Here we detail about the nine steps for balancing of accounts in ledger.

Balancing of an account is to total both debit and credit sides of an account and putting the difference on that side which is shorter. All ledger accounts are usually closed and balanced at the end of an accounting period. The main reason for balancing is to ascertain the precise position of a business enterprise at a particular period of time. It is worth mentioning here that only permanent accounts are balanced and carried forward to the balance sheet.

Examples of permanent accounts are assets, liabilities and capital accounts. All temporary accounts viz. expenses and revenues are not balanced; rather at the end of the accounting year, they are directly transferred to the Trading and Profit & Loss Account.

The following steps are taken for balancing the accounts:

ADVERTISEMENTS:

Step 1:

Both the sides of an account are totaled.

Step 2:

The difference of both the sides is ascertained.

ADVERTISEMENTS:

Step 3:

If total of debit side exceeds the total of credit side, it is known as debit balance and the difference is inserted on the credit side by writing the words ‘By Balance c/d or By Balance c/o or By Balance c/f’ in the particulars column.

Step 4:

If total of credit side exceeds the total of debit side, it is known as credit balance and the difference is inserted on the debit side by writing the words ‘To Balance c/d or To Balance c/o or To Balance c/f’ in the particulars column.

ADVERTISEMENTS:

Step 5:

Record the date on which the account is closed and balanced.

Step 6:

Write total amount on both sides of the account horizontally.

ADVERTISEMENTS:

Step 7:

Draw single lines just above and double lines or single thick line just below the total amounts on each side of account.

Step 8:

ADVERTISEMENTS:

In case of debit balance, bring down the balance by writing the words ‘To Balance b/d or To Balance b/o or To Balance b/f’ in the particulars column and record the date at the beginning of the next accounting period.

Step 9:

In case of credit balance, bring down the balance by writing the words ‘By Balance b/d or By Balance b/o or By Balance b/f’ in the particulars column and record the date at the beginning of the next accounting period.

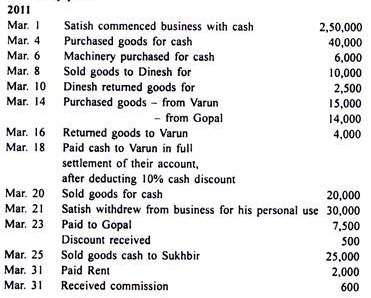

Illustration: (Comprehensive)

ADVERTISEMENTS:

Journalise the following transactions, post them into Ledger and balance the account. The books are closed on 31st March 2011 every year.