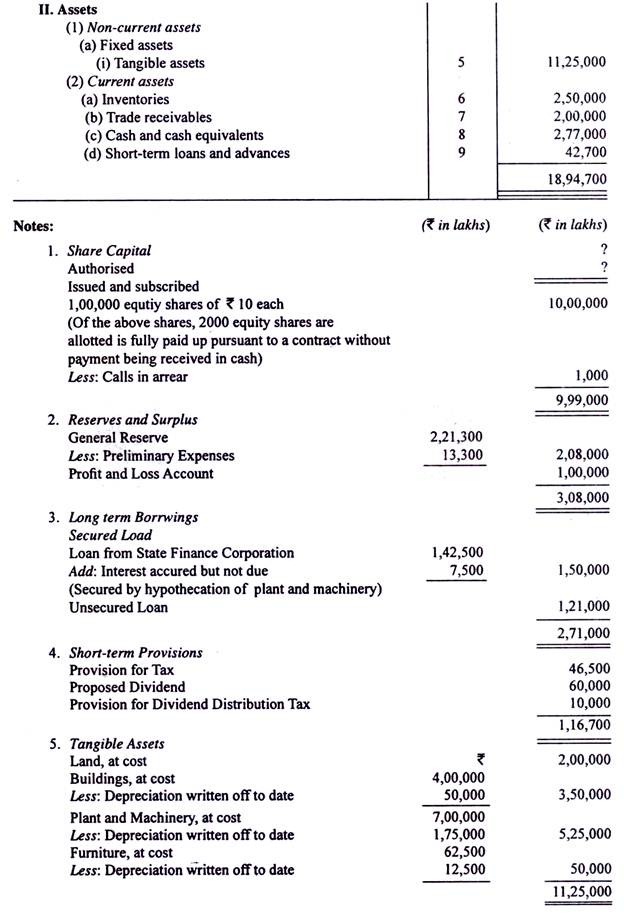

Illustration 3:

The Balance Sheet of Zee Ltd. as at 31-3-2012 is given below:

Illustration 4:

The articles of association of Diana Ltd. provide for the following:

9. Separate Bank Account for Dividends:

According to section 205(1 A), within five days from the date of declaration of dividend, a company has to open a separate bank account for the payment of dividends. From the general bank account, the amount of dividends to be paid is transferred to a separate account called Dividend Bank Account.

All dividend warrants will then be paid out of Dividend Bank Account. The balance of Dividend Bank Account will be equal to the dividends which have not yet been claimed.

10. Interest out of Capital:

As has been pointed out earlier, dividends cannot be paid except out of profits or in other words, dividends cannot be paid out of capital. In certain cases, however, the Central Government has the power to permit payment of interest to shareholders even when there is no profit.

A company which has to wait rather a long period before it can commence production (because construction of works may take long) may find the shareholders restive if nothing is given to them by way of yield.

Moreover, if construction is carried on with borrowed funds, interest will have to be paid; hence there is some theoretical justification for payment of interest to the shareholders.

Section 208 governs payment of interest in such cases. The company is allowed to pay interest on such shares as are issued for the purpose of defraying the expenses of the construction of any works or building or of providing any plant which cannot be made profitable for a lengthy period, subject to the following conditions:—

(a) The payment is authorised by Articles or by a special resolution.

(b) Prior sanction of the Central Government is obtained.

(c) The payment of interest is made only for such period as may be determined by the Central Government.

But the period cannot extend beyond the close of the half year next after the half year in which the works, buildings, etc., have been actually completed. For example, if the construction is over on 10th January, 2011 interest cannot be paid after 30th September, 2011.

(d) The rate of interest does not exceed four per cent per annum or such other rate as the Central Government may, by notification in the Official Gazette, direct.

The Central Government can order an enquiry at the company’s cost before according its sanction. The company can treat the interest so paid as part of the cost of construction.

11. Bonus Shares:

Sometimes the company may not be in a position to pay cash dividends in spite of adequate profits because of the adverse effect on the working capital of the company. Moreover, all prudent companies build up reserves for purposes of expansion and for building up financial strength.

Later, however, to satisfy shareholders and to portray a realistic relationship between capital and profits earned, the company may issue shares, without payment being required, to the existing equity shareholder Such shares are known as bonus shares. Bonus shares can be issued only if such an issue is permitted by the Articles of Association.

Guidelines for Issue of Bonus Shares:

In keeping with the pace of liberalisation and reforms in the primary market, the Securities and Exchange Board of India (Primary Market Department) vide its press release dated 15.4.1994 modified the guidelines for bonus shares.

The modified guidelines are as follows:-

(i) These guidelines are applicable to existing listed companies who shall forward a certificate duly signed by the issuer and duly countersigned by its statutory auditor or by a company secretary in practice to the effect that the terms and conditions for issue of bonus shares as laid down in these guidelines have been complied with.

(ii) Issue of bonus shares after any public/rights issue is subject to the condition that no bonus issue shall be made which will dilute the value or rights of the holders of debentures, convertible fully or partly.

In other words, no company shall, pending conversion of FCDs/PCDs, issue any shares by way of bonus unless similar benefit is extended to the holders of such FCDs/PCDs, through reservation of shares in proportion to such convertible part of FCDs or PCDs. The shares so reserved may be issued at the time of conversion(s) of such debentures on the same terms on which the bonus issues were made.

(iii) The bonus issue is made out of free reserves built out of the genuine profits or securities premium collected in cash only.

(iv) Reserves created by revaluation of fixed assets are not capitalized.

(v) The declaration of bonus issue, in lieu of dividend, is not made.

(vi) The bonus issue is not made unless the partly-paid shares, if any existing, are made fully paid-up.

(vii) The company —

1. has not defaulted in payment of interest or principal in respect of fixed deposits and interest on existing debentures or principal on redemption thereof, and

2. has sufficient reason to believe that it has not defaulted in respect of the payment of statutory dues of the employees such as contribution to provident fund, gratuity, bonus etc.

(viii) A company which announces a bonus issue after the approval of the Board of Directors must implement the proposal within a period of six months from the date of such approval and shall not have the option of changing the decision.

(ix) There should be a provision in the Articles of Association of the company for capitalisation of reserves, etc. and if not, the company shall pass a Resolution at its General Body Meeting making provision in the Articles of association for capitalisation of reserves etc.

(x) Consequent to the issue of bonus shares, if the subscribed and paid-up capital exceed the authorised share capital, a Resolution shall be passed by the company at its General Body Meeting for increasing the authorised capital.

The application has to be supported by a certificate from the auditor of the company in regard to the facts stated and the fact that the guidelines have been complied with. It has to be affirmed by the Principal Officer of the company.

Bonus shares are generally issued in the following circumstances:—

(a) When the company’s cash resources are inadequate for a cash dividend.

(b) When the company wants to build up cash resources for expansion or other purposes like repayment of liability. Many of the present large companies have achieved their position by refusing to distribute all their profits as cash dividends. The accumulated profits are later converted into shares.

(c) When the company, having built up large reserve, wishes to show to the outsiders (and also the shareholders) the correct earning capacity.

Suppose, a company has the following summarised balance sheet:

Suppose further, that the company earns during a year Rs 20,00,000. A superficial view will show that the company earns 40 per cent on its capital. This may give rise to accusations against the company of profiteering.

Labour may also feel restive and may demand a much greater share in the company’s revenues. The correct position is that the company earns Rs 20 lakh on Rs 150 lakh. The yield, therefore, works out to be 13.33% which appears to be much more reasonable than forty per cent. To present a correct picture, the company may decide to convert the reserves into shares and distribute the shares among the shareholder

Bonus shares can be issued out of the following:—

(1) Balance in the Profit and Loss Account;

(2) General Reserves or other reserves accumulated out of profits;

(3) Balance in the Sinking Fund for Redemption of Debentures after the debentures have been redeemed;

(4) Realised capital profits and reserves;

(5) Capital Redemption Reserve Account (created out of profits for the redemption of redeemable preference shares);

(6) Premium received on issue of shares.

Bonus Shares can be issued in the form of fully paid shares at par, or at a premium. But the bonus can also be distributed, at least theoretically, by way of making partly paid shares fully paid, that is to say, the bonus can be applied towards the call that may be due on the shares. This last form of bonus means that the liability of the shareholders on partly paid shares is extinguished. But SEBI guidelines do not permit it.

From the point of view of the company, allotment of bonus shares has the advantage that it does not result in the release of resources of the company. Because of the bonus issue, the profits become part of the share capital which increases the creditworthiness of the company.

It may be resorted to by the company in case of expansion of its business; it will, however, not increase the total resources at the disposal of the company. It can also the used by the company to reduce its abnormally high rate of dividend as it will increase the amount of share capital without increasing the profitability of the company.

It should be remembered that when bonus shares are distributed, the shareholders may not gain at all. This is because of the fact that the market value of the shares depends upon the dividend received. If the company issues bonus shares, the profits (which do not increase) will have to be distributed over a larger number of shares, thus reducing the dividend per share.

This will result in a fall in the value of the shares in the market. Thus, the shareholder will have a larger number of shares but the total value of his holding will not increase because each share now is of a smaller value.

Hence, the shareholder makes no entry in his books on receipt of bonus shares. However, the shareholder will benefit in the form of capital appreciation if there is a net increase in the amount of dividend received by him.

The company has to make the following entries in its books:—

1. Debit Profit and Loss Appropriation Account (or General Reserve or Securities Premium Account or Capital Redemption Reserve Account, depending from what source the bonus is being given).

Credit Bonus to Equity Shareholders Account.

2. Debit Bonus to Equity Shareholders Account with the total amount. Credit Share Capital Account with the nominal value of shares issued.

Credit Securities Premium Account with the premium, if any, on the bonus shares.

The fact of the issue of the bonus shares has to be disclosed in the balance sheet. Mention must be made of the number and the amount of shares issued as bonus shares and also source from which the bonus shares have been issued.

Illustration 5:

The company decided to issue bonus shares at the rate of three shares for every four shares held and decided, for this purpose, to utilise the securities premium, Rs 60 lakh out of reserve and the balance out of the Profit and Loss Account. Give journal entries to give effect to the above and give the amended liabilities side of balance sheet.

12. Public Deposits:

The Companies (Amendment) Act, 1974 introduced sections 58A and 58B to regulate acceptance of deposits by non-banking companies. The Central Government in consultation with the Reserve Bank of India may prescribe the limits up to which, the manner in which and the conditions subject to which deposits may be invited or accepted by company either from the public or from its members.

Briefly, the company has put to an advertisement in at least one newspaper of English and a regional language and the advertisement must contain all the information about the company as prescribed. No company can accept or renew any deposit which is repayable on demand or on notice or after a period of less than six months or more than 36 months from the date of acceptance or renewal of such deposit.

However, for the purpose of meeting any short-term requirements of funds, a company may accept or renew deposits for a period of less than 6 months provided that such deposits do not exceed ten per cent of the aggregate of the paid-up share capital and free reserves of the company and are repayable not earlier than three months from the date of such deposits or renewal thereof.

Generally, the amount of public deposits is not to exceed 35% of the paid-up share capital and free reserves—composed of 10% of the paid-up share capital and free reserves from shareholders, or against unsecured debentures or from others against guarantee provided by any directors, and the remaining from the general public.

For the purpose of arriving at the aggregate of the paid-up share capital and free reserves, the amount of accumulated balance of loss, balance of deferred revenue expenditure and other intangible assets, if any, will be deducted.

Illustration 6:

From the following particulars furnished by Pioneer Ltd., prepare the Balance Sheet as at 31st March, 2012, as required by Part I, Schedule VI of the Companies Act.

Illustration 7:

The following is the trial balance of Lakshmi Co. Ltd. as at 31st March, 2012:

Illustration 8:

Auto Parts Manufacturing Co. Ltd. was registered with a nominal capital of Rs. 10 crore dividend into shares of Rs. 10 each, of which 40 lakh shares had been issued and fully called.

The following is the Trial Balance extracted on 31st March, 2012.

Illustration 9:

The following information has been extracted from the books of account of Jay Ltd. as at 31st March, 2012:

Notes on Accounts:

Significant Accounting Policies:

(i) Basis of preparation of financial statements:

The financial statements have been prepared on the basis of historical cost concept in accordance with the generally accepted accounting principles and the provisions of the Companies Act, 1956.

(ii) Valuation of Inventories:

Inventories are valued at the lower of historical cost or the net realisable value.

(iii) Valuation of Investments:

Investments are valued at lower of cost or net realisable value.

(iv) Depreciation:

Depreciation on fixed assets is provided using the straight-line method, based on the period of five years. Depreciation on additions is provided for the full year but no depreciation is provided on the assets sold in the year of their disposal.