When a company issues shares at a price less than their face value, it is said to have issued them at a discount. For example, if a company issues shares of the face value of Rs 100 each at Rs 95 each, it will be said to have issued them at a discount of 5%. In order to issue shares at a discount, a company has to fulfill all the conditions laid down in Section 79 of the Companies Act.

These conditions are as follows:

(i) The shares to be issued at a discount must be of a class already issued;

(ii) The issue of the shares at a discount must be authorized by a resolution passed by the company in general meeting and sanctioned by the Central Government;

ADVERTISEMENTS:

(iii) The resolution must specify the maximum rate of discount at which the shares are to be issued. If the maximum rate of discount specified in the resolution exceeds 10%, the issue shall not be sanctioned by the Central Government unless the Government is of the opinion that a higher percentage of discount may be allowed in the special circumstances of the case;

(iv) Not less than one year has, at the time of the issue, elapsed since the date on which the company was entitled to commence business;

(v) The shares to be issued at a discount must be issued within two months after the date on which the issue is sanctioned by the Central Government or within such extended time as the Central Government may allow.

In case of revival and rehabilitation of sick industrial companies, the provisions of section 79 shall have effect as if for the words “Central Government”, “the word Tribunal” had been substituted.

ADVERTISEMENTS:

After a company has issued shares at a discount, every subsequent prospectus for further issue of shares must contain particulars of the discount allowed on the issue of the shares or of so much of that discount as has not been written off by the date of the issue of the prospectus.

Discount allowed by the company on issue of shares is a capital loss. The amount is debited to ‘Discount on Issue of Shares Account’. Mostly, the discount is adjusted in the allotment money.

In this case, when the entry is passed for recording the allotment money due, the amount of discount is debited to Discount on Issue of Shares Account, the amount due after taking into consideration the discount is debited to Share Allotment Account and the total of the two is credited to Share Capital Account.

On receipt of allotment money, Bank is debited and Share Allotment Account is credited with the amount actually received.

ADVERTISEMENTS:

In the balance sheet, ‘Discount on Issue of Shares Account’ appears on the “Assets” side under the heading ‘Miscellaneous Expenditure’. The account represents a fictitious asset and should be gradually written off by transfer to Profit and Loss Account although there is no legal compulsion to do so.

It is also possible to apply Securities Premium Account to write off this account. To do so, Securities Premium Account will be debited and Discount on Issue of Shares Account will be credited.

Illustration 1:

Following are the excerpts from the Balance Sheet of ABC Ltd. as on 31st March, 2011:

ADVERTISEMENTS:

Liabilities Share Capital

Authorised 5,00,00,000

Issued and Subscribed:

25,00,000 Equity Shares of Rs. 10 each, fully paid up 2,50,00,000

ADVERTISEMENTS:

1,00,000 14% Preference Shares of Rs. 100 each, fully paid up 1,00,00,000

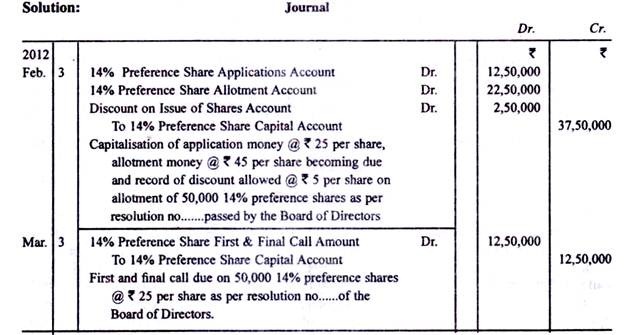

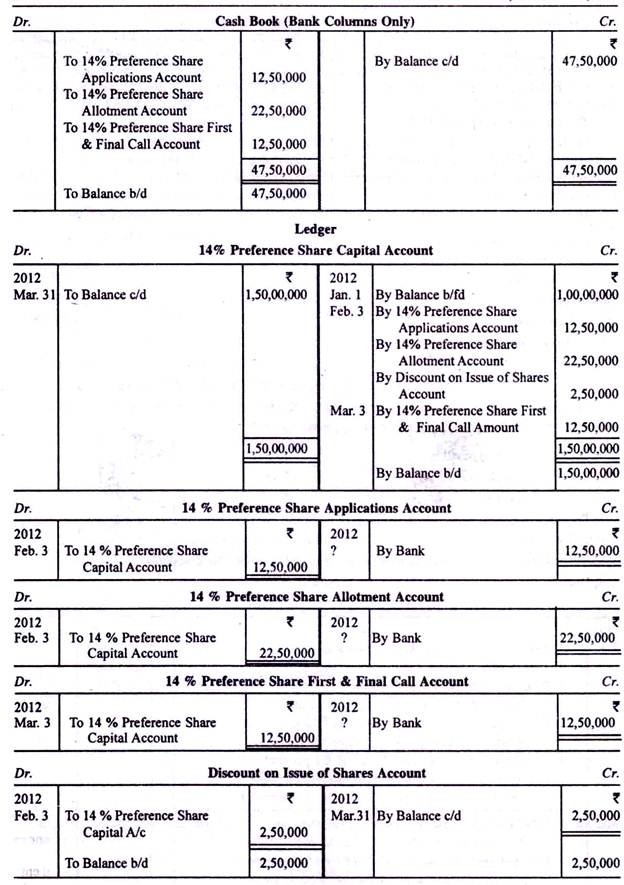

In January, 2012, the company issued to public 50,000, 14% preference shares of Rs. 100 each at a discount of 5%, the amount per share being payable as follows:—

With application Rs 25

On allotment Rs 45

ADVERTISEMENTS:

On first and final call Rs 25

The issue was fully subscribed. The Board of Directors allotted the shares on 3rd February, 2012. The call was made on 3rd March, 2012. All the moneys were received.

Record the transactions relating to the issue in the books of the company.