After reading this article you will learn how to post journalized transactions into ledger accounts.

Ledgers are the main or principal books of account wherein account-wise synthesis of primary records are made and account-wise balance of each such account is determined. Posting means each record in ledger made out of journal. Balancing means determination of accumulated total of each account in the ledger at a particular point of time.

Design of Ledger Account:

ADVERTISEMENTS:

Usual and Traditional design of a Ledger account is shown in Exhibit 5.3.

A ledger account has two sides: debit and credit. Each of the debit and credit side has five columns—

(i) Date,

ADVERTISEMENTS:

(ii) Particulars,

(iii) Journal folio (J.F.), i.e., journal page number from which debit or credit is taken,

(iv) Ledger folio (L.F.), i.e., ledger page number of corresponding account, and

(v) Amounts of debit or credit.

ADVERTISEMENTS:

Ledger Posting:

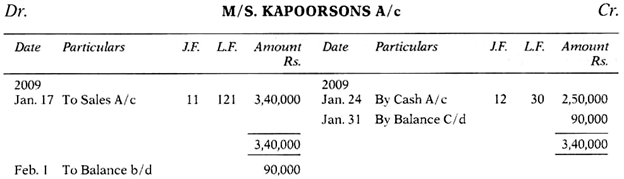

There are as many as thirteen accounts, namely; Cash A/c, Capital A/c, Leasehold Property A/c, Furniture A/c, Purchases A/c, Carriages A/c, Sales A/c, M/s Jeo & Co. A/c, M/s Kapoorsons A/c, Wages A/c, Electricity Charges A/c, Telephone Expense A/c and Drawings A/c. Can you now say what is the amount of total purchases? What is the amount of sales? How much is cash in hand? Yes, you can do it by adding debit with debit and deducting the credit. For large number of transactions it will take long time. Ledger posting is a synthetical technique by which you can say this immediately.

The following steps are to be followed for ledger posting:

(i) Open the necessary accounts in the ledger book. Each account should be opened in a separate page and adequate pages should be left before starting a new account, since large number of postings may be necessary in each account. For example, in a ledger book Capital A/c may be in Page No. 1, Purchases A/c in Page No. 7, and so on.

ADVERTISEMENTS:

(ii) A debit account is posted on the debit side mentioning the name of the corresponding credit account attaching a prefix ‘To’.

Example, Deembale invested Rs.14,00,000. Journal entry is—

Exhibit 5.4 shows that in the Cash Account ‘To Capital A/c’ is posted on the debit side. This means Cash A/c is debited to Capital A/c.

ADVERTISEMENTS:

(iii) A credit account is posted on the credit side mentioning the name of the corresponding debit account attaching the prefix ‘By’.

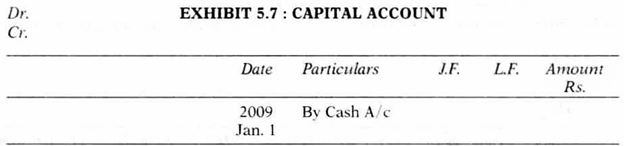

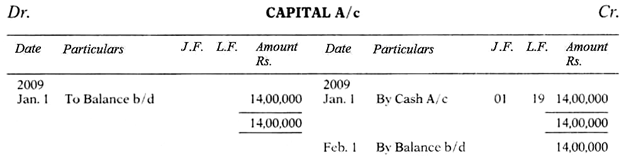

Exhibit 5.5 shows that in the Capital Account ‘By Cash A/c’ is posted on the credit side. This means Capital Account is credited by Cash Account.

(iv) In case of posting on the debit side mention the date of transaction in the date column of debit side. But for posting on the credit side mention date of transaction in the date column of the credit side. See Exhibits 5.6 and 5.7.

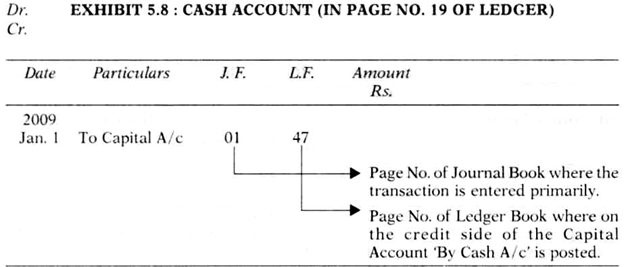

(v) Journal Folio of both the accounts involved in a transaction is the same. (For example, journal entry for the transaction ‘Deembale invested Rs.14,00,000 is recorded in Page No. 01 in the Journal Book. So in both the Cash Account and Capital Account against the posting dated 1st Jan. J.F. is 01’. See Exhibit 5.7.)

(vi) If posting in the Cash Account is done in Page No. 19 and in the Capital Account in Page No. 47 of the ledger, then post 47 in the L.F. Column of the Cash Account on the debit side, but post 19 in the L.F. column of the Capital Account on the credit side. See Exhibit 5.8.

ADVERTISEMENTS:

(vii) Put the amount of the transaction in the respective account columns of both the accounts. See Exhibit 5.10.

Balancing:

ADVERTISEMENTS:

Balancing is the determination of accumulated total of ledger accounts at a given point of time. It is either total of debits for a given time over total of credits or total credits for a given time over total of debits.

Given below the Purchase Account and Sales Account which are prepared from the journal entries given in Illustration 5.2 for the month of January.

Balance put on the debit side for total of credits.

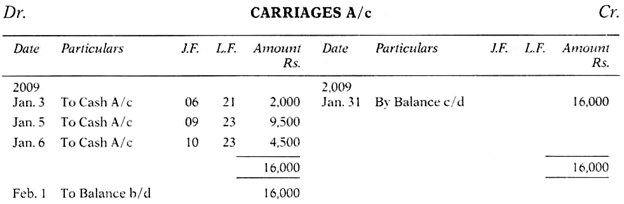

If total debits are more than total credits, balance is put on the credit side. It is called debit balance. Similarly, if total credits are more than total debits, balance is put on the debit side. It is called credit balance.

In the Purchase Account total of debits is Rs.8,50,000 but it has no credit. So Rs.8,50,000 are put on the credit side as debit balance. In the sales account total of credits is Rs.7,30,000 but it has no debit. So Rs.7,30,000 are put as credit balance in the debit side. The words ‘Carried Down’ or ‘c/d’ arc used as suffix to the word ‘Balance’. This means the balance is further carried to the next period. It is not closed by transferring to any other account.

After balancing, both sides of the ledger account are totaled. In the given example, total of Purchase Account is Rs.8,50,000 and total of Sales Account is Rs.7,30,000. Here balancing is done at the end of a month. It shows that total purchases for the month of January was Rs.8,50,000 and total sales during that month was Rs.7,30,000.

At the beginning of the next month, such balances are brought down. This is shown by using the words To Balance b/d’ in case of debit balance and using the words ‘By Balance b/d’ in case of credit balance. This process continues till the end of accounting period.

If the posting of an account remains incomplete in one ledger page and is continued to the next page, then total debits and credits are calculated at the end of each ledger page and such balances are carried forward to next page. In such a case the words ‘Balance c/P are used to indicate total of debits and credits at the page-end. At the beginning of the next page such balances are brought forward using the words ‘Balance b/f’.

Thus the words ‘Brought Forward’ are abbreviated as b/f and c/f is the abbreviation of the words ‘Carried Forward’. Also if balancing is done in one page and the balance is carried to the next page for continuation of the account, the terms ‘Balance c/f’ and ‘Balance b/f’ are used very often instead of the terms ‘Balance c/d’ and ‘Balance b/d’ respectively.

Example 5.3 Consider the transactions given in Example 5.2. Prepare necessary ledger accounts.

Solution:

Alternative Design of Ledger Account:

An alternative design of ledger account is given below. As per the alternative design there is only one column each for ‘Date’, ‘Particulars’, ‘J.F.’ and ‘L.F.’ and four amount columns. Of the amount columns, first one is meant for debit posting, second is for credit posting, third is for debit balance and the last one is for credit balance.

But if any account only produces either debit balance or credit balance, then one balance column is sufficient.

If the alternative design is followed, debit posting is to be understood by the prefix ‘To’ and posting of the amount in the ‘Dr. Amount’ column. Similarly, a credit posting is to be understood by the prefix ‘By’ and posting in the ‘Cr. Amount’ column. Continuous balancing is possible using this form. So in practice this form is mostly preferred.

Day Books:

Day Books are special type of journals. Usually Day Books are kept to record the transactions relating to credit purchase, credit sales, purchase returns, sales returns, bills receivable and bills payable. Day Books arc kept to arrange a particular type of transactions in one place which occur frequently.

It is also kept to avoid large number of ledger posting. In business large number of credit purchases and credit sales are very common. For example, if there are twenty credit purchases and fifty credit sales transactions, seventy journal entries and one hundred forty ledger postings become necessary. Instead of following this cumbersome process. Day Books may be used. By this twenty credit purchases are entered in a separate book and totaled and posted only once instead of twenty postings to the Purchases Account. Even it is possible to do posting only once in a week or once in a month.

Purchases Day Book:

Purchases Day Book is meant for recording all credit purchases of merchandise to be dealt with by the enterprise in the ordinary course of activities.

Given below a design of Purchases Day Book. It has five columns—

(i) Date,

(ii) Particulars,

(iii) Voucher No.,

(iv) L.F. and

(v) Amount.

Date of transaction is entered into the ‘Date’ column. In the ‘Particulars’ column name of the suppliers is first entered. Below the name of supplier a brief description (narration) is given about the quantity purchased, rate and terms of payment. In the third column No. of the supplier’s bill is entered. Note here that every consignment of goods sent by the suppliers is accompanied by a bill. In the fourth column L.F. of the concerned supplier is entered. And in the last column amount of the transaction is recorded.

Example:

Rakesh, a sole proprietor, purchased the following goods on 2nd September, 2008. Enter these transactions in a suitable Purchases Day Book:

Purchased from Sahu & Sons 100 sachets of Flora sunflower oil @ Rs.525 per sachet, less 5% trade discount.

Purchased 5,000 packets of frozen peas @Rs.8.50 per packet from M/s. All Time Foods. Purchased 1,000 packets of frozen cauliflower @ Rs.9.25 each from M/s Gurgaon Farm.

Solution:

Totaling the day book is termed as casting. If wrongly the total becomes more than what it should be, this error is termed as overcasting. On the other hand, if wrongly the total becomes less than what it should be, this error is termed as under casting. Trade discount is the price concession offered by the seller to the buyers from the listed price. Trade discount is deducted from the gross price and the net amount is shown in the Purchases Day Book.

Posting from Purchases Day Book is very simple. One has to assume every entry as—

Purchases A/c Dr.

To Supplier’s A/c

This means in the Purchases A/c there would be debit posting and in the Supplier’s A/c there would be credit posting.

Example:

Prepare necessary ledger accounts for the transactions given in Example 5.4.

Solution:

Sales Day Book:

Sales Day Book is meant for recording all credit sales of merchandise to be dealt in the ordinary course of business. The design of a Sales Day Book is like Purchases Day Book.

Example:

Ramesh, a sole-proprietor, sold the following goods on 30th September, 2008. Enter these transactions in a suitable Day Book and show the necessary ledger accounts.

Sold to M/s. Fresh Foods 80 sachets of Flora oil @ Rs.537.75 per sachet less 2% trade discount.

Sold to M/s. Agarwal & Sons 600 packets of frozen peas @ Rs.8.75 per packet; Sold to M/s. Robinson Vegetables 500 packets of frozen cauliflower @ Rs.9.60 per packet.

Solution:

Purchases Return Book or Return Outward Book:

This book is meant for recording all returns of merchandise purchased in course of ordinary activities. The form of this day book is similar to Purchases Day Book and Sales Day Book:

Example:

Rakesh, a sole proprietor, returned the following goods on 24th September, 2008:

Returned to M/s. Sahu & Sons 10 sachets of Flora oil for defective container design.

Returned to M/s. All Time Foods 100 packets of frozen peas which were found without standard mark.

Enter the above transactions in a suitable Day Book and show the necessary ledger postings. Rates are to be taken from Example 5.5. Folios and ledger balances given in Solution Example 5.5 should also continue.

Solution:

So in the Purchases Return A/c credit postings are made and corresponding debit postings are made in the Supplier’s A/c.

Sales Return Book or Return Inward Book:

This day book is meant for recording all returns of merchandise sold in course of ordinary activities. Go through Example 5.8 and understand the technique of entry to the book and postings therefrom.

Example:

Ramesh, a sole proprietor, received the following returns from the customers on 1st October, 2008:

M/s. Fresh Foods returned 10 sachets sent in excess of order on 30th Sept., 2008.

M/s. Robinson Vegetables returned 50 packets of frozen cauliflower sent excess of order on 30th Sept., 2008.

Take the sales return, folio, etc. in continuation of Example 5.6.

So debit posting is done in the Sales Ret urn A/c and corresponding credit posting is done in the Customers A/c.

Advantages of Day Books:

Advantages of having separate Day Books are as follows:

I. Recording in a classified manner:

Transactions and events can be recorded in a classified manner. So when a particular type of transactions and events occur in large number or at a frequent interval, those can be grouped at the first instance for ready reference.

II. Avoiding large number of postings:

Large number of postings can be avoided. Day Books can be cast at weekly/fortnightly/monthly intervals. And thereafter, single posting can be made in the concerned account. For example Purchases Day Book is cast on monthly basis. If in a month there are 100 purchase transactions, only one posting to Purchase Account covers all such transactions. However, posting to the Suppliers’ Accounts cannot be avoided.

III. Division of work:

When several day books are maintained accounting work can be assigned to more than one person. In fact, in a large business organisation several departments carry out purchase, sale, etc. independently. One clerk in the accounts section can co-ordinate with the functional department and write the Day Books. This helps to keep the record up to date. Also this helps to develop expertise of the dealing clerk.

Uses of Ledger Accounts:

Ledger accounts have at least two-fold uses:

(i) These are used to understand the position of various accounts at any point of time.

(ii) These are used to prepare Trial Balance and Final Accounts.

Accounts are suitably classified as per specific information needs. Important assets, liabilities, expenses and incomes accounts are kept separately which provide basic information to the users of accounts. Ledger accounts are main part of the books of account.