In this article we will discuss about the accounting procedure for the issue of shares at discount, explained with the help of necessary journal entries and illustration.

Generally a Company is not allowed to issue shares at a discount, i.e. at a price less than the face value of the shares. However, if a Company wants to raise capital by way of issuing shares at discount, i.e. the buyer is required to pay less amount than the face value, then the shares are said to have been issued or sold at a discount.

Such type of issue of shares at discount is subject to the following conditions as laid down in Sec. 79 of the Companies Act:

(a) The shares to be issued at a discount must be of a class already issued.

ADVERTISEMENTS:

(b) The issue must be authorised by a resolution passed by the company in General Meeting and sanctioned by the Company Law Board.

(c) Rate of discount should not be more than 10%.

(d) One year must have passed since the date at which the Company was allowed to commence business.

(e) The issue of such shares must take place within two months after the date of court s sanction or within such extended time as the Court may allow.

ADVERTISEMENTS:

It follows that no new Company can issue shares at a discount in the beginning. A new class of shares cannot be offered at a discount.

The above said conditions do not apply to reissue of forfeited shares in which case the discount can be equal to the amount already received.

Discount on issue of shares being a capital loss to a Company, should be debited to “Discount on Shares Account” and shown as an asset in the Balance Sheet. Generally such discount is recorded at the time of allotment.

As per Section 80, a company after the commencement of the Companies (Amendment) Act 1988 cannot issue any preference shares which are irredeemable or redeemable after the expiry of a period of 10 years from the date of its issue. It means a company can issue redeemable preference shares which are redeemable within 10 years from the date of their issue.

ADVERTISEMENTS:

Accounting Entries and Procedure:

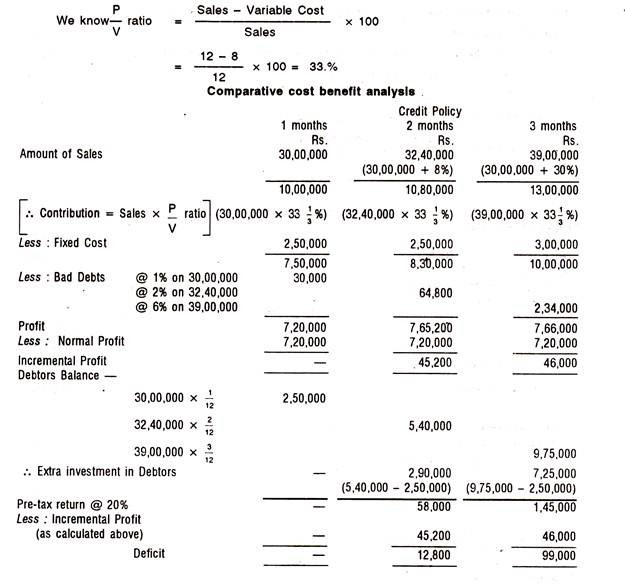

Illustration:

An existing Company offered 20,000 Equity Shares of Rs. 10 each at a discount of 5%.

ADVERTISEMENTS:

The shares were payable as under:

On Application Rs. 3.00 per share

On Allotment Rs. 4.00 per share

On First Final Call Rs. 2.50 per share.

ADVERTISEMENTS:

Public applied for 16,000 shares and shares have been allotted. All moneys were received Pass entries in the journal and Cash Book and show the Balance Sheet.

Solution: