Read this article to learn about the journal entries, items on debit and credit side in preparation of profit and loss account.

For preparing Profit and Loss Account, closing entries shall be made in the Journal Proper. Through these entries, items of revenue and expenses related to the Profit and Loss Account are closed by transferring their balances to Profit and Loss Account.

Accounts of indirect expenses i.e., expenses which could not find place in Trading Account such as office salaries, rent, depreciation etc. are closed by transferring to the debit side of the Profit and Loss Account. Similarly, accounts related to the other sources of incomes such as commission or discount received etc. shall be shown on the credit side of the Profit and Loss Account.

Journal Entries:

The following journal entries shall be passed:

(i) For Closing of all Debit Accounts Related to Indirect Expenses:

ADVERTISEMENTS:

Profit and Loss Account Dr.

To Rent Account

To Salaries Account

To Postage Account

ADVERTISEMENTS:

To Stationery Account

To Advertisement Account

To Discount Allowed Account

ADVERTISEMENTS:

(ii) For Closing all Credit Accounts Related to Indirect Incomes:

Rent Received Account Dr.

Discount Received Account Dr.

To Profit and Loss Account

(iii) For Closing the Profit and Loss Account:

ADVERTISEMENTS:

(a) In case credit side exceeds the debit side (i.e., net profit):

Profit and Loss Account Dr.

To Capital Account

Or

ADVERTISEMENTS:

To Profit and Loss Appropriation Account

(b) In case debit side exceeds the credit side (i.e., net loss):

Capital Account Dr.

To Profit and Loss Account

ADVERTISEMENTS:

ADVERTISEMENTS:

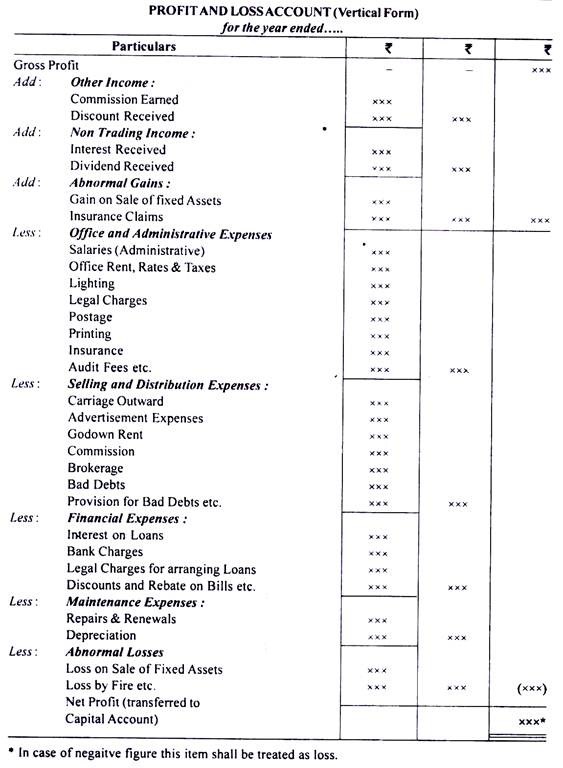

The following is the pro-forma of Profit and Loss Account when it is prepared as a separate Account:

Items on Debit Side of Profit & Loss Account:

(i) Gross Loss:

This is the first item to be shown on the debit side of Profit and Loss Account and brought forward from Trading Account.

(ii) Indirect Expenses:

Indirect expenses are those expenses which are incurred in connection with selling and distribution of goods and general administration of the business enterprise.

ADVERTISEMENTS:

Indirect expenses can be further classified into:

(a) Office and Administrative Expenses

(b) Selling and Distribution Expenses

(c) Financial Expenses

(d) Maintenance Expenses

(e) Abnormal Losses.

(a) Office and Administrative Expenses:

Expenses incurred for carrying out the routine work of the enterprise fall under this category. For example, expenses related to salaries of office employees, office rent, lighting, legal charges, postage, printing, rates, taxes, insurance and audit fees etc.

(b) Selling and Distribution Expenses:

Expenses incurred for promoting sales and distributions of goods come under this category. For example, carriage outward, advertisement expenses, godown rent, cost of after sales services, commission, brokerage and other sales promotional expenses.

(c) Financial Expenses:

Expenses incurred for arranging the finance for functioning of business enterprise come under this category. For example, interest on loans, bank charges, and legal charges for arranging loans, brokerage paid for arranging funds, discounts and rebate on bills etc.

(d) Maintenance Expenses:

Expenses incurred for maintaining the fixed assets of the office of the business enterprise come under this category. For example, repairs, renewals and depreciation on fixed assets etc.

(e) Abnormal Losses:

During the course of business, it may suffer some abnormal losses arising due to some carelessness or for sometimes when the enterprise has not acted upon diligently. For example, loss on sale of fixed asset or loss by fire/theft etc.

(iii) Net Profit:

The Profit and Loss Account of a business enterprise is prepared for an accounting period. The net profit of the business firm is calculated by totaling the credit side and debit side of the Profit and Loss Account. If credit side is more than the total of the debit side, the difference between the two totals is the net profit.

Items on Credit Side of Profit & Loss Account:

(i) Gross Profit:

This is the first item to be shown on the credit of Profit and Loss Account and brought forward from Trading Account.

(ii) Other Income:

The business enterprise may earn some income of financial nature, other than the income from sale of goods, such as commission earned or discount received. These incomes are to be shown on the credit side of the profit and loss account.

(iii) Non-Trading Income:

Incomes earned on account of interest or dividend on the amount invested outside the business in the shape of investment in banks or other companies, shares or debentures etc. fall under this category and shall be recorded on the credit side of the profit and loss account.

(iv) Abnormal Gains:

Gains arising out of sale of some fixed assets are capital gains and shall be recorded on the credit side of the profit and loss account.

(v) Net Loss:

The net loss of the business firm is calculated by totaling the credit side and debit side of the Profit and Loss Account. If debit side is more than the total of the credit side, the difference between the two totals is the net loss.

Illustration. (Preparation of Trading and Profit & Loss Account) The following is the Trial Balance of Raj & Co. as at 31st March, 2011: