This article will help you to differentiate between Over-Capitalisation and Under-Capitalisation.

1. Over-capitalisation involves a great-strain on the financial resources of a company whereas under-capitalisation implies high rate of earnings on its shares.

2. The remedial procedure of over-capitalisation is more difficult and expensive as compared to the remedial procedure of under-capitalisation.

3. Under-capitalisation accelerates cut-throat competition amongst companies; results in discontentment among employees and grouse amongst customers; whereas over-capitalisation adversely affects the shareholders and endangers the economic stability and Social prosperity.

ADVERTISEMENTS:

4. Over-capitalisation is a common phenomena than under-capitalisation which is relatively a rare phenomena.

Illustration 1:

The following example illustrates the over and under capitalisation situations of a company:

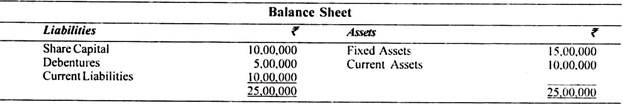

(1) Over-Capitalisation:

[Here the excess of fixed liabilities over fixed assets is (15,00.000 – 12,00,000) = Rs. 3,00,000. Thus, we say that the firm is over capitalised to the extent of Rs. 3,00,000]

(2) Under-Capitalisation:

[Here the excess of fixed assets over fixed liabilities is Rs. (16,00,000 – 15,00,000) = Rs. 1,00,000. Hence, we say that the firm is under-capitalised to the extent Rs. 1,00,000]

ADVERTISEMENTS:

(3) Fairly-capitalised:

[Here the fixed liabilities, i.e., Shares + Debentures are equal to the amount of fixed assets. Hence, this firm is said to be fairly-capitalised]

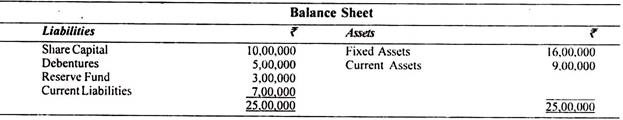

(4) An Under-capitalised concern really over-capitalised:

[Here the fixed assets of the company of Rs. 16,00,000 exceed the fixed liabilities in the form of shares and debentures amounting to Rs. 15,00,000 (10,00,000+5,00,000). The concern seems to be under-capitalised. But in fact, there is a reserve fund amounting to Rs. 3,00,000.

In case reserve fund is taken into consideration, the fixed liabilities are Rs. 18,00,000 and there is an excess of fixed liabilities over fixed assets of Rs. 2,00,000 (18,00,000- 16,00,000). Hence, in reality, the concern is over-capitalised].