After reading this article you will learn about Financial Leverage:- 1. Impact of Financial Leverage 2. Degree of Financial Leverage 3. Significance 4. Limitations.

Impact of Financial Leverage:

The financial leverage is used to magnify the shareholders earnings. It is based on the assumption that the fixed charges/costs funds can be obtained at a cost lower than the firm’s rate of return on its assets.

When the difference between the earnings from assets financed by fixed cost funds and the costs of these funds are distributed to the equity stockholders, they will get additional earnings without increasing their own investment.

Consequently, the earnings per share and the rate of return on equity share capital will go up. On the contrary, if the firm acquires fixed cost funds at a higher cost than the earnings from those assets then the earnings per share and return on equity capital will decrease. The impact of financial leverage can be analysed while looking at earnings per share and return on equity capital.

ADVERTISEMENTS:

Illustration 1:

A firm is considering two financial plans with a view to examining their impact on Earnings per Share (EPS). The total funds required for investment in assets are Rs. 5,00,000:

The earnings before interest and tax are assumed as Rs. 50,000, Rs. 75,000 and Rs. 1,25,000. The rate of tax be taken at 50%.

ADVERTISEMENTS:

Solution:

Comments:

ADVERTISEMENTS:

(1) Plan 1 is a leveraged financial plan because it has 80% debt financing and has only 20% equity financing. Plan II is a conservative financial plan where fixed cost funds are only 20% of total funds and the rest is financed through equity capital.

(2) The EPS is increasing in Plan I with the increase in profits (EBIT). In situation (1) the earnings per share is same in both the plans i.e., Re. 0.50. As the EBIT has increased from Rs. 50,000 to Rs. 75,000 (situation 2) the EPS in plan I is Rs. 1.75 while it is Rs. 0.81 in plan II. EPS is Rs. 4.25 in Plan I and Rs. 1.438 in Plan II when EBIT increases to Rs. 1,25,000

(3) It is a clear from the analysis that EPS is increasing with the increase in profits in Plan I as compared to that of Plan II. This is possible with the use of more fixed cost funds in plan I as compared to Plan II.

(4) The increase in EPS in Plan I is due to the financial leverage because earnings before interest and tax are same in all the situation.

ADVERTISEMENTS:

Illustration 2:

A Ltd. Company has equity share capital of Rs. 5,00,000 divided into shares of Rs. 100 each. It wishes to raise further Rs. 3,00,000 for expansion cum modernisation plans. The company plans the following financing schemes:

(a) All common stock

(b) Rs. one lakh in common stock and 7 two lakh in 10% debentures.

ADVERTISEMENTS:

(c) All debt at 10% p.a.

(d) Rs. one lakh in common stock and Rs. two lakhs in preference capital with the rate of dividend at 8%.

The company’s expected earnings before interest and tax (EBIT) are Rs. 1,50,000. The corporate rate of tax is 50%).

You are required to determine the earnings per share (EPS) in each plan and comment on the implications of financial leverage.

ADVERTISEMENTS:

Solution:

Comments:

In the four plans of fresh financing, Plan III is the most leveraged of all. In this case additional financing is done by raising loans @ 10% interest. Plan II has fresh capital stock of Rs. one lakh while Rs. two lakhs are raised from loans. Plan IV does not have fresh loans but preference capital has been raised for Rs. two lakhs.

ADVERTISEMENTS:

The earnings per share is highest in Plan III i.e. Rs. 12. This plan depends upon fixed Cost funds and thus has benefited the common stockholders by increasing their share in profits. Plan II is next best scheme where EPS is Rs. 10.83. In this case too Rs. 2 lakhs are raised through fixed cost funds. Even in Plan IV, where preference capital of Rs. 2 lakhs is issued, it is better than Plan I where common stock of Rs. 3 lakh is raised.

The analysis of this information shows that financial leverage has helped in improving earnings per share for equity shareholders. It helps to conclude that higher the ratio of debt to equity the greater the return for equity stockholders.

Impact of Leverage on Loss:

If a firm suffers losses then the highly leveraged scheme will magnify the losses per share. This impact is discussed in illustration 3.

Illustration 3:

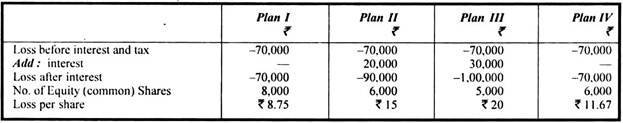

Taking the figures in Illustration 2, a concern suffers a loss of Rs. 70,000. Discuss the impact of leverage under all the four plans:

ADVERTISEMENTS:

Solution:

Comments:

The loss per share is highest in Plan III because it has the higher debt-equity ratio while it is lowest in Plan 1 because all additional funds are raised through equity capital. The leverage will have an adverse impact on earnings if the firm suffers losses because fixed cost securities will magnify the losses.

Illustration 4:

Calculate EPS (earning per share) of Shy Ltd. and Smart Ltd. assuming (a) 20% before tax rate of return on assets (b) 10% before tax rate of return on assets based on the following data:

Assume a 50%) income tax in both cases. Also give your comments on the financial leverage.

Solution:

Comments:

Smart Ltd. has used debt in its financing, as such when the rate of return is 20% (higher than the cost of debt), its EPS is higher than that of Shy Ltd. which does not use any debt. But when the financial leverage is unfavourable at 10% rate of return (the cost of debt is higher), there is a negative impact of leverage and the EPS has decreased.

Degree of Financial Leverage:

The degree of financial leverage measures the impact of a change in operating income (EBIT) on change in earning on equity capital or on equity share.

Degree of financial leverage DFL can be calculated as:

DFL = Percentage change in EPS/Percentage change in EBIT

or

DFL = EBT/EBT (or, EBIT-I)

Illustration 5:

XYZ Company has currently an equity share capital of Rs. 40 lakhs consisting of 40,000 equity shares of Rs. 100 each. The management is planning to raise another Rs. 30 lakhs to finance a major programme of expansion through one of the four possible financing plans.

The options are:

(i) Entirely through equity shares.

(ii) Rs. 15 lakhs in equity shares of 7 100 each and the balance in 8% Debentures.

(iii) Rs. 10 lakhs in equity shares of Rs. 100 each and the balance through long-term borrowing at 9% interest p.a.

(iv) Rs. 15 lakhs in equity shares of Rs. 100 each and the balance through preference shares with 5% dividend.

The company’s expected earning before interest and taxes (EBIT) will be Rs. 15 lakhs. Assuming corporate tax rate of 50%, you are required to determine the EPS and comment on the financial leverage that will be authorised under each of the above scheme of financing.

Solution:

Comments:

Since the EPS as well as degree of financial leverage (DFL) is highest in financial plan 111, it should be accepted. The company should raise Rs. 10 lakhs in equity shares and the balance of Rs. 20 lakhs through long-term borrowing at 9% interest p.a.

Significance of Financial Leverage:

Financial leverage is employed to plan the ratio between debt and equity so that earning per share is improved. Following is the significance of financial leverage:

(1) Planning of Capital Structure:

The capital structure is concerned with the raising of long-term funds, both from shareholders and long-term creditors. A financial manager has to decide about the ratio between fixed cost funds and equity share capital. The effects of borrowing on cost of capital and financial risk have to be discussed before selecting a final capital structure.

(2) Profit Planning:

The earning per share is affected by the degree of financial leverage. If the profitability of the concern is increasing then fixed cost funds will help in increasing the availability of profits for equity stockholders. Therefore, financial leverage is important for profit planning.

The level of sales and resultant profitability is helpful in profit planning. An important tool of profit planning is break-even analysis. The concept of break-even analysis is used to understand financial leverage. So, financial leverage is very important for profit planning.

Limitations of Financial Leverage:

The financial leverage or trading on equity suffers from the following limitations:

1. Double-edged Weapon:

Trading on equity is a double-edged weapon. It can be successfully employed to increase the earnings of the shareholders only when the rate of earnings of the company is more than the fixed rate of interest/ dividend on debentures/preference shares. On the other hand, if it does not earn as much as the cost of interest bearing securities, then it will work adversely and hence cannot be employed.

2. Beneficial only to Companies Having Stability of Earnings:

Trading on equity is beneficial only to the companies having stable and regular earnings. This is so because interest on debentures is a recurring burden on the company and a company having irregular income cannot pay interest on its borrowings during lean years.

3. Increases Risk and Rate of Interest:

Another limitation of trading on equity is on account of the fact that every rupee of extra debt increases the risk and hence the rate of interest on subsequent loans also goes on increasing. It becomes difficult for the company to obtain further debts without offering extra securities and higher rates of interest reducing their earnings.

4. Restrictions from Financial Institutions:

The financial institutions also impose restrictions on companies which resort to excessive trading on equity because of the risk factor and to maintain a balance in the capital structure of the company.