Each and everything you need to know about Incentive Plan as studied in Cost Accounting and Human Resource Management.

Learn about:

- Incentive Plan:Halsey (And Halsey-Weir) Premium Plan, Rowan Plan, The Hour-to-Hour or 100% Bonus Plan, Taylor’s Differential Piece Rate, Merrick Multiple Piece Rate, Emerson’s Efficiency Plan, Gantt Task and Bonus System, Bedeaux or Points Scheme, Hayne’s Plan, Barth Scheme, Accelerating Premium Bonus Plan, Priestman’s Production Bonus Plan (with Features, Examples, Formulas, Advantages and Disadvantages)

- Types of Incentive Plan – Important Premium Plans: Halsey Premium, Halsey-Weir Bonus Scheme, Rowan Plan and Group Bonus System (With Illustration, Similarities, Differences, Examples, Solution and Advantages)

- Top 4 Types of Incentive Plan – Taylor Differential Piece Rate Method, Merrick Multiple Piece Rate system, Halsey Premium Bonus Plan and Rowan Premium Bonus Plan (with Features and Formula.

- Incentive Plan – For Indirect Workers (With Important Methods of Incentive Schemes)

- Top 3 Types of Incentive Plan – Profit Sharing Plan, Co-Partnership and Non-Monetary Incentives (With Merits and Demerits)

Incentive Plan: Types, Group Incentive Plans, Halsey Plan, Examples, Formulas, Advantages, Disadvantages and Everything Else..

Incentive Plan:Halsey (And Halsey-Weir) Premium Plan, Rowan Plan, The Hour-to-Hour or 100% Bonus Plan, Taylor’s Differential Piece Rate, Merrick Multiple Piece Rate, Emerson’s Efficiency Plan, Gantt Task and Bonus System, Bedeaux or Points Scheme, Hayne’s Plan, Barth Scheme, Accelerating Premium Bonus Plan, Priestman’s Production Bonus Plan (with Features, Examples, Formulas, Advantages and Disadvantages)

Some of the specific incentive plans are being discussed here:

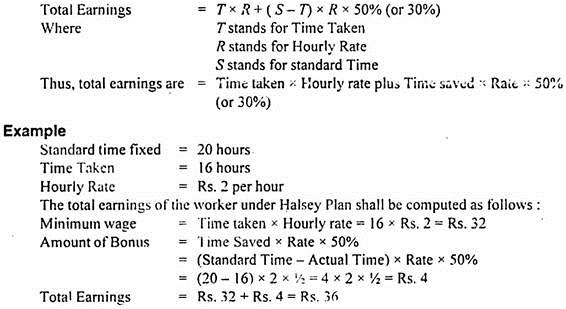

Type # 1. Halsey (And Halsey-Weir) Premium Plan:

ADVERTISEMENTS:

It is a simple combination of time-speed basis of payment.

The feature of the plans are:

(a) Worker is paid at an hourly rate for the time for which he has worked.

(b) A standard time is determined and if a worker finishes a job before the time fixed, he is paid a bonus for the time saved, besides the wages for the actual time spent by him on the job.

ADVERTISEMENTS:

(c) The amount of bonus is 50% of the time saved in case of Halsey Plan and 30% In case of Halsey-Weir Plan and is allowed at the same hourly rate at which he is paid Tor actual time worked.

Thus, his total emoluments are the aggregate of guaranteed hourly wages for actual time worked plus the amount of bonus.

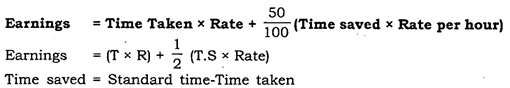

It can be expressed by way of a formula:

Advantages:

ADVERTISEMENTS:

(i) The system is easy to operate. Calculations involved are not very complicated.

(ii) Both the employer and the employees are benefited by this plan as the profit of time saved is divided between both of them.

Disadvantages:

(i) It is a difficult task to determine a standard time. Fixation of standard time on the basis of performance of the most efficient worker shall be of no use since all the workers shall finish the work beyond the standard time.

ADVERTISEMENTS:

Proper time and motion studies should be carried out and there should be scientific determination of standard time. Past performances of the workers should guide the management in the task of setting up of standards.

(ii) Workers object to this scheme because they do not get the full profit of the time saved. But this objection is not tenable since the time saved may also be due to the cooperation of the management.

(iii) Workers may perform certain jobs with a high speed to earn bonus and may soldier on other jobs to take rest, for they are guaranteed wages for the actual time taken. Thus, the management is at the mercy of labour regarding the speed of production work.

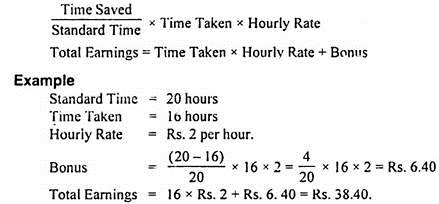

Type # 2. Rowan Plan:

ADVERTISEMENTS:

Rowan Plan differs from the Halsey plan regarding calculations of bonus. It is modified form of the Halsey System. The workers get wages at an hourly rate for the actual time spent on the job under this plan also. Besides the guaranteed minimum wages, they get a bonus if the task is finished before the determined standard time as is the case with Halsey plan. Under this plan bonus is that proportion of wages of actual time taken which the time saved bears to the standard time in place of 50% or so as in the case of Halsey plan.

The merits and demerits of Halsey plan are applicable in case of Rowan plan also.

Besides those, the other disadvantages of Rowan plan are as follows:

(i) The calculations are not simple and hence the workers sometimes fail to understand the computations.

ADVERTISEMENTS:

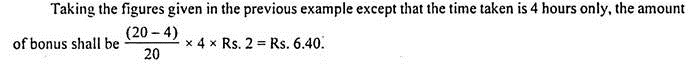

(ii) Under certain circumstances, a very efficient worker and comparatively not so efficient worker earn the same amount of bonus. This is because after every decrease in the time taken beyond 50% of the standard time, the amount of bonus goes on decreasing.

Example:

Thus, we see that in spite of the fact that a worker has finished the job only in 4 hours, his bonus is the same as that of a worker who does the work in 16 hours. It leads us to conclude that workers shall not exert their labour so as to finish the work in less than 50% of the standard time.

Comparison of the Two Plans:

ADVERTISEMENTS:

If a worker finishes the work in half of the time allotted to him, the amount of bonus as well as total earnings shall be the same under both the plans— Rowan and Halsey (assuming the bonus at 50% under Halsey plan). The reward for the increase in effort is not to that extent under Rowan plan as it is under Halsey plan.

If the time taken is more than the time saved the worker is benefited under Rowan plan but as the time taken decreases and the time saved increases to more than the time taken, the worker is better remunerated under Halsey plan. (The student can himself see it by calculating the bonus and total earnings under both the plans with the help of different examples).

Type # 3. The Hour-to-Hour or 100% Bonus Plan:

Under this plan, 100% of the time saved is paid to worker as bonus. It is different from piece rate system because here the standard time per unit of output is fixed rather than a standard rate per unit of output.

The formula of calculating the earnings can be expressed thus:

Total Earnings = Time taken x Hourly Rate + Time Saved x Hourly Rate

ADVERTISEMENTS:

Example:

Standard time per piece = 1 hour

No. of pieces completed = 10

Actual time taken = 6 hours

Hourly Rate = Rs. 2 per hour

Earnings = 6 x Rs. 2 + (10 – 6) x Rs. 2

= Rs. 12 + Rs. 8 = Rs. 20.

If a worker completes only 5 pieces then also he shall get the wages for 6 hours of work at the rate of Rs. 2 per hour. Thus, in fact, it is a piece work system combined with a minimum wage at the time-rate system. The total pay is exactly the same as under piece-rate system if the worker attains the standard speed i.e. he starts completing one piece in one hour.

The system is considered most suitable from the point of view of equity and justice. From the costing point of view, the unit cost shall be constant, once the standard speed is attained by a worker. The system differs from Halsey plan since here bonus is paid at 100% of time saved instead of 50% (or 30% Halsey-Weir Plan) of time saved under Halsey plan.

Type # 4. Taylor’s Differential Piece Rate:

F. W. Taylor introduced a scheme for wage payment by which the goal of maximum output may be achieved. The basis suggested by Taylor is that low piece rate should be paid for low production and high piece rate should be paid for high production.

According to Taylor, a standard time is fixed and the worker who finishes the allotted work before the standard time should be paid at a higher rate and the worker who cannot complete the task within the standard time should be remunerated at a lower rate.

This standard should be set up very accurately with the help of time and motion studies because it is the demarcating line for higher and lower rates of wages. Thus, two piece rates are fixed, one for those who perform the standard task in standard time (may be termed as efficient workers) and the other for those who perform less than the standard task in the standard time (may be termed as inefficient workers).

Usually rates are 175% and 83% of the piece work rate for efficient and inefficient workers respectively.

Example:

Standard production = 10 units per hour

Working hours in a day = 8 units

Worker A produces = 70 units

Worker B produces = 100 units

Hourly rate for less than the standard production is Rs. 2 per unit.

Hourly rate for standard and more than the standard production is Rs. 3 per unit.

The standard production in 8 hours should be 80 units. Worker A, who produces 70 units, i.e., below standard shall get wages @ Rs. 2 per unit i.e., Rs. 140 and worker B who produces 100 units shall be getting 100 x Rs. 3 i.e., Rs. 300, because he produces more than the standard output.

Thus, this system provides a great incentive to workers to cross the standard line and the slow workers always try to achieve greater proficiency. However, the day wages are not guaranteed to workers under this system. The system is beneficial to workers as well as employers, since the workers get wages at an increased rate according to units produced and the employers get increased output at lower cost of production.

The system is disadvantageous since its application is difficult besides not assuring any minimum wage. The limit set in is not justified because if a worker just fails to reach the standard output, the low rate of wages shall be given to him while if he just crosses the limit, higher rate of wages shall be payable to him.

Besides that, there is a great difference of amount in the high and low rates. The large variation in the earnings of workers because of high and low rates is a source of conflict among them. Moreover, employer-employee relations may also be strained, if the standard is put at a very high level.

Type # 5. Merrick Multiple Piece Rate:

Under this system, all the essentials of Taylor’s Differential Piece Rate are present except the fact that there are several differentials or say 3 graded piece rates instead of only one differential i.e., 2 piece rates.

The defect of the Taylor’s system in regard to a sudden change in the rate of wages is removed by this system to some extent. Three categories of workers are there—beginners, average workers and first-class men—under this system.

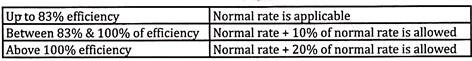

The rates usually applied are as under:

(a) Up to 83% – Ordinary piece rate

(b) 83% to 100% – 110% of ordinary piece rate

(c) Over 100% – 120% of ordinary piece rate

Example:

Standard task 12 units per hour.

The worker who produces less than 10 units per hour can be paid, say, at the rate of Rs. 2.20 per unit; another who produces, say 10 to 12 units per hour may be paid at the rate of Rs. 2.50 per unit and the third one who produces more than 12 units may be remunerated at the rate of Rs. 3 per unit.

Type # 6. Emerson’s Efficiency Plan:

This scheme combines minimum day wages and the differential rate. Emerson, one of Taylor’s associates, formulated this scheme. Under this plan, a standard task for a unit of time or standard time for a job is set up first, and then the level of worker’s efficiency is determined on that basis. If a worker can finish the task in the allotted time, he is regarded as 100% efficient—one of 66 2/3 % efficiency and another of 150% efficient.

The bonus is paid to a worker at a nominal rate if he just attains the level of 66 2/3% efficiency. The bonus increases in a given ratio as the output increases from 66 2/3 % of standard output and beyond the level of 100% efficiency.

Different rates are applicable at different levels of efficiency. Emerson used 32 differentials so that each and every worker tries to work harder at every stage and earn more and more by increased bonus rate. The increase in rate is gradual and thus the transition is affected from day rate to piece rate as and when there is better performance of workers.

The workers who cannot attain 66 2/3% level of efficiency are paid at the time rate. Beyond that, the graded scale of bonus starts and at 80% efficiency, the amount of bonus is 4% efficiency, it increases to 20% of the wages earned. If the worker is more than 100% efficient, he will receive wages for the time taken plus 20% of wages so earned and plus wages for time saved.

Example:

Standard output – 1,000 units per day

I Worker produces – 600 units per day

II Worker produces – 800 units per day

III Worker produces – 1,000 units per day

IV Worker produces – 1,200 units per day

First worker works at 60% efficiency and hence he will get wages at time rate, second worker works at 80% efficiency, hence he would be paid daily wages according to time rate plus 4% bonus; the third worker is at 100% level of efficiency, therefore, he will be remunerated according to time rate for hours worked plus a bonus at 20. The fourth worker’s efficiency is 120%, His remuneration will be the day wage plus 40% as bonus (20% for time saved and 20% for bonus).

Type # 7. Gantt Task and Bonus System:

This system also involves establishment of standards after carrying out proper time and motion studies. Workers who complete their task in the standard time, are termed as 100% efficient. They get wages for the time taken plus bonus at a fixed percentage of the wages earned. Workers who complete their job in less than the standard time get wages for the standard time plus bonus at a fixed percentage of wages earned.

Bonus is generally 20% of time wages earned. Slow workers are paid guaranteed wages for the day. Mr. Gantt has remarked—”If a man follows his instructions, and accomplishes all the work laid out for him as constituting his proper task for the day, he is paid a definite bonus in addition to the day rate which he always gets. If, however, at the end of day, he has failed to accomplish all of the work laid out, he does not get his bonus, but simply his day rate.”

The demerit of this plan is that workers are divided into categories—one who get the bonus and the others who do not.

Example:

Standard Rate = Rs. 2 per hour

Standard hours for the job 10 hours.

Bonus is 20% of standard time.

I Worker completes the work in 12 hours.

II Worker completes the work in 10 hours.

III Worker completes the work in 8 hours.

First worker shall receive the wages for the work for 12 hours at the rate of Rs. 2 per hour i.e., Rs. 24. Second worker shall get the wages for 10 hours at the rate of Rs. 2 per hours i.e., Rs. 20 plus 20% of 10 hours i.e. for 2 hours @ 2 or Rs. 4, thus in aggregate 24. We can say that he shall be remunerated for 12 hours.

The third worker who does the work in 8 hours shall receive the wages for 10 hours as it is the standard time set for the job plus 20% of 10 hours. Thus, his remuneration shall be 10 x Rs. 2 + 2 x Rs. 2 i.e., Rs. 20 + 4 = Rs. 24 per hour.

Thus, with the reduction of time spent on the job, the earnings per hour increase and hence, the total earnings per day go on increasing. Therefore, this system is also named as “Progressive Rate” system. Thus, it is a system of time rate for sub-standard workers and piece rate for standard and above standard workers.

Type # 8. Bedeaux or Points Scheme:

In this system, a point or, bedeaux abbreviated as “B” is defined as the work which a man should be able to perform in one minute. The standard work per minute is set after careful time and motion studies. A task or operation can be expressed in a number of “Bs” depending upon the nature of the job. The standard “B” makes allowance for the normal rest and fatigue also.

Thus, the “B” which is to be done in one minute is normal task which can be performed by normal workers. The standard time of different jobs is calculated beforehand and is expressed in terms of “Bs”. Thus, if standard time for a job is 10 hours, under this plan it would be expressed as 600 “Bs”. The standard ‘Bs’ of various jobs done by a worker in a week are calculated and compared with the actual time.

If the actual time exceeds the standard time, the worker gets wages for actual time worked. Thus, the system guarantees time wages to workers. If the standard “Bs” exceed the actual time, the difference is divided by 60 to get hours saved.

The wages for such time saved are divided between worker and the foreman in the ratio of 3 : 1. This is done on the basis that good performance of the worker is also due partly on account of the cooperation given to him by the foreman. Now there is a tendency to give the entire bonus for the time saved to the worker, since the sharing by the foreman used to be resented by the workers.

The number of “Bs” or points earned by a worker are put on the notice board daily so that the worker can know the wages earned by him and can make efforts to earn more points to achieve the standard. This acts as an incentive for higher production in the factory.

Type # 9. Hayne’s Plan:

Under this plan also, the standard is set in minutes. The standard time for my job is expressed in the standard man-minutes called as “MAINTS” under the plan. If the work is of a repetitive nature, the time saved is shared between the worker and the foreman in the ratio of 5:1. If the work is non-repetitive, the worker, the employer and the foreman share the value of time saved in the ratio of 5 : 4 : 1. The worker is paid according to hourly rate for the time spent by him on the job. Thus, the time wages are assured to the worker.

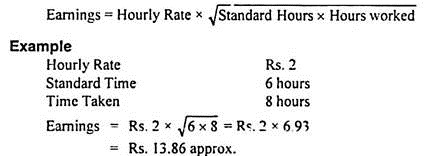

Type # 10. Barth Scheme:

The formula for calculating the remuneration is as follows under this scheme:

The scheme is entirely different from the other schemes, and applied for the workers who are new to the industry and the work. After they are trained and they become well-versed with the work, some other scheme is adopted in place of Barth scheme.

The scheme shall be unsuitable for more and more efficient workers as the rate of increase of bonus is very slow. It cannot provide incentives to workers in case when efficiency exceeds 100%.

Type # 11. Accelerating Premium Bonus Plan:

Under this plan bonus is paid to workers at an increased late according to more and more time saved, instead of as a fixed percentage under Halsey Plan and as a decreasing percentage under Rowan Plan. This provides a great inducement to workers to achieve the goal of higher production.

Type # 12. Priestman’s Production Bonus Plan:

Under this plan the standard output is determined beforehand which has to be achieved, say, in a week by the workers as a group in a factory. The standard output can be set in terms of units or points. If the workers produce more than the standard output, the bonus is paid to them according to the proportion of increase in output. This is cooperative production bonus plan since all the workers jointly make efforts to attain the standards.

Example:

Workers engaged in a factory = 100

Standard output = 400 units in a week

Actual output = 500 units.

In addition to the basic wages, the workers shall receive a bonus for the increase of output by 100 units. The proportion of increase is 25% of the standard and hence, all the workers shall get a bonus of 25% on their wages.

Type # 13. Bonus System for Indirect Workers:

Some progressive concerns have designed systems of rewarding even indirect workers by setting up norms for the results of their efforts. They are based either on the own efforts of the indirect workers or the output of allied group of direct workers.

For example, in the former case a maintenance foreman may be rewarded for the timely completion of the maintenance programme, a sweeper may be rewarded on the basis of the floor area cleaned by him etc.

In the latter case the indirect workers may also be granted some incentive bonus if the workers of the departments to which they render service become entitled to bonus. This may be justified on the ground that they have also helped the direct works in completing or achieving their targets.

However, the former method should be preferred to the latter because that links bonus with the own efforts of the worker.

Individual and Group Bonus Schemes:

Incentive schemes to reward the workers for their efficiency and to motivate them to perform above average level of activity, may be either on individual basis or group or gang basis. In those cases where the work of individual workers can be measured against the standards set, it would be certainly better to pay incentives on the basis of relative efficiency of each worker.

This will be a great moral boost to the worker since he knows that his reward has a direct link with his own performance. However, the scheme should be well-defined and clearly understood by the worker.

In those cases where the output of individuals cannot be measured separately, group bonus schemes are used. In case of such a scheme, the group as a whole gets a reward for performance.

The scheme has the following advantages:

(i) Team spirit develops among the workers since each worker knows that his or her reward for performance of the group as a whole.

(ii) There is a healthy competition between different groups doing the same job. This results in more production but less costs.

(iii) The supervisors and operators also feel interested in the scheme since they will also be rewarded for the performance of their group.

(iv) It involves less accounting and costing work.

Group incentive schemes sometimes do not work effectively because of some workers being lazy and inefficient. Other workers also become lazy in due course since they resent sharing of fruits of their hard work by other inefficient workers. Moreover, induction of new workers in the existing groups become difficult on account of opposition by existing workers.

Types of Incentive Plan – Important Premium Plans: Halsey Premium, Halsey-Weir Bonus Scheme, Rowan Plan and Group Bonus System (With Illustration, Similarities, Differences, Examples, Solution and Advantages)

The following are the important premium plans:

1. Halsey Premium:

This plan was introduced by F.A Halsey in 1891. In this plan an hourly rate is fixed for remunerating the worker. A standard time is also fixed for each job expressed in hours of work. If a worker finishes the job in less than the standard time he is offered a bonus which is equal to 50% of the wages of time saved.

If a worker takes the standard time or more to complete the job or operation, then wages for actual time taken by him at the time rate is paid (no bonus is given).

Advantages of Halsey Plan:

The various advantages of Halsey plan are:

i. This system is simple to understand and easy to operate.

ii. It guarantees time wages to workers

iii. The wages of time saved are shared by both the employer and employees.

iv. It distinguishes efficient employees from inefficient employees.

v. Fixed overhead cost per unit is reduced with increase in production

vi. Under this system inefficiency is not penalized.

Disadvantages of Halsey Plan:

The main disadvantages of Halsey plan are:

i. Fixation of standard time is very difficult

ii. The incentive or bonus provided under this scheme is not as high as the straight piece rate system.

iii. Under this scheme there is the possibility of the workers rushing through their work to save time. This results in the neglect of the quality of work.

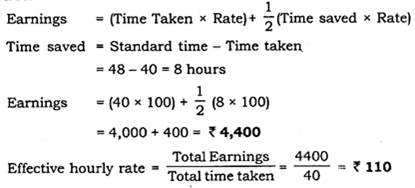

Illustration:

From the following data calculate the earnings of a worker under Halsey plan. Also calculate effective hourly rate.

Time allowed – 48 hours

Time taken – 40 hours

Rate per hour – Rs. 100

Solution:

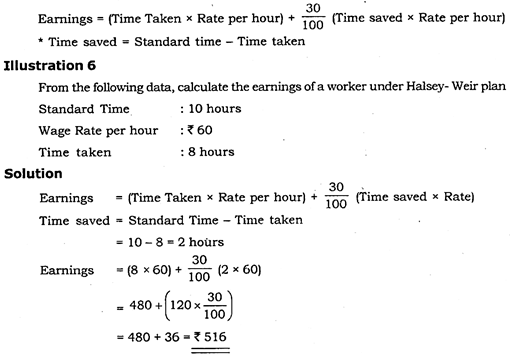

2. Halsey-Weir Bonus Scheme:

The Halsey’s bonus scheme introduced in England, by Messrs G and J Weir with slight modification is called “Halsey Weir Bonus scheme”.

Under this scheme a standard time is fixed for the completion of each job or operation. Each worker is guaranteed time wages at an agreed hourly rate for the number of hours worked on the job, whether he completes the job within the standard time or not.

If a worker completes the job in less than the standard time and saves some time, he is paid bonus for the time saved in addition to the time wages. Bonus is 30% of the time saved at the agreed hourly rate for the actual workers worked.

3. Rowan Plan:

This system was introduced by David Rowan of Glasgow. This system is similar to Halsey plan. A standard time is fixed for each job or operation. Each worker is guaranteed time wages at an agreed hourly rate for the actual number of hours worked, whether he completes the job within the standard time or not.

If a worker completes the job or operation in less than the standard time allowed, he is given bonus for the time saved in addition to time wages, at the agreed hourly rate. Bonus is that proportion of wages of actual time taken which the time saved bears to standard time.

Comparative Study of Halsey Plan and Rowan Plan:

Similarities:

The main similarities between these two schemes are:

i. Both Halsey plan and Rowan plan guarantee time wages to workers

ii. In both the schemes, bonus is paid only for the time saved.

iii. In both the schemes, the gains arising from the time saved by the workers are shared by both the employer and the employees.

Differences:

The main differences between these two schemes are:

i. Halsey plan is simple to understand and execute; whereas Rowan plan is difficult to understand and execute.

ii. Under Halsey plan, the gains arising from the time saved by the workers are shared between the employer and employees equally; whereas, under Rowan plan, the gains arising from the time saved by the workers are shared between the employer and employees, but not equally.

Advantages of Rowan Plan:

The advantages of Rowan plan are the following:

i. This system provides incentive for efficiency

ii. It assures the minimum time wages to workers.

iii. It is suitable for beginners.

iv. The employer is protected even if the rate is not properly fixed

v. It pays higher bonus to workers compared to Halsey plan.

vi. It results in reduction in labour cost per unit.

Disadvantages of Rowan Plan:

The disadvantages of this system are the following:

i. It is difficult to understand and calculate.

ii. Efficiency beyond certain point is not rewarded.

iii. The system is more complex and expensive.

4. Group Bonus System:

Where a group of workers is collectively responsible for manufacturing the product, it may not be possible to adopt individual incentive schemes. Under such circumstances bonus is paid to that particular team working together. Group bonus is based on the combined output of the team.

So, to determine the amount of bonus, productivity is found out. Then, the bonus so distributed is shared between them on an agreed ratio, usually in the ratio of likely time earnings. Group bonus refers to the bonus paid for the collective efforts made by a group of workers. It is distributed among them on an agreed basis.

Advantages of Group Bonus Scheme:

The following are the advantages of group bonus system:

i. It creates team spirit among the workers

ii. Eliminates excessive wastage of materials since it creates a healthy competition among different groups.

iii. Encourages supervisors to raise production

iv. Easy to understand and requires less cost accounting work.

Disadvantages:

The disadvantages of group bonus system are:

i. Difficult to get worker’s acceptance.

ii. Number of members of a group should not be large.

iii. Practical difficulties in fixing the amount of incentive.

iv. Less flexible than individual schemes.

Various Methods of Distribution of Group Bonus:

The following are the methods of distribution of group bonus:

1. If, in a group, the workers are uniformly qualified and skilled, the group bonus can be equally distributed.

2. On the basis of time wages of individual workers.

3. Determining the skill, rate of pay, etc., of worker and then as a specified percentage.

4. In proportion of time rate of each worker. This can be applied only in case where time put in by the individual workers is the same.

Top 4 Types of Incentive Plan – Taylor Differential Piece Rate Method, Merrick Multiple Piece Rate system, Halsey Premium Bonus Plan and Rowan Premium Bonus Plan (with Features and Formula)

Following is the list of many incentive plans being practiced by various organizations:

(1) Taylor Differential Piece Rate Method

(2) Merrick Multiple Piece Rate system

(3) Halsey Premium Bonus Plan

(4) Rowan Premium Bonus Plan

The following are the important methods of incentive plans:

(1) Taylor Differential Piece Rate Method:

This system was introduced by F. W. Taylor, the father of Scientific Management.

The main features of this incentive plan are as follows-

(a) Day wages are not guaranteed, i.e. it does not assure any minimum amount of wages to workers,

(b) A standard time for each job is set very carefully after time and motion studies,

(c) Two piece rates are set for each job- the lower rate and the higher rate.

The lower piece rate is payable where a worker takes a longer time than the standard time to complete the work. Higher rate is payable when a worker completes the work within the standard time.

In other words, lower piece rate is payable for low piece work (inefficient workers) and higher piece rate is payable for high piece of work (efficient workers). As per this, there is a great difference between the wages of an efficient and an inefficient worker.

Earnings under this method is calculated as follows:

Earnings = No. of units produced x Differential Rate per unit Differential Rate per unit = Rate per unit x % of efficiency

(2) Merrick’s Differential Piece Rate System:

This system was introduced by Mr. Merrick and it is a modification of Taylor’s differential piece rate system. Under Taylor’s differential piece rate system, workers who are not attaining the standard output (100%) are penalized, whereas under Merrick system, there is no imposition of such punitive lower rate upon them.

Under this method workers are paid based on certain percentage of efficiency and the differential rate is calculated as follows:

(3) Halsey Premium Bonus Plan:

This plan was introduced by F A Halsey in 1891. It is a simple combination of time and piece rate systems. A worker is paid a guaranteed base rate and is rewarded when his performance exceeds the standard output. A standard time is established in respect of each job. Bonus is paid on the basis of 50% of time saved.

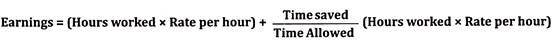

The total wages payable or earnings under this method is calculated as follows:

Earnings = (Hours worked x Rate per hour) + ½ (Time saved x rate per hour) Time saved = Standard time – Hours worked (Time taken)

(4) Rowan Premium Bonus Plan:

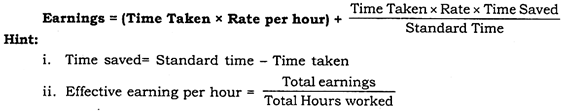

A standard time is established in respect of each job or process. There is a guaranteed base rate. A bonus is paid on the basis of time saved computed as a proportion of the time taken which the time saved bears to the standard time or time allowed.

The total wages or earnings under this method is calculated as follows:

Incentive Plan – For Indirect Workers (With Important Methods of Incentive Schemes)

In the manufacturing of an article, indirect workers also play an important role. They are as important as direct worker and, therefore, incentives should be made for them as well. They are as much entitled to bonuses as the direct workers, because any lackness in their service may come in the way of realising organisational goals.

Payment of bonus to indirect workers creates team spirit and they work with zeal and enthusiasm. It also helps in maintaining the efficiency of important services like plant repairs, stores maintenance, materials handling etc.

While introducing incentive schemes to indirect workers the following points should be kept in mind –

(i) The scheme should achieve all-round efficiency in the organisation,

(ii) It should be provided for a specific period, say a week, a month etc.,

(iii) It should be organised to relate the rewards with the efforts,

(iv) It should ensure payment of bonus at regular intervals.

Some of the important methods providing incentives to indirect workers may be stated thus:

(i) Repairs and Maintenance Staff:

Incentive schemes for this class may be introduced in the following manner:

a. For routine and repetitive work, for which efficiency can be measured, a group system may be set up.

b. It may be based on the reduction of breakdowns and number of complaints.

c. If the work can be associated with a group of direct workers, bonus payable may be related to their output.

(ii) Store Staff:

Introduction of an incentive scheme for this class may be based on:

a. Value of materials handled, or

b. Number of requisitions handled.

(iii) Office Staff:

To give incentive to office staff, job evaluation may be done for each item of office work and an appropriate bonus scheme may be fixed on the basis of performance (for reduction of overtime, for disposing of files for clearing pending work, for maintaining schedules etc).

(iv) Materials Handling Staff:

Incentives to this group may be based on the number of items of materials handled. To this end, standard hourly rates may be fixed, and where this is not feasible, a monthly overall bonus related to the efficiency of performance may be granted.

(v) Executives:

Supervisors, foremen and executives could be provided adequate non-financial incentives in the form of job security, participation in decision making, career development activities, housing facilities, medical benefits.

Other Incentive Plans:

Indirect Monetary Incentives based on the prosperity of an organisation may also be offered to workers with a view to promote zeal and commitment on their part.

The following schemes fall under this category:

(i) Profit sharing

(ii) Co-partnership.

(i) Profit Sharing:

Profit sharing is a scheme whereby employers undertake to pay a particular portion of net profit to their employees on compliance with certain service conditions and qualifications. The purpose of introducing profit sharing schemes has been mainly to strengthen the loyalty of employees to the firm by offering them an annual bonus (over and above normal wages) provided they are on the service rolls of the firm for a definite period.

The share of profit of the worker may be given in cash or in the form of shares in the company. These shares are called bonus shares. In India, the share of the worker is governed by the payment of Bonus Act.

Merits:

a. The idea of sharing the profits inspires the management and the worker to be sincere, devoted and loyal to the firm.

b. It helps in supplementing the remuneration of workers and enables them to lead a rich life.

c. It is likely to induce motivation in the workers and other staff for quicker and better work so that the profits of the firm are increased, which in turn increases the share of workers therein.

d. Workers do not require close supervision, as they are self-motivated to put in extra labour for the prosperity of the firm.

e. It attracts talented people to join the ranks of a firm with a view to share the profits.

Demerits:

a. Profit sharing scheme is, in practice, a fair-weather plan. Workers may get nothing if the business does not succeed.

b. Management may dress up profit figures and deprive the workers of their legitimate shared profits.

c. Workers tend to develop loyalty towards firm discounting their loyalty toward trade unions, thus impairing the solidarity of trade unions.

d. Fixation of worker’s share in the profits of a firm may prove to be a bone of contention in the long run.

(ii) Co-Partnership:

In this system, the worker gets his usual wages, a share in the profits of the company and a share in the management of the company as well. Thus, employees share the capital as well as profits. When co-partnership operates with profit sharing the employees are allowed to leave their bonus with the company as shares (bonus shares).

This system is an improvement over all other systems of wage payment in that it implies both profit-sharing and control sharing. It also offers a recognition of the claim of the dignity of labour as the worker is viewed as a partner in the business. They would, in turn, create a sense of belongingness among workers and stimulate them to contribute their best for the continued prosperity of the company.

Top 3 Types of Incentive Plan – Profit Sharing Plan, Co-Partnership and Non-Monetary Incentives (With Merits and Demerits)

1. Profit Sharing Plan:

A part of the profit is paid as bonus as per the agreement between labour union and the management. In India profit sharing bonus is governed by Payment of Bonus Act 1965. According to this act minimum bonus payable is 8.33% of wages and maximum bonus is 20% of wages. There is no restriction in payment of bonus in excess of 20% if the management is willing.

Merits:

i. It promotes employer and employee co-operation.

ii. A sense of attachment with the company is established in the minds of workers.

iii. It induces workers to improve their efficiency.

Demerits:

i. Bonus payable is ascertained only at the end of the year. During the year the workers are in the dark about the amount of bonus they will get. This delayed payment of bonus does not motivate the workers sufficiently.

ii. Often there is dispute between management and workers in fixing the rate of bonus payable.

iii. Workers may not get any bonus in the year of loss. The loss may be due to various market conditions, but workers are denied bonus.

iv. All workers get same rate of bonus irrespective of their individual efficiency.

2. Co-Partnership:

Under this scheme workers become co-partners of the business by contribution to the capital of the company. Thus employees become co-owners of the business and get a share in the profit. Employee’s stock option plan is an example of co-partnership.

Merits:

i. It reduces the labour – management misunderstanding.

ii. It instils a sense of oneness with the business.

iii. Labour turnover is reduced considerably.

iv. Employees themselves are interested in increasing the profit of the business.

3. Non-Monetary Incentives:

Workers can also be motivated by providing good facilities.

The following are few examples of non-monetary incentives:

i. Good working conditions,

ii. Free medical care,

iii. Free transport facilities,

iv. Subsidised canteen facilities,

v. Promotion,

vi. Free or subsidised housing facilities,

vii. Welfare schemes.

Merits:

i. It does not increase the wage payment.

ii. It creates satisfaction in workers mind and improves the morale of employees.

iii. It helps to reduce the labour turnover.

iv. Helps in attracting the skilled and efficient workers.

v. It reduces workers absenteeism.