This article throws light upon the top three methods for computation of cost of debt. The methods are: 1. Debt Issued at Par 2. Debt Issued at a Premium or at a Discount 3. Cost of Redeemable Debt.

Method # 1. Debt Issued at Par:

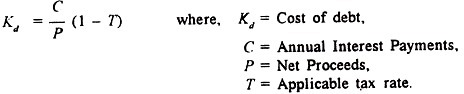

The method of computation for ascertaining cost of debt which is issued at par is comparatively an easy task. It is nothing but the explicit interest rate adjusted again for the tax liability.

Symbolically,

Example:

ADVERTISEMENTS:

A company has issued 8% debentures and the tax rate is 50%, the after tax cost of debt will be 4%. — It may be’ calculated as under:

Since interest is treated as an expense while calculating firm’s income for income- tax purpose, the tax is deducted out of the interest payable. This tax adjusted interest rate is used only where the EBIT (Earnings/Profits before Interest and Tax) is equal to or exceed the interest.

ADVERTISEMENTS:

Needless to mention that if EBIT is found to be negative one, the cost of debt should be considered before adjusting the interest rate of tax, i.e., in the above case, the cost of debt (before adjusting rate of tax) will be 8% only.

Method # 2. Debt Issued at a Premium or at a Discount:

In many cases, bonds or debentures may be issued at a premium (when, it is more than the face value) or at a discount (when it is less than the face value). In that case, the cost of debt must not be equal to the coupon rate of interest. Moreover, if discounts or premiums are amortized for income-tax purposes, it should also be considered.

However, the appropriate formula for calculating cost of debt where discounts or premium and floatation cost is involved, is presented below:

Illustration:

ADVERTISEMENTS:

A company issues 10% Debentures tor Rs. 2,00,000 Rate of tax is 55%. Calculate the cost of debt (after tax) if the debentures are issued (i) at par (ii) at a discount of 10% and (iii) at a premium of 10%.

Solution:

Cost of debt is calculated as under:

ADVERTISEMENTS:

Solution:

(i) Issued at Par

= Rs. 20,000/Rs. 2,00,000 (1 – .55)

ADVERTISEMENTS:

=1/10 x .45

= 4.5%

(ii) Issued at a Discount of 10%

Rs. 20,000/Rs. 1,80,000 (1 – .55)

ADVERTISEMENTS:

= 1/9 x .45

= 5 %

(iii) Issued at Premium of 10%

Rs. 20,000/Rs. 2,20,000 (1 – .55)

ADVERTISEMENTS:

= 1/11 x .45

= 4.1 %

Illustration:

A company raises Rs 90,000 by the issue of 1,000 10% Debentures of Rs. 100 each at a discount of 10%, repayable at per after 10 years. If the rate of company’s tax is 50, what is the cost of debt capital to the firm?

Solution:

Method # 3. Cost of Redeemable Debt:

If debt and/or debentures are redeemed after the expiry of a period, the effective cost of debt before tax can be calculated with the help of the following formula:

Illustration:

A company issues 10,000, 10% Debentures of Rs.10 each and realises Rs.95,000 after allowing 5% commission to brokers. The debentures are redeemed after 10 years. Calculate the effective cost of debt before tax.

Solution:

However, in the present case, if the tax rate is considered @ 55%, the cost of debt after tax may be computed as under: