Here is a compilation of top eleven accounting problems on valuation of goodwill and shares with its relevant solutions.

Problem 1:

From the following information find out Goodwill (a) as per annuity method, (b) as per 4 years’ purchase of super profit, and (c) as per capitalisation of super profit method.

Net profits for four years:

ADVERTISEMENTS:

I year Rs. 30,000; II year Rs. 40,000 III year Rs. 50,000; IV year Rs. 60,000. The profit includes non-recurring profits on an average basis of Rs. 3,000.

Problem 2:

ADVERTISEMENTS:

The net profits of a Company, after providing for taxation, for the past five years are Rs. 42,000; Rs. 47,000; Rs. 45,000; Rs. 39,000 and Rs. 47,000. The capital employed in the business is Rs. 4, 00,000 on which a reasonable rate of return of 10% is expected.

Calculate the goodwill under:

(a) Capitalisation of Average Profit Method and

(b) Capitalisation of Super Profit Method.

ADVERTISEMENTS:

Solution:

Problem 3 (Capitalisation Method):

Balance Sheet of Mr. X as on 31st Dec. 2004 was as under:

Find out Goodwill by Capitalisation Method.

Solution:

Problem 4:

ADVERTISEMENTS:

Ram runs a chemist shop. His net assets on 31st December 2004 amount to Rs. 20, 00,000. After paying a rent of Rs. 20,000 a year and salary of Rs. 20,000 to the chemist, he earns a profit of Rs. 1,50,000. His landlord, who happens to be an expert chemist, is interested in purchasing the shop 12% is considered to be a reasonable return on capital employed. What can Ram expect as payment for goodwill?

Solution:

Problem 5 (Capitalisation of weighted average profit):

ADVERTISEMENTS:

P. Ltd. proposed to purchase the business carried on by Mr. A. Goodwill for this purpose is agreed to be valued at three years purchase of the weighted average profits of the past four years.

The appropriate weights to be used are:

On a scrutiny of the accounts, the following matters are revealed:

ADVERTISEMENTS:

(a) On 1st September 2003, a major repair was made in respect of the plant incurring Rs. 30,000 which amount was charged to revenue. The said sum is agreed to be capitalised for goodwill calculation subject to adjustment of depreciation of 10% p.a. on reducing balance method.

(b) The closing stock for the year 2002 was overvalued by Rs. 12,000.

(c) To cover management cost of annual charge of Rs. 24,000 should be made for the purpose of goodwill valuation.

Compute the value of goodwill of the firm.

Solution:

Problem 6:

On 31st December 2004, the Balance Sheet of a Limited Company disclosed the following position:

On 31st December 2004, the fixed assets were independently valued at Rs. 3, 50,000 and the goodwill at Rs. 50,000.

The net profits for the three years were:

2002 Rs. 51,600; 2003 Rs. 52,000 and 2004 Rs. 51.650 of which 20% was placed to Reserve Account and this proportion being considered reasonable in the industry in which the Company is engaged and where a fair investment return may be taken at 10%. Compute the value of the Company’s share by (a) the Assets Method and (b) the Yield Method.

Problem 7:

The Balance Sheet of Sumana Ltd. as at 31.12. 2004 were as follows:

The assets were revalued as follows:

Land and Building Rs. 1, 00,000: Plant and Machinery Rs. 4, 50,000. The normal rate of return on capital employed for valuation of Goodwill is 10%. Goodwill should be valued on the basis of 3 years’ purchase of the super profits of the company. The average annual profits of the company is Rs. 1, 06,000. 40% of the money invested in Building is treated as non-trading assets; because Rent of Rs. 10,000 is collected from the building annually. You are asked to compute the value of each Equity share. Ignore taxation.

Problem 8:

J & Co. Ltd. was incorporated on 21st April 2004 with an authorised share capital of Rs. 25, 00,000 in equity shares of Rs. 10 each. The company issued 20,000 equity shares for cash at a premium of Rs. 2.50 per share which were all paid. There was no business until 30th June 2004, on which day the company decided to purchase the going businesses of S & Co. Ltd. and L & Co. Ltd. by its own shares of Rs. 10 each at a premium of Rs. 2.50 per share (assets and liabilities of both the companies were taken at their book values and their goodwill was valued at 2½ years’ purchase of super-profits, the normal profits being calculated at 10% of the capital employed in case of each).

Summarised Balance Sheets, as on 30.6.2004, were as follows:

Problem 9:

The following particulars are available in relation to a company:

(a) Capital:

450, 6% Preference shares of Rs. 100 each, fully paid.

4,500 Equity shares of Rs. 10 each, fully paid.

(b) External Liabilities Rs. 7,500.

(c) Reserves and Surplus Rs. 3,500.

(d) The average normal profit (after taxation) earned every year by the company Rs. 8,505.

(e) The normal profit earned on the market value of Equity shares, fully paid, of the same type of companies is 9%.

(J) The Asset-Backing Method assuming that out of the total assets worth Rs. 350 are fictitious.

(g) Ascertain the value of equity shares under earning capacity method.

Problem 10:

The following is the summarised Balance Sheet of X Co. Ltd as on 31.12.2004

On 1.1.2005, all the Preference shares were redeemed at a premium of Rs. 10 per share out of profits otherwise available for dividends.

You are asked to ascertain the intrinsic value of each of the Equity shares by Assets Backing Method, on the basis of the Balance Sheet immediately after redemption of preference shares.

Take into account the following information:

(i) Goodwill to be taken at Rs. 50,000

(ii) 10% of Sundry Debtors are bad;

(iii) A claim for compensation to an employee has been admitted on 1.1.2005, for Rs. 1,000;

(iv) All the other assets are taken at their book values as shown in the above Balance Sheet.

Solution:

Problem 11:

The following is the Balance Sheet of XYZ Co. as on 31st December 2004:

Freehold Premises were valued early in 2004 t Rs. 80000. Average yield in this type of business is 15 per cent on Capital Employed.

You are required to find out the fair value of each share on the basis of above-mentioned facts, assuming the weights for 2002, 2003 and 2004 were assigned as 1, 2, and 3, respectively.

Solution:

Notes:

1. Since Income-Tax payable is given, it is treated as a current liability and. as such, deducted from total assets. And, for the purpose, it has been assumed that Provision for taxations is nothing but a Provision only.

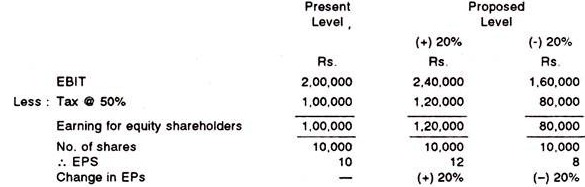

2. Income-Tax is assumed to be @ 50%

3. It has also been assumed that normal rate of return is also @ 15%

As per Yield-Basis Method: